Today’s stock market session began with a cautious tone, as investors adopted a wait-and-see approach. However, the market quickly gained momentum as robust capital inflows surged into the banking sector. The VN-Index climbed over 20 points at one stage, eventually closing at 1,731 points, up nearly 15 points. Despite this, upward pressure was tempered by selling in Vingroup-related stocks and several large-cap shares toward the end of the session.

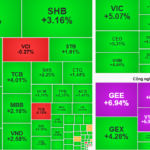

Banking stocks surged, becoming the primary drivers of the VN-Index’s gains today.

The banking sector took center stage, with a slew of stocks rallying after a prolonged consolidation period. CTG stood out with a gain of over 6%, nearing its daily limit, amid news that VietinBank is set to issue nearly 2.4 billion dividend-paying shares at a ratio exceeding 44%, marking the largest dividend payout in the industry for 2025. The issuance is scheduled for Q4/2025 to Q1/2026.

VPB, MBB, and BID rose more than 4%, while VCB advanced over 2%. TCB, ACB, MSB, and LPB also closed in positive territory, contributing to a nearly 22-point rise in the VN30 Index.

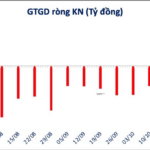

Inflows into banking stocks accounted for nearly half of the market’s total proactive buying volume, significantly boosting overall liquidity to over VND 28.5 trillion—the highest level in more than a month.

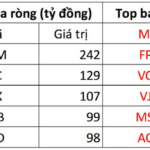

Foreign investors were net buyers to the tune of nearly VND 3.6 trillion, highlighted by a VND 3.3 trillion block trade in VPL shares. Overseas investors also accumulated MBB, VPB, CTG, and MWG.

Beyond the banking sector, the retail industry saw vibrant activity, with FRT hitting its daily limit and MWG climbing nearly 6%, fueled by optimism surrounding holiday spending.

Meanwhile, real estate stocks exhibited mixed performance, as VIC and VRE declined, while CEO, KDH, and DIG maintained upward trajectories. Airline shares faced pressure, with VJC falling nearly 2%.

Although market breadth favored gainers and investor sentiment markedly improved, the late-session narrowing of gains underscored lingering profit-taking sensitivity. At the close, the VN-Index rose 14.7 points (0.86%) to 1,731.7 points. The HNX-Index added 0.8 points (0.31%) to 259.67 points, and the UPCoM-Index gained 0.46 points (0.38%) to 120.16 points.

Fierce Sell-Off Hits Overheated Stocks

The VN-Index extended its decline in the afternoon session on November 19th. Large-cap stocks universally corrected, while small and mid-cap shares were also bathed in red, with HAG plummeting near its floor price.