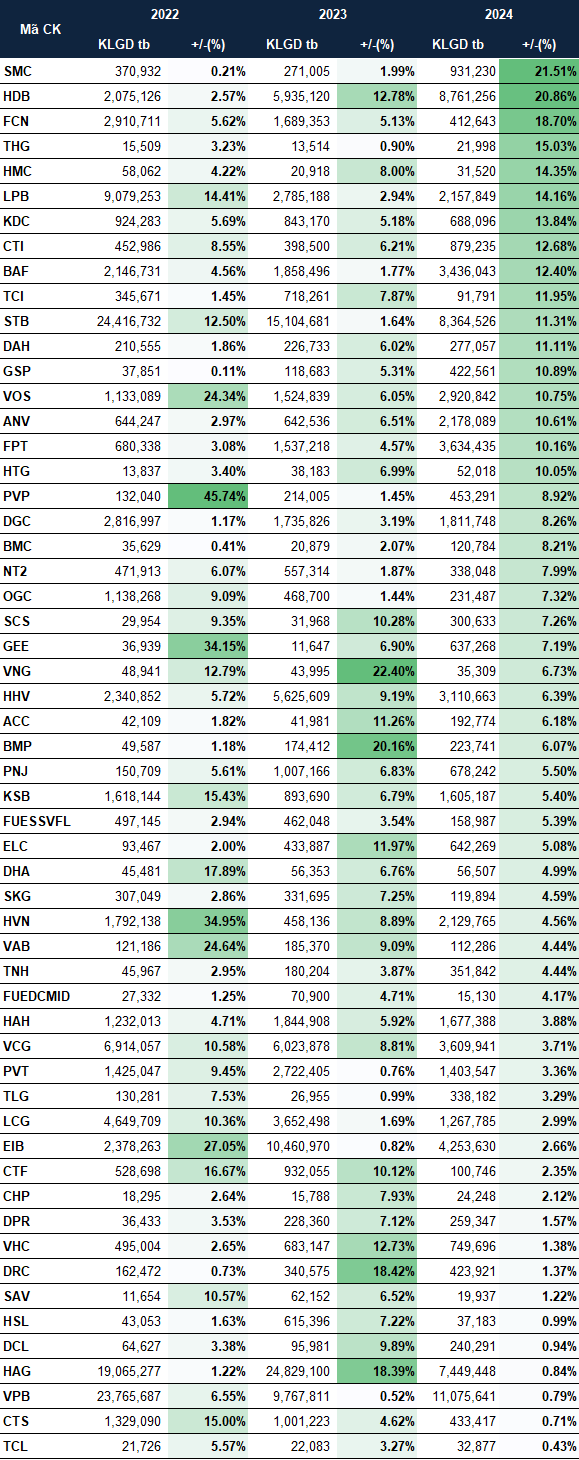

According to data from VietstockFinance, 56 stocks/fund certificates on the HOSE exchange have consistently risen in December over the past three years (2022-2024). These include stocks from various sectors such as banking (HDB, STB, VPB, VAB, LPB), aviation (HVN), technology (FPT), construction and infrastructure (FCN, HHV, VCG, LCG), seafood (ANV, VHC), and agriculture (HAG, BAF).

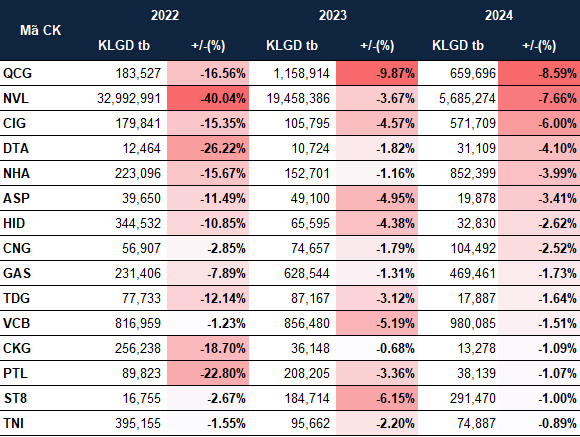

Conversely, 15 stocks typically decline during this period, including leading companies like NVL in real estate, GAS in energy, and VCB in banking.

|

Stocks on HOSE Rising in December (2022-2024)

Source: VietstockFinance

|

|

Stocks on HOSE Declining in December (2022-2024)

Source: VietstockFinance

|

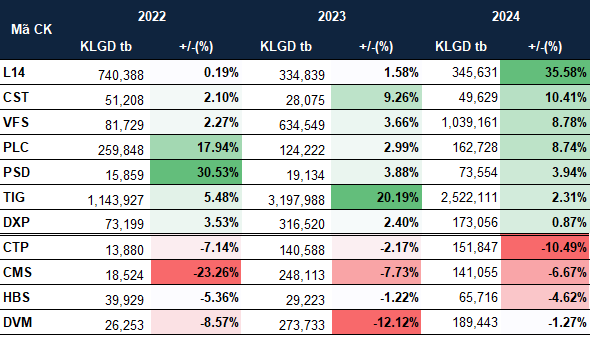

On the HNX exchange, 7 stocks consistently rise, including L14, CST, VFS, PLC, PSD, TIG, and DXP. Only 4 stocks typically decline: CTP, CMS, HBS, and DVM.

|

Stocks on HNX Rising/Declining in December (2022-2024)

Source: VietstockFinance

|

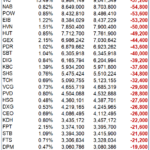

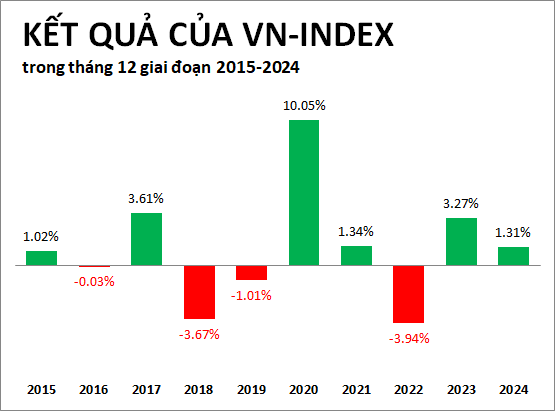

The year-end optimism is further reflected in the performance of the VN-Index. Over the past decade (2015-2024), the VN-Index has risen in December for six years.

Source: VietstockFinance

|

Phu Hung Securities (PHS) notes that the VN-Index is testing the 1,690 – 1,700 point resistance zone. If sectoral momentum improves, the upward trend could sustain, targeting 1,750 points. Conversely, if divergence persists, correction risks remain. The 1,640 point level continues to act as support.

PHS favors a hold strategy, monitoring Midcap reactions. Sectors showing clear support tests include Banking, Real Estate, Energy, Consumer, and Utilities. If a breakout from near-term resistance occurs, investors may consider deploying capital. Weakness could extend the sideways phase, forming a short-term bottom.

Vietcombank Securities (VCBS) agrees, noting that despite attractive valuations, capital remains hesitant. VCBS recommends maintaining exposure to trending stocks while exiting weakening ones at resistance. Avoid chasing highs to mitigate reversal risks.

– 08:00 04/12/2025

Foreign ETF Funds Witness Heavy Selling as Index Nears 1,700-Point Milestone

After a 4-week period of silence, the VanEck Vectors Vietnam ETF (VNM ETF) shifted to net selling during the week of November 21-28, 2025, coinciding with the VN-Index approaching the 1,700-point milestone.

Steel Giant’s HoSE Ascent: Holding $136M in Cash, Q3 Profits Surge 58%

The Ho Chi Minh City Stock Exchange (HoSE) has officially announced the acceptance of the listing application for all 149 million shares of Ton Dong A Joint Stock Company (stock code: GDA). This milestone marks a significant step in the company’s transition to the main bourse, following over two years of trading on the UPCoM market.

Hot Springs Real Estate Poised for Significant Price Surge

Hot springs real estate has emerged as a global trend, captivating investors with its unique appeal, health benefits, and sustainable profit potential. This exclusive market is poised for significant value appreciation in the coming decade, making it a highly sought-after asset.

Why Da Nang is the Rising Star for Real Estate Investors

With its competitive pricing, expansive land availability, modern infrastructure, thriving tourism, and high quality of life, Da Nang has emerged as a top contender in the real estate investment landscape. According to industry experts, the quality of properties in Da Nang even surpasses that of Hanoi and Ho Chi Minh City, making it a highly attractive destination for investors.