Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 629 million shares, equivalent to a value of more than 19.1 trillion VND; the HNX-Index reached over 61.3 million shares, equivalent to a value of more than 1.1 trillion VND.

The VN-Index opened the afternoon session with continued tug-of-war dynamics, despite buyers’ efforts to lift the index. However, selling pressure persisted, restraining the upward momentum, and the VN-Index closed with a slight gain. In terms of influence, VIC, VHM, VPL, and GEE were the most positively impactful stocks on the VN-Index, contributing over 12.7 points. Conversely, VCB, TCB, MBB, and LPB faced selling pressure, subtracting 4.4 points from the index.

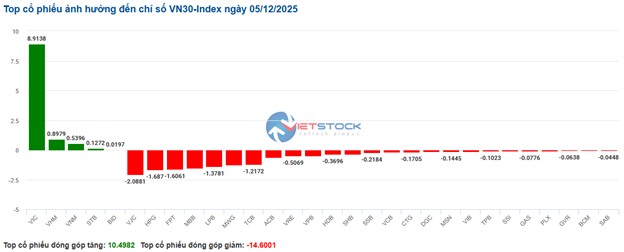

| Top 10 stocks most impacting the VN-Index on 05/12/2025 (in points) |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by stocks such as KSV (-3.28%), DTK (-5.6%), CEO (-3.04%), and NVB (-1.42%).

| Top 10 stocks most impacting the HNX-Index on 05/12/2025 (in points) |

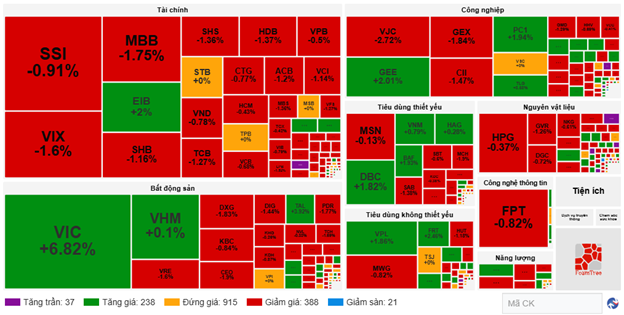

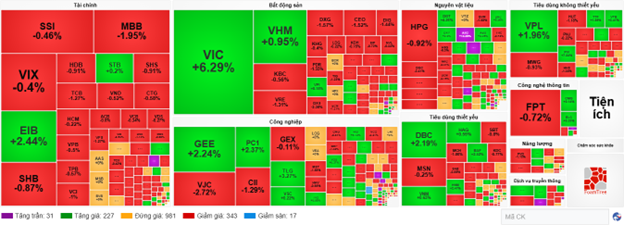

By the close, the market declined with red dominating most sectors. Specifically, the energy sector recorded the sharpest decline at 1.33%, primarily due to BSR (-1.62%), PVS (-2.11%), PVD (-1.88%), and PLX (-1.57%). The finance and IT sectors followed with declines of 1.26% and 1.25%, respectively. Notable stocks under selling pressure included SSI (-1.68%), SHB (-3.18%), VIX (-2.59%), MBB (-2.14%), FPT (-1.33%), CMG (-0.81%), and VEC (-1.95%).

Conversely, the real estate sector was among the few with positive growth, rising 2.51%, primarily driven by VIC (+6.97%), VHM (+1.71%), TAL (+6.13%), LGL (+1.03%), and VPI (+0.88%).

In terms of foreign trading, foreign investors turned net sellers with over 680 billion VND on the HOSE, concentrated in VIC (137.33 billion), SSI (137.03 billion), ACB (114.5 billion), and VIX (77.54 billion). On the HNX, foreign investors net sold over 64 billion VND, focusing on MBS (29.02 billion), PVS (26.69 billion), CEO (5.08 billion), and SHS (3.71 billion).

| Foreign net buying and selling trends |

Morning Session: VIC Supports the Index, VN-Index Fluctuates Around 1,745 Points

VIC‘s support helped the VN-Index maintain a positive green trend despite the market’s overall selling bias. At the mid-session break, the VN-Index rose 8 points (+0.46%), reaching 1,745.27 points. Meanwhile, the HNX-Index decreased by 0.26%, closing at 261.63 points. Market breadth showed 409 gainers, 275 losers, and 915 unchanged stocks.

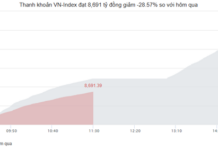

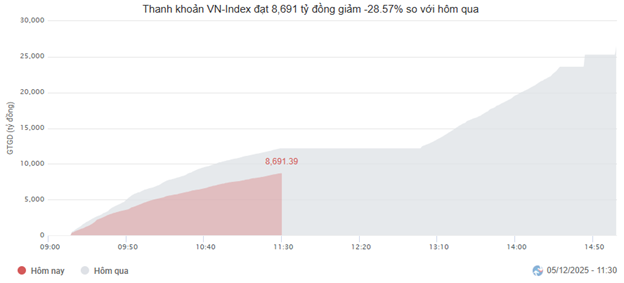

Market liquidity remained quite subdued this morning. The trading volume on HOSE only reached over 271 million units, equivalent to nearly 8.7 trillion VND, down 28.57% from the previous session. HNX recorded a volume of 30 million units, equivalent to over 519 billion VND, down 36.79% from the previous session.

Source: VietstockFinance

|

In terms of influence, the top 10 most impactful stocks contributed a total of 12.62 points to the VN-Index, with VIC alone contributing over 9 points. Conversely, MBB, VCB, and VJC exerted the most pressure, subtracting a combined total of over 2.44 points from the index.

| Top 10 stocks most impacting the VN-Index in the morning session of 05/12/2025 (in points) |

Divergence continued to dominate, with all sectors fluctuating within narrow ranges. The energy sector temporarily lagged with a 0.9% decline, influenced by adjustments in leading stocks such as BSR (-1.29%), PLX (-1.29%), PVS (-1.21%), and PVD (-0.94%).

Large-cap sectors like finance and industry also exerted significant pressure on the index, with many stocks facing strong adjustments, including VIX (-1.6%), MBB (-1.75%), SHS (-1.36%), SHB (-1.16%), HDB (-1.37%), TCB (-1.27%), ACB (-1.2%); VJC (-2.72%), GEX (-1.84%), CII (-1.47%), GMD (-1.29%), and HVN (-2.55%). However, there were still some standout performers attracting good demand, such as PVI hitting the ceiling, EIB (+2%), ABB (+0.65%); GEE (+2.01%), PC1 (+1.94%), TLG (+3.58%), HID (+5.64%), and SCS (+1.28%).

On the other hand, real estate temporarily led the market with a 2.2% increase, primarily due to the positive contributions of stocks like VIC (+6.82%), KSF (+4.32%), SSH (+1.27%), and TAL (+3.92%). The rest were deeply in the red, including VRE (-1.6%), BCM (-1.06%), DXG (-1.83%), PDR (-1.77%), CEO (-1.9%), and TCH (-1.69%).

Source: VietstockFinance

|

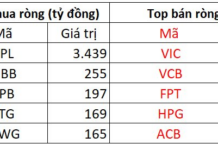

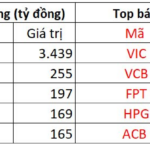

Foreign investors were net sellers with a value of over 625.72 billion VND across all three exchanges. Selling pressure was concentrated in VIC with a value of 145.01 billion VND. Meanwhile, HPG and VPB led the net buying list with values of 35.65 billion and 26.92 billion, respectively.

| Top 10 stocks with foreign net buying and selling in the morning session of 05/12/2025 |

10:30 AM: Selling Pressure Resurfaces

Increased selling pressure caused the main indices to reverse and decline sharply. As of 10:30 AM, the VN-Index narrowed its gain to over 8.3 points, trading around 1,745 points. The HNX-Index decreased by nearly 1 point, trading around 261 points.

Red dominated the VN30-Index group. However, VIC, VHM, VNM, STB, and BID were among the few stocks positively impacting the VN30, contributing a total increase of over 10 points. Conversely, VJC, HPG, FPT, and MBB faced strong selling pressure, subtracting 2.08 points, 1.68 points, 1.6 points, and 1.52 points, respectively, from the index.

Source: VietstockFinance

|

Red dominated the banking and securities sectors, with most stocks declining sharply. Specifically, SSI decreased by 0.46%, MBB by over 2.14%, VIX by 0.4%, HDB by 0.76%, and SHB by 0.58%.

The real estate sector maintained strong growth at 2.05%, driven primarily by VIC (+6.29%) and VHM (+1.05%). However, the rest were widely in the red, including DXG (-1.31%), KBC (-0.56%), VRE (-1.31%), and PDR (-1.55%).

Compared to the opening, sellers seemed to gain the upper hand. There were 343 declining stocks and only 2 advancing stocks.

Source: VietstockFinance

|

Opening: Early Session Divergence, Finance Sector Faces Widespread Selling Pressure

At the start of the session on 05/12, as of 9:30 AM, the VN-Index surged by over 19 points, reaching 1,755 points. The HNX-Index increased by over 1.7 points, reaching 264 points.

Green and red alternated across all sectors. Real estate led with a strong 2.79% growth, driven primarily by VIC surging to its ceiling early in the session (non-rights trading day), VHM (+3.14%), VRE (+0.44%), and KHG (+0.4%).

Conversely, the finance sector faced less favorable conditions, with most stocks in the red. Selling pressure concentrated on MBB (-1.36%), SSI (-0.46%), VIX (-0.2%), SHS (-0.91%), and TCB (-0.99%).

Stocks from the Vingroup and Gelex families, such as VIC, VHM, VPL, and GEE, led the market with a combined contribution of over 15.9 points. Conversely, MBB, TCB, HVN, and VPB weighed on the index, subtracting over 1.9 points.

– 15:35 05/12/2025

Technical Analysis Afternoon Session 04/12: Aiming for the October 2025 High

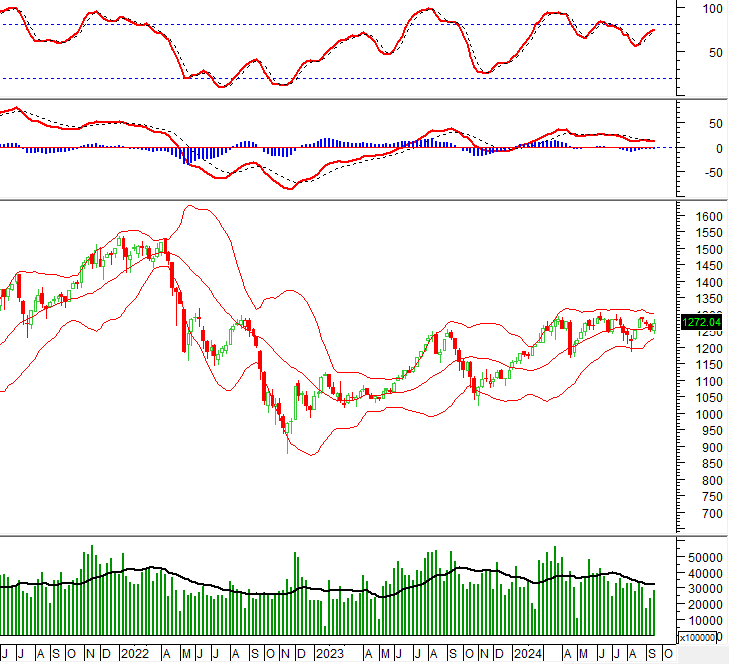

The VN-Index has paused its upward momentum but remains close to the Upper Band of the Bollinger Bands, while the MACD continues its ascent. Meanwhile, the HNX-Index has rebounded after retesting its November 2025 low (around the 255-259 point range).

Vietstock Daily 05/12/2025: Aiming for the Previous Peak?

The VN-Index extended its winning streak, holding firm despite intraday volatility and closely tracking the upper Bollinger Band. Trading volume remained above its 20-day average, while the MACD indicator continued to widen its gap with the Signal line, reinforcing the index’s positive short-term outlook. This momentum positions the VN-Index to challenge its October 2025 peak, targeting the 1,760-1,795 point range.

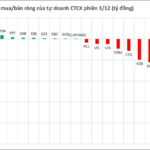

Two Stock Codes Witness Abnormal Net Selling by Securities Firms, Totaling Hundreds of Billions in the December 3rd Session

Proprietary trading desks at securities firms collectively offloaded a staggering VND 625 billion (approximately USD 27 million) in net sales during the period.