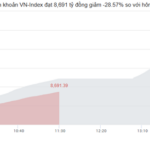

The stock market on December 4th experienced a relatively volatile session, with foreign investors continuing their net buying trend, providing a positive boost. The benchmark index marked its sixth consecutive day of modest gains, edging closer to the highest price levels seen in October 2025. At the close, the VN-Index rose by 5.47 points (+0.32%) to reach 1,737.24 points. Foreign trading activity was a highlight, with net purchases totaling approximately 1,086 billion VND.

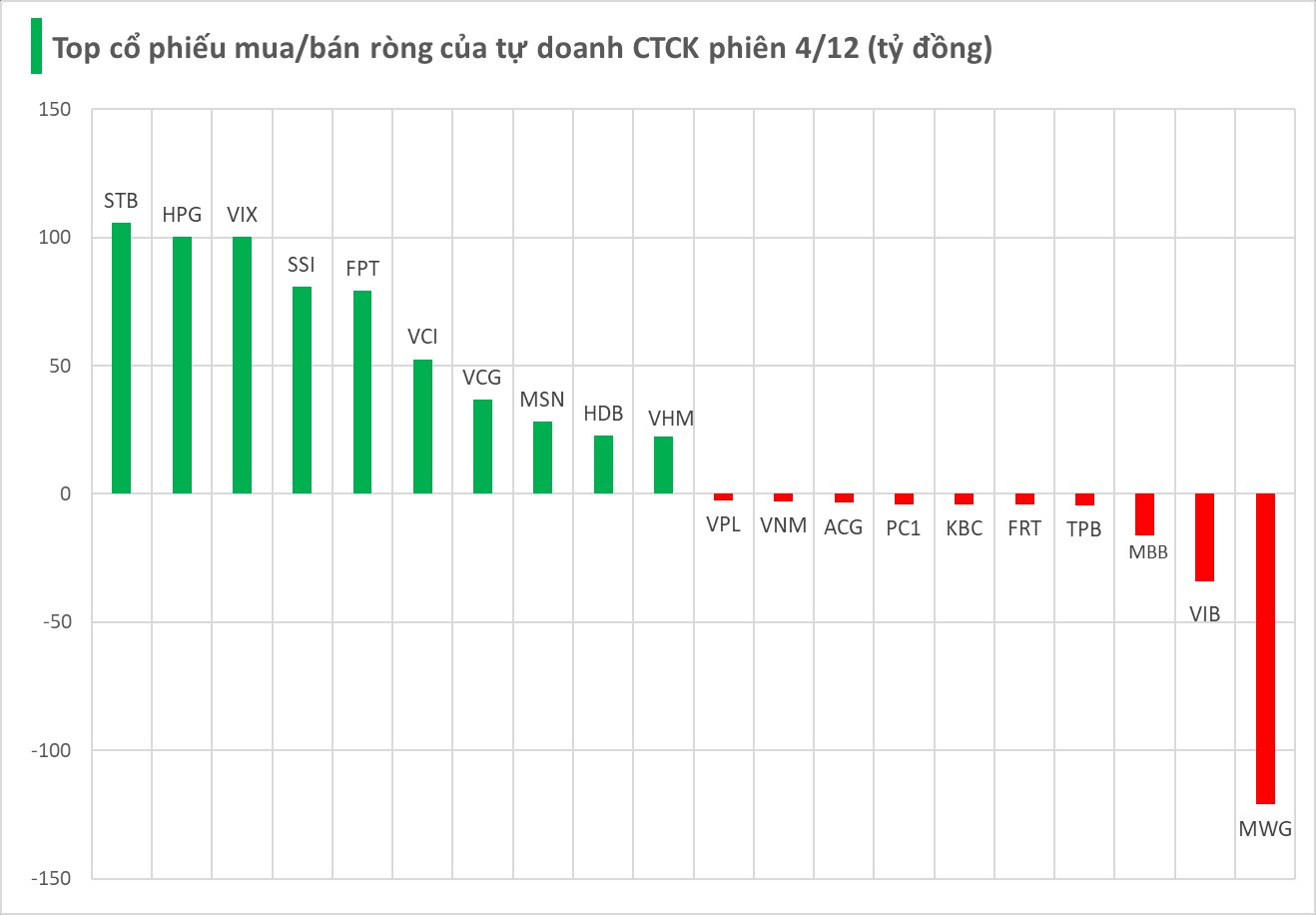

Securities firms’ proprietary trading desks recorded a net buy of 567 billion VND on the Ho Chi Minh Stock Exchange (HOSE).

Specifically, STB saw the strongest net buying at 106 billion VND, followed by HPG (100 billion), VIX (100 billion), SSI (81 billion), FPT (79 billion), VCI (53 billion), VCG (37 billion), MSN (28 billion), HDB (23 billion), and VHM (22 billion VND) – all among the actively net-bought stocks by securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in MWG, with a value of -121 billion VND, followed by VIB (-34 billion), MBB (-16 billion), TPB (-4 billion), and FRT (-4 billion VND). Other stocks also recorded notable net selling pressure, including KBC (-4 billion), PC1 (-4 billion), ACG (-4 billion), VNM (-3 billion), and VPL (-3 billion VND).

Record Foreign Inflow: Investors Pour $146 Million into Billionaire Pham Nhat Vuong’s Stocks on December 3rd

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately VND 3.745 trillion. This substantial investment demonstrates their confidence in the market’s potential and serves as a positive indicator for future growth.

Market Pulse 12/05: Foreign Investors Resume Net Selling of Blue-Chip Stocks, VIC Keeps VN-Index in the Green

At the close of trading, the VN-Index rose 4.08 points (+0.23%) to 1,741.32, while the HNX-Index fell 1.66 points (-0.63%) to 260.65. Market breadth favored decliners, with 434 stocks falling and 282 advancing. The VN30 basket mirrored this trend, with 24 stocks declining, 3 advancing, and 3 unchanged.