At the Analyst Meeting held on the afternoon of December 3rd, the leadership of PVI Joint Stock Corporation (stock code: PVI) provided detailed information regarding the divestment process of the Vietnam Oil and Gas Group (PVN) and the company’s business outlook.

According to Decision No. 1243/QĐ-TTg on the approval of the restructuring plan, PVN must complete its divestment from PVI by December 31, 2025, at the latest. Mr. Nguyen Tuan Tu, CEO of PVI, updated that the consulting steps for the divestment process are nearly complete. The PVN Board of Members is expected to meet this week or next to finalize the plan.

The proposed divestment roadmap will be executed through a public auction of the entire lot, scheduled for late this year or early January 2026.

PVI Stock Price Movement

On the stock market, PVI shares are currently trading around VND 88,200-89,000 per share, marking a 72% growth since June 2025. Based on the current market price, the 35% stake held by PVN is valued at approximately VND 7.1 trillion.

Addressing concerns about the impact of major shareholder changes on business operations, Mr. Duong Thanh Danh, Vice Chairman of PVI’s Board of Directors, assured that PVN’s divestment will not negatively affect the company’s performance. While there may be changes in top-level representatives, the management team and personnel at subsidiaries will remain stable.

PVI’s leadership emphasized that the relationship between PVI and PVN has evolved into a commercial partnership based on mutual benefits. Over the past five years, PVI has provided services for PVN projects through open tenders, competing fairly with other insurance providers in the market.

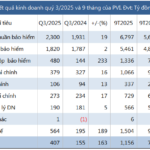

In terms of financial performance, PVI recorded VND 21,615 billion in revenue in the first nine months, a 38% increase, with after-tax profit reaching VND 1,195 billion, up 45.5% year-on-year. The insurance business was the primary driver, with a 160% profit growth, including a doubling of reinsurance revenue.

Based on these results, PVI estimates consolidated revenue for 2025 at around VND 28,300 billion, exceeding the annual plan by 32%. Pre-tax profit is projected at VND 1,577 billion, a 41% increase compared to 2024.

However, for 2026, PVI’s management is cautious, setting a revenue target of VND 28,800 billion, a slight increase from the 2025 estimate. This is due to the impact of consecutive storms in 2025, which have significantly affected the insurance market, increasing compensation costs and reinsurance expenses. Additionally, interest rates and exchange rates in 2026 are not expected to provide significant support for financial investments.

Alongside PVN’s divestment, PVI is seeking a strategic partner for its subsidiary, Hanoi Re – HDI. PVI plans to reduce its ownership from 81.01% to 51% to maintain control. The target partners are international insurance or reinsurance companies with specialized expertise rather than pure financial investors. This transaction is expected to be completed in Q3 or Q4 2026.

In financial investments, PVI adheres to safety rules, allocating 70% to deposits, 20% to bonds, and the remainder to higher-risk assets. The company’s leadership noted that interest rates remained low this year, with a slight increase in October. For 2026, PVI forecasts no significant interest rate changes due to monetary policies aimed at curbing rate hikes to support economic growth.

Regarding exchange rates, PVI profited from exchange rate differences in 2025, but 2026 is uncertain, and provisions may be necessary. With foreign exchange reserves covering approximately 13 weeks, or around USD 20 billion, the State Bank faces pressure in managing exchange rates, influenced by the Fed’s interest rate decisions.

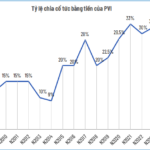

PVI Announces Dividend Payout: 3,150 VND per Share

PVI Holdings Corporation (HNX: PVI) has announced the closure of its shareholder registry for the 2024 cash dividend distribution. The ex-dividend date is set for October 1st.

The Ultimate Guide to Captivating Copy: “Unveiling Petrosetco’s (PET) Major Shareholder: A Thrilling Post-Trade Revelation as Executives Plan Their Exit”

If PVN’s divestment plan goes according to schedule, Petrosetco’s shareholder structure will undergo significant changes.