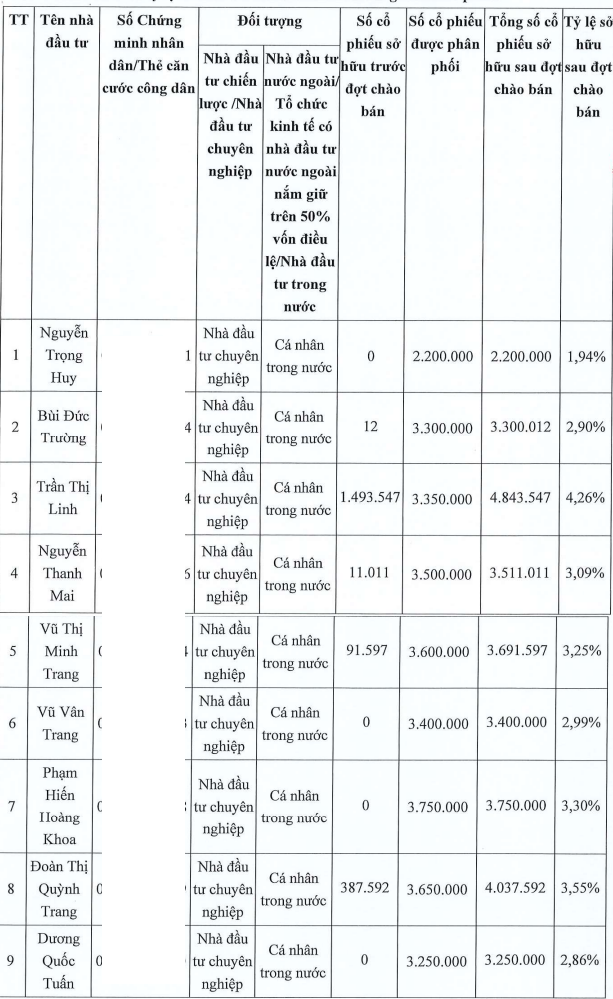

On November 28, the Board of Directors of MST passed a resolution to register changes in the charter capital in the Enterprise Registration Certificate, increasing it from over 836 billion VND to more than 1.136 trillion VND, a rise of 300 billion VND. Prior to this, on November 24, the company successfully issued 30 million shares to nine domestic professional individual investors, four of whom became new shareholders.

At a price of 10,000 VND per share, MST raised 300 billion VND, which will be entirely used to repay loans at BIDV Thai Ha Branch.

|

9 investors participating in the purchase of 30 million MST shares

|

This marks the second capital increase for MST this year, following the issuance of nearly 7.6 million shares as dividends to 3,615 existing shareholders in August.

In addition to raising capital through share issuance, the company also plans to acquire assets and borrow funds. In early November, MST approved a loan of 300 billion VND from SHB Ha Dong Branch to supplement working capital and issue guarantees for production and business activities.

In this transaction, the company agreed to implement security measures, using assets owned by the company and/or third parties approved by SHB, in compliance with legal regulations and SHB policies.

The capital demand of MST is significant in 2025, a year in which the company aims to achieve over 68 billion VND in after-tax profit, four times the 2024 figure, with high expectations pinned on the Greenhill Village project to generate profits and cash flow.

Despite these ambitions, the company has earned less than 16 billion VND in the first nine months, achieving only 23% of its target.

In the market, MST shares have been in a sideways trend since mid-2023. Recently, the stock gained attention by surging from 5,400 VND per share to 6,500 VND per share in just a few days.

| MST Stock Performance Since 2025 |

|

The Greenhill Village Quy Nhon resort project was assigned to Greenhill Village LLC (now Greenhill Village JSC) in 2019 with an initial registered capital of 230 billion VND. In 2022, the project’s capital was increased to 2.596 trillion VND. That same year, Ms. Truong My Lan attempted to acquire the project but was unsuccessful. The project covers 16.6 hectares on National Highway 1D, Ghenh Rang Ward, Quy Nhon City, Binh Dinh Province, divided into five zones with 500 condotel units and 148 villas. Construction is scheduled from Q4 2023 to Q1 2026. As of November 2025, the project is progressing with technical infrastructure in the western zone, achieving 100% alignment and 90% road foundation completion. In November 2024, MST won the auction for Greenhill Village’s debt at VietinBank (HOSE: CTG) Thu Thiem Branch for 410 billion VND, matching the asset’s starting price. MST serves as the developer and contractor. According to the financial report as of September 30, 2025, MST has invested over 198 billion VND in the developer, holding an 18% stake. MST’s Strategy at Greenhill Village Quy Nhon

|

– 15:23 03/12/2025

When Does VIX Opt to Increase Capital?

On December 2nd, the Board of Directors of VIX Securities JSC (HOSE: VIX) passed a resolution to implement a plan to issue nearly 919 million shares, raising over VND 11,026 billion. During the recent extraordinary general meeting, the company’s leadership shared the expected date for finalizing the list of shareholders eligible for the rights issue.

ABBank Surpasses Targets with Pre-Tax Profit of VND 3.4 Trillion in 11 Months, Nearly Doubling Annual Plan

An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) reported pre-tax profits of VND 3.4 trillion in the first 11 months of 2025, nearly doubling its annual target.

Spectacular Business Breakthrough: OCBS Surges Capital to 3.2 Trillion VND with a Series of Major Strategic Moves

On November 27, 2025, OCBS Securities Corporation (OCBS) held an Extraordinary General Meeting of Shareholders to approve a capital increase plan, raising its charter capital to VND 3,200 billion. This marks OCBS’s second capital hike in 2025, following the successful completion of its previous increase from VND 300 billion to VND 1,200 billion in July 2025.