Supply Chain Financing: The Key to Optimizing Capital and Sustainable Growth for Large Enterprises

The trend of diversifying global supply chains is opening up opportunities for Vietnamese businesses to accelerate, particularly those operating under supply chain models such as construction, logistics, and real estate. According to data from the General Statistics Office and the Ministry of Finance, foreign direct investment (FDI) in Vietnam for the first 10 months of 2025 reached an estimated $21.3 billion, an 8.8% increase compared to the same period last year and a record high for the past five years. However, only about 5,000 Vietnamese enterprises out of 1 million are actively participating in the global supply chain, accounting for a mere 0.001% of the total.

Experts emphasize that to capitalize on the shifting global supply chain, Vietnamese businesses must enhance their competitiveness to meet stringent requirements. Additionally, they need to address the challenge of securing substantial and continuous investment capital, ensuring stable and transparent cash flow across all stages, and fostering stronger connections between suppliers and banking systems.

In this context, supply chain financing has emerged as a strategic tool for large enterprises to optimize working capital, enhance competitiveness, and build a sustainable value chain. This framework enables suppliers to access funds immediately upon transaction confirmation, while allowing buyers to extend payment terms without straining supplier relationships.

Supply chain financing is a strategic tool for large enterprises to optimize working capital and enhance competitiveness.

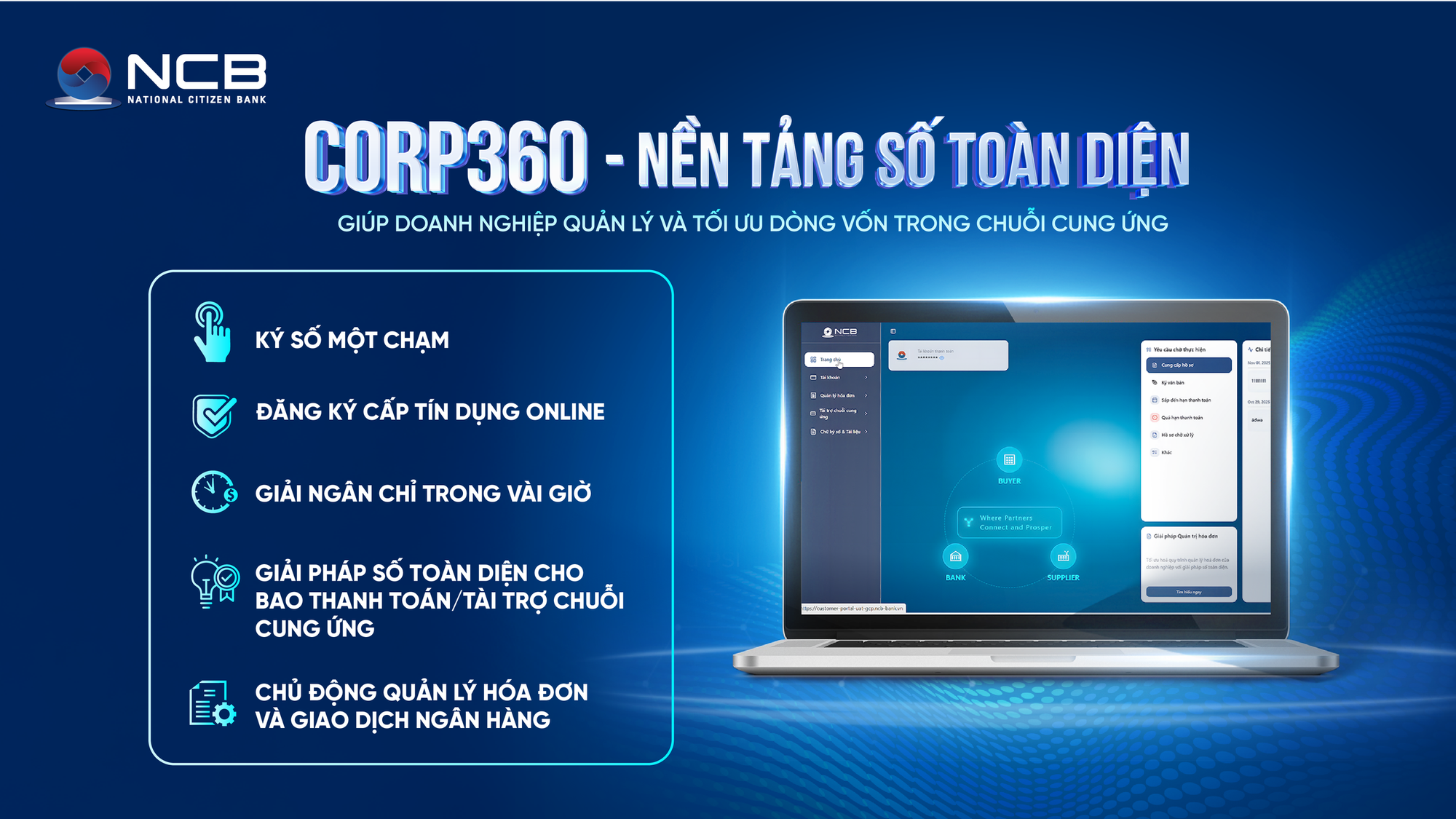

NCB Corp360 Platform: A Superior Solution for Corporations and Large Enterprises

Ahead of the curve, National Citizens Bank (NCB) has launched the modern supply chain financing platform, Corp360, marking a significant milestone in providing tailored financial solutions for corporations and large enterprises. The platform enables businesses within the supply chain to manage the entire payment process seamlessly.

Suppliers can track the status of payment requests from initiation to disbursement, giving them better control over cash flow and financial planning. Buyers, on the other hand, can easily manage supplier lists, monitor credit limits, interest rates, and fees, and approve payment requests online swiftly. They can also manage payables by due date, project, and partner. By connecting data across the value chain, Corp360 streamlines processes, optimizes capital flow, and enhances operational and financial efficiency for businesses.

NCB Corp360 Platform connects the value chain, streamlines processes, and optimizes capital flow, enhancing operational and financial efficiency.

Corp360 revolutionizes the way large enterprises and banks collaborate by digitizing all processes on a unified platform, significantly reducing processing times and eliminating manual bottlenecks associated with traditional methods. The platform also supports multi-level approval workflows tailored to each enterprise’s governance model, ensuring robust control while maintaining operational flexibility.

One of NCB Corp360 Platform’s standout features is its ability to aggregate and display all data on a single, intuitive dashboard. Businesses can monitor cash flow in real-time, cross-check and validate invoices directly with data from the General Department of Taxation, and manage input and output invoices by partner. Automated validity checks and information reconciliation enable businesses to make informed decisions based on accurate data, minimizing operational risks.

NCB currently provides supply chain financing to over 120 enterprises with credit facilities totaling trillions of VND, funding 30 large-scale projects nationwide, including several landmark projects in key locations. The bank also boasts a robust ecosystem of partners, including 30 major construction contractors across Vietnam, 5 of the top 10 VNR 500 construction firms, and 8 leading securities companies. This ecosystem serves a vast clientele of large enterprises with diverse, high-quality portfolios spanning trade, manufacturing, technology, and more.

This advantage allows NCB to deliver enhanced value to new customers by leveraging existing resources, offering comprehensive and differentiated financial solutions. Corp360 Platform is the latest breakthrough in NCB’s commitment to supporting the growth of corporations and large enterprises through flexible, digitally integrated financial products that lead the market.

By the end of Q3 2025, NCB had surpassed all 2025 business targets, with total assets reaching over 154.1 trillion VND, a 30% increase from the end of 2024 and 14% above plan. Deposits (excluding issued securities) totaled nearly 119.326 trillion VND, and customer loans exceeded 94.956 trillion VND, up 24% and 33% respectively compared to the end of 2024.

For more information, visit NCB’s website at https://www.ncb-bank.vn, contact any NCB branch or transaction office nationwide, or call the hotline at (028) 38 216 216 – 1800 6166.

Unlocking Opportunities: How Surging FDI Growth Propels Vietnam’s Plastic Industry Forward

Vietnam’s plastics industry is undergoing a transformative phase, fueled by surging foreign direct investment (FDI). This influx of capital is driving both growth and the need for enterprises to elevate their operations to meet international benchmarks. ACB stands as a pivotal partner, empowering businesses to navigate this evolving landscape and seize the opportunities presented by this industrial shift.

Why Does the Plastics Industry Benefit from FDI Growth?

The influx of foreign capital into Vietnam is fueling a surge in growth for the supporting industries. This presents both an opportunity and a challenge, compelling domestic enterprises to enhance localization rates and meet stringent quality standards. As a critical link in the supply chain, the plastics industry—ubiquitous across manufacturing sectors—now stands at a pivotal moment poised for breakthrough advancement.

Mr. Trần Hồng Minh Officially Assumes Role as KienlongBank CEO Starting Today, December 1st

Following approval from the State Bank of Vietnam, the Board of Directors of Kienlong Commercial Joint Stock Bank (KienlongBank; UpCOM: KLB) has officially announced the appointment of Mr. Trần Hồng Minh as the new Chief Executive Officer, effective December 1, 2025.