The Ho Chi Minh City Stock Exchange (HoSE) announced on November 27, 2025, that it has received the listing application for 149 million shares of GDA, issued by Dong A Steel Joint Stock Company. Ho Chi Minh City Securities (HSC) is the advisor for this transaction.

Since 2021, Dong A Steel has planned to go public and list on HoSE but had to halt the process due to financial conditions not meeting listing standards.

In September 2023, the company listed its GDA shares on UPCoM. By October 2025, the Board of Directors officially relaunched the listing plan.

Established in 1998, Dong A Steel specializes in producing galvanized steel sheets, aluminum-zinc alloy coated steel, color-coated steel, and black color-coated steel. Its factory has an annual capacity of approximately 800,000 tons.

In the first nine months of 2025, the company reported net revenue of VND 11,914 billion and after-tax profit of VND 235 billion, down 22% and 26.5% year-on-year, respectively.

Compared to the 2025 targets of VND 18,000 billion in revenue and VND 300 billion in after-tax profit, Dong A Steel has achieved 66% of its revenue goal and 78% of its profit target.

From 2025 to 2026, the company plans to complete legal procedures and initiate Phase 1 of Factory 4, with a capacity of 300,000 tons/year. The total design capacity of this factory is expected to reach 1.2 million tons/year upon completion.

Dong A Steel aims to expand its product portfolio to include specialized steel sheets for household appliances, interiors, and automobiles, while focusing on developing high-end segments to increase added value.

In the long term, the company is preparing for the Phu My Galvanized Steel Sheet Factory project, with a total investment of VND 7,000 billion and a design capacity of 1.2 million tons/year. The factory is expected to begin trial operations in Phase 1 from 2027.

As of September 30, 2025, the company’s total assets stood at VND 11,557.5 billion, down 10.6% from the beginning of the year.

Notably, cash and bank deposits accounted for nearly 30% of total assets at VND 3,278 billion, a decrease of approximately VND 700 billion from the start of the year. Inventory decreased by about VND 500 billion to VND 3,081 billion, primarily finished goods.

Meanwhile, construction in progress expenses tripled to VND 206 billion, mainly due to a sharp increase in asset purchases to nearly VND 160 billion.

On the liabilities side, the company’s total debt was VND 7,651 billion, of which loans accounted for VND 6,183 billion.

Mining Giant Loses $320 Million Market Cap in 3 Days Post-Emergency Announcement, No Longer a Billion-Dollar Company

The sharp decline in stock prices followed VIMICO’s issuance of a resolution on November 26, 2025, approving measures to meet the requirements for public company status.

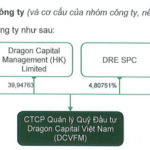

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.

VPS Seeks Maximum Loan of VND 6.9 Trillion from Techcombank

The VPS Board of Directors has approved a credit facility with Techcombank, with a maximum credit limit of VND 6.9 trillion, to invest in Government bonds and Government-guaranteed bonds.