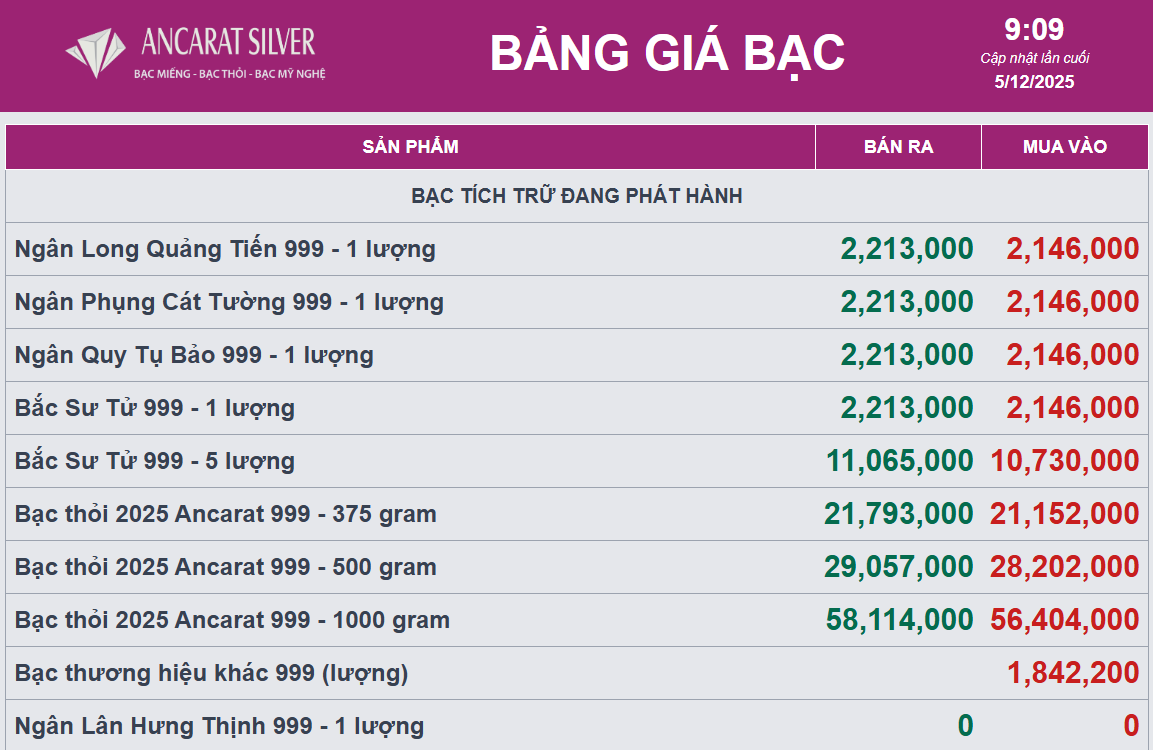

At Ancarat Vietnam Joint Stock Company, silver prices have decreased today, listed at VND 2,146,000 per tael (buy) and VND 2,213,000 per tael (sell) in Hanoi. This reflects a drop of approximately VND 34,000 per tael on the buying side and VND 37,000 per tael on the selling side compared to yesterday morning.

Meanwhile, the price of 1kg 999 fine silver bars stands at VND 56,404,000 per bar (buy) and VND 58,114,000 per bar (sell), updated at 9:09 AM on December 5th.

Globally, silver prices have fallen to $57.1 per ounce.

During the morning session on December 5, 2025, spot silver prices dropped to $57 per ounce as the market underwent a correction following a previous strong rally. This decline reflects investors’ cautious sentiment amid the precious metals market’s exposure to fluctuating USD dynamics, monetary policy expectations, and reduced safe-haven demand.

According to James Hyerczyk, an analyst at FX Empire, the prior surge had pushed silver prices somewhat beyond their short-term fundamentals, necessitating a natural cooling-off period. However, he emphasizes that silver remains in an upward trend, driven by significant momentum from gold. Global gold prices are holding above critical support levels and are likely to reach new highs, thereby maintaining a positive sentiment spillover into the silver market.

Silver prices are currently heavily influenced by expectations that the U.S. Federal Reserve (Fed) may adjust interest rate policies in the near future. The USD shows signs of modest recovery, making precious metals less attractive to investors holding other currencies. Additionally, high U.S. Treasury yields contribute to downward pressure on silver prices as capital shifts toward higher-yielding assets.

Nevertheless, many experts believe silver’s long-term outlook remains positive due to industrial demand, particularly in renewable energy, electronics, and optical device manufacturing. If the market continues to absorb macroeconomic information in a stabilizing manner, silver prices could rebound in upcoming sessions.