Income Rises 6-8%, Housing Prices Surge 12-20% Annually

Speaking at the recent annual event, “Southern Key Region Real Estate Forum I and Awards Ceremony for Outstanding Real Estate Brands, Products, and Services in the Southern Key Region 2025,” Mr. Dương Long Thành, Chairman of Thắng Lợi Group, recalled: Around 2010, a house in Bến Cát (former Bình Dương) cost only about 300 million VND.

At that time, the average income of a worker, laborer, or civil servant was only about 5-7 million VND per month. They only needed to work and save for 5-6 years to buy a house.

Real demand focuses on apartments with adequate amenities, a safe, civilized, and convenient living environment.

According to Mr. Thành, the real estate market is currently experiencing significant fluctuations, but one unchanging fact is that real housing demand consistently accounts for 70-80% of total market demand.

Vietnam currently has approximately 53 million people of working age, and the urbanization rate has surpassed 41%, creating a substantial demand for housing in urban areas. The demand for real housing is becoming more practical and larger, prioritizing products with transparent legal frameworks, suitable prices, full amenities, reasonable operating costs, and good liquidity.

Meanwhile, the rapid rise in housing prices compared to income is becoming a significant challenge. This creates a growing gap between housing demand and affordability for the population, posing a national challenge with many issues requiring solutions.

Mr. Thành pointed out that housing prices are rising faster than incomes. Specifically, while average incomes increase by only 6-8% annually, housing prices have risen by 12-20% per year over the past decade. This prolonged disparity creates an increasingly large gap between financial capacity and property values.

In the market, products no longer align with the majority’s needs, as there are no options suitable for the population’s income levels. The market has recently focused on high-end projects with large areas and luxurious materials, resulting in high prices that are out of reach for most buyers. Meanwhile, real demand centers on apartments with adequate amenities, a safe, civilized, and convenient living environment.

Additionally, high input costs are a concern. Legal fees, taxes, land unit prices, and volatile construction material costs, coupled with the impact of loan interest rates, all affect the final price.

Finally, accessing credit is difficult for many. During 2024-2025, interest rates began to rise. Increasing deposit rates led to higher lending rates, putting significant pressure on homebuyers due to loan amounts, interest rate fluctuations, and credit policy restrictions, making homeownership even more challenging.

Businesses need to develop products that meet real demand.

“Faced with these challenges, the market must return to its core value: housing serves the residential needs of the people. Solutions are needed to bridge the housing gap, so every Vietnamese citizen has the opportunity to own their own home,” said Mr. Thành.

To address housing issues, Mr. Dương Long Thành proposed refining policies to align the market with real demand. Policies should focus on increasing the supply of affordable housing and social housing, implementing support mechanisms for first-time homebuyers, and streamlining legal procedures to reduce costs and risks for both businesses and buyers.

Locally, planning should prioritize residents’ needs. Cities should adopt a “15-minute” compact urban model, providing essential services within a short travel radius, along with a synchronized transportation infrastructure to improve housing accessibility and enhance quality of life.

For businesses, products must align with real demand. Projects should aim to serve residents well, ensuring reasonable prices, transparent legal frameworks, and construction quality that meets market expectations.

Long-Term Vision Needed

Similarly, Mr. Lê Như Thạch, Chairman of Bcons Group, noted that based on regional and global experiences, creating affordable housing requires optimizing apartment size and functionality. Instead of large apartments, smaller units reduce costs. Buyers focus more on the total purchase price rather than the price per square meter.

Bcons designs primarily focus on small apartments (45 m²), which can include two bedrooms while meeting buyer needs through smart design. “Many ask how Bcons launched tens of thousands of apartments in just a few years. We aim to sell apartments priced between 1-2 billion VND, making them affordable for real buyers,” said Mr. Thạch.

Instead of large apartments, businesses propose smaller units to reduce costs.

A key point is that Bcons handles all stages, from design and construction to project management, sales, and building operations. Each stage saves significant costs, with total profits comparable to other businesses. However, this approach carries the risk of organizational collapse if projects are not continuously developed.

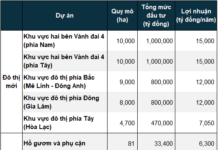

Meanwhile, Mr. Phạm Lâm, Chairman and CEO of DKRA Group, emphasized the need for a long-term vision for the entire Ho Chi Minh City region. The primary development driver is infrastructure connectivity, with clear functional zoning to create logical urban spaces and avoid compressed urbanization. It’s crucial to enable residents of former Bà Rịa – Vũng Tàu, Bình Dương, and Long An to commute to Ho Chi Minh City conveniently for work and education.

“Interregional transportation infrastructure, multimodal connectivity, and clear functional planning are essential. In the future, satellite cities will play a vital role. Residents can live comfortably without being in the city center. Buyers’ preferences are shifting; they now choose integrated urban areas with amenities, services, and natural landscapes, even if farther from the center,” said Mr. Lâm.

According to Mr. Lâm, Ho Chi Minh City lacks luxury real estate products, requiring increased future supply. Additionally, after areas were affected by natural disasters, we should reevaluate and adopt sustainable development approaches to maximize the effectiveness of real estate products.

Dr. Nguyen Tri Hieu Warns of Bubble Signs in Vietnam’s Real Estate Market

The market is teetering on the brink of a bubble as supply threatens to surge, inventories swell, and housing becomes increasingly inaccessible for the general population.

Skyrocketing Condo Prices Fueled by Weak Supply

Property prices in Hanoi and Ho Chi Minh City continue to soar, with many projects reaching 150–180 million VND per square meter. Experts attribute this surge not to speculation, but to a scarcity of supply, rising land costs, legal complexities, and a prolonged supply-demand imbalance.