The Race for Contactless Payment Dominance Among Vietnamese Banks

The integration of contactless and online payment methods in Vietnam’s banking sector is heating up. From Apple Pay, Google Pay, Samsung Pay, and Garmin Pay to Visa and Mastercard’s click-to-pay solutions, banks are aggressively adopting these technologies as a critical strategy in an era where users have almost entirely shifted to digital channels.

This trend became evident when Apple Pay entered Vietnam, triggering an unprecedented ripple effect. Numerous banks reported a 5–7 fold increase in cards added to Apple Wallet on the very first day. By 2025, over 20 banks had adopted contactless payments via Apple Pay, expanding to include Google Pay, Samsung Pay, and Garmin Pay to cover the entire user device ecosystem.

Among state-owned banks, Vietcombank led the way with the earliest adoption of Apple Pay and Google Pay, significantly increasing the share of contactless transactions at POS terminals. BIDV and VietinBank, despite a later start, leveraged their massive user bases to drive widespread adoption of contactless payments, particularly among Android users.

Private banks demonstrated greater flexibility. VPBank emerged as one of the leaders in contactless payment coverage, supporting Apple Pay, Google Pay, Samsung Pay, and Garmin Pay, while also promoting virtual cards to streamline the user experience.

Techcombank maintained its lead with the highest proportion of contactless transactions in its total card transactions. Its high-income customer base, who frequently use Apple devices and smartwatches, fueled the growth of contactless methods. Additionally, in-app payments on F@st Mobile were optimized to require just one biometric authentication layer, boosting online transactions in consumer sectors.

TPBank made its mark with a “cardless from the start” model, enabling instant online card issuance and activation of Apple Pay/Google Pay.

MB Bank also saw significant success with its young, digitally-savvy customer base and high online payment demand. The MB Bank App was positioned as a “payment hub,” integrating virtual cards and all contactless methods, driving a surge in e-commerce payments.

Mid-tier banks like ACB, Sacombank, HDBank, VIB, and OCB accelerated their efforts to stay competitive. ACB quickly adopted Samsung Pay, Google Pay, and Apple Pay, enhancing the experience within its ACB One app. Sacombank and HDBank focused on POS contactless payments and virtual card issuance to support traditional customers transitioning to digital environments.

In this landscape, Cake by VPBank stands out as a leading digital-first bank, pioneering contactless payment solutions. According to official information, Cake is one of the few Vietnamese banks offering international payment cards fully compatible with Apple Pay, Google Pay, Garmin Pay, and Click to Pay—covering all devices and spending scenarios. Cake users can seamlessly pay via smartphones, smartwatches, or online with Click to Pay, where e-commerce platforms automatically recognize cards based on registered phone numbers or emails, completing transactions in seconds.

Cake’s early collaboration with Visa to implement Click to Pay—incorporating tokenization, two-factor authentication, and 3D Secure—has elevated online transaction security. Additionally, the Tự Do 2in1 co-branded card with Vietnam Post allows flexible switching between payment accounts and credit limits, ensuring seamless payments in all situations.

Why Mobile-First is the Future for Banks

In many developed markets, mobile payments have surpassed traditional cards. In South Korea, mobile payments account for over 50% of retail transactions, according to the Bank of Korea. In China, Alipay and WeChat Pay have nearly eliminated physical cards, with over 90% of urban residents preferring QR codes or phone taps. Even in the U.S.—the birthplace of credit cards—Apple Pay and Google Pay have seen double-digit growth for years, thanks to the growing “tap to pay” habit on iPhones and Android devices.

In Vietnam, the 2023–2025 period is seen as the most transformative for mobile-first banking. The State Bank of Vietnam reports that mobile payments in the first nine months of 2025 increased by 22% in value compared to the same period in 2024, outpacing the growth of physical cards. Major banks like Vietcombank, BIDV, Techcombank, MB, VPBank, and ACB have collectively integrated Apple Pay, Google Pay, Samsung Pay, and Garmin Pay, making smartphones the go-to payment method for both in-person and online transactions. At POS terminals, users simply tap their devices; on websites, Click to Pay enables card payments without manual input.

The mobile-first trend is driven by three core factors: convenience, speed, and security. Smartphones reduce payment steps to a minimum—just a tap or scan. Facial recognition and fingerprint technology are replacing passwords, speeding up transactions and reducing risks. While physical cards are prone to loss or theft, mobile wallets protect users through tokenization, replacing actual card numbers with temporary tokens to minimize fraud.

Vietnamese banks are thus pivoting to mobile-first and digital card strategies. Many are adopting a “virtual card first, physical card later” model. VPBank, TPBank, Cake, and Techcombank allow customers to issue cards online within 1–2 minutes and use them immediately with Apple Pay or Google Pay; physical cards are only printed upon request. Each digitized card saves banks 20,000–40,000 VND in printing, shipping, and support costs—a significant saving when scaled to millions of cards.

In e-commerce, Click to Pay exemplifies the “cardless yet card-based” era. Users no longer need to enter card details or carry physical cards—websites automatically identify cards via registered emails or phone numbers, with authentication completed on the phone in seconds. This is why online card payments via digital platforms have surged in the past two years.

For younger users, smartphones are becoming the “central financial wallet”: paying for groceries, food delivery, rides, entertainment, savings accounts, and credit card bills—all manageable on a single device. For banks, mobile-first is no longer just a tech trend but a strategic race to capture digital customers. The bank that integrates fastest, offers the widest ecosystem, and delivers the smoothest experience will dominate this new frontier.

How Are Account Management Fees Regulated by Banks?

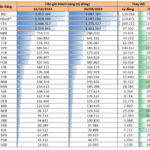

Customers are typically required to pay account management fees to banks for maintaining their checking accounts. However, most banks now offer fee waivers for all priority members, with eligibility criteria that are relatively easy to meet.

Unveiling the Top Banks with the Lowest Non-Performing Loan Ratios Today

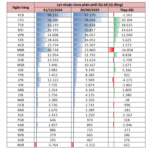

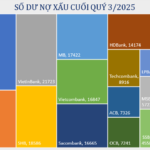

By the end of Q3 2025, financial reports from 27 banks revealed a combined non-performing loan (NPL) total exceeding 265 trillion VND, accounting for 1.95% of their total outstanding loans.