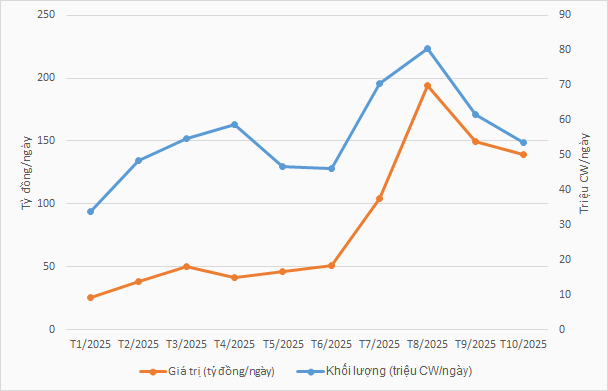

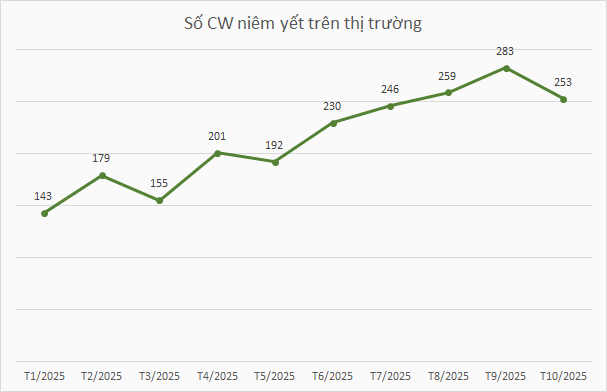

According to data from HOSE, in January 2025, the CW market recorded a trading volume of 25 billion VND per session. By October, liquidity had surged to nearly 140 billion VND per session. This expansion in liquidity was partly driven by the increased scale of products. From 140 CWs listed in the first month of the year, the number rose to 250 CWs by October, nearly doubling. As of November 14, the number of listed CWs exceeded 300.

|

CW Market Liquidity

|

Source: HOSE

|

The CW issuance landscape has also expanded. By November 2025, 14 securities companies had participated in issuing warrants. The increase in issuers has led to a significant rise in product offerings. Alongside established issuers like SSI, KIS, and HSC, new entrants such as TCBS, VPBankS, Kafi, and ACBS have actively issued products, further energizing the market.

How effective has this business segment been for securities companies?

In the first nine months, ACBS reported a loss of nearly 200 billion VND from selling CWs, compared to a loss of just 19 billion VND in the same period last year. However, the company earned nearly 438 billion VND from stock sales, partly from hedging assets for CWs.

As of September 30, the value of hedging assets for ACBS‘s CWs reached over 1 trillion VND, an increase of 1 trillion VND since the beginning of the year. These investments are currently yielding a 5.6% return.

Similarly, SSI incurred a net loss of over 325 billion VND from selling its issued CWs in Q3. However, the company netted 716 billion VND from stock sales, including hedging stocks for CWs. Overall, in the first nine months, SSI recorded a net loss of nearly 198 billion VND from CW trading.

The scale of SSI‘s hedging assets for CWs increased from 968 billion VND to 2,664.287 billion VND.

VPBankS also mirrored this CW activity pattern, with a net profit of over 10 billion VND from selling CWs. Additionally, the company earned over 10 billion VND from selling hedging securities. In the first nine months, the company profited approximately 250 million VND from CW trading, while earning over 3.3 billion VND from selling listed stocks for hedging purposes.

In the first nine months, TCBS also recorded a loss of 4 billion VND from CW trading.

These CW trading results stem from the significant rise in underlying stocks, particularly in Q3. Given the characteristics of CWs as call options, investors had favorable conditions to profit from both holding CWs and trading price differences on the market during the uptrend.

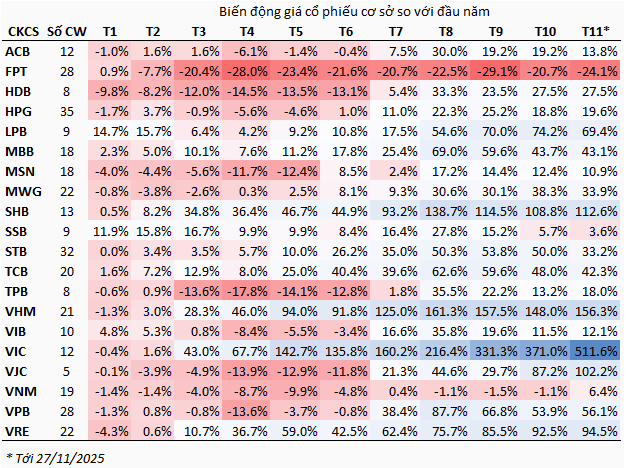

In the first 11 months of 2025, nearly 350 CWs were traded on the market. Of these, 187 were in-the-money (ITM), meaning the underlying stock price exceeded the strike price, compared to 162 out-of-the-money (OTM) CWs.

Alongside the favorable market conditions, the underlying stocks for CWs showed a positive outlook. By the end of November, 19 out of 20 underlying stocks had increased in value since the beginning of the year. Notable gainers included VIC (up over 500%), VHM (up over 150%), and SHB and VJC (both up over 100%). As derivative products based on these assets, CWs also benefited from the uptrend. A majority of 184 CWs increased in value, compared to 164 that decreased, making short-term CW trading highly profitable for investors.

|

Underlying Stocks Enter Uptrend in Q3/2025

|

Conversely, securities companies faced disadvantages due to payouts to profitable investors at maturity and market-making activities for CWs. However, by holding underlying stocks as hedges, securities companies were insulated from significant losses during the uptrend. Additionally, they earned fees from issuance and brokerage commissions from investor trading.

In an uptrend, despite direct losses from CW trading, securities companies still benefited overall. Moreover, CWs complement the product ecosystem of securities companies, offering investors more choices. The growing number of securities companies entering this segment highlights efforts to enhance product portfolios in the highly competitive securities market.

– 12:00 04/12/2025

Moody’s Upgrades MSB’s Credit Rating

According to the latest assessment by Moody’s Ratings (Moody’s), Maritime Commercial Joint Stock Bank (HoSE: MSB) has had its long-term deposit and issuer ratings upgraded from B1 to Ba3. Additionally, the bank’s Baseline Credit Assessment (BCA) has been raised from b2 to b1.

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.

Seafood & Food Stocks Lead the Week in Attracting Investment

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.