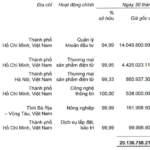

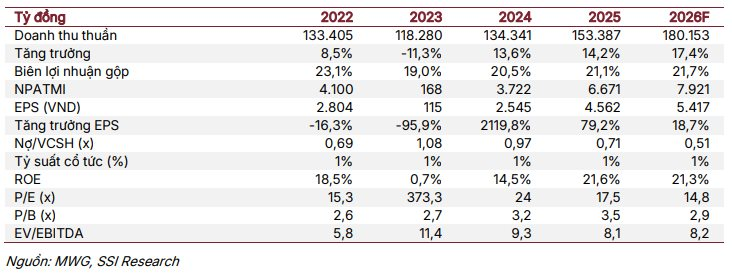

In Q3/2025, MWG achieved record-breaking business results with revenue reaching VND 39.9 trillion, a 17% year-on-year increase and 6% quarter-on-quarter growth. Net profit hit VND 1.78 trillion, soaring 121% year-on-year and 8% quarter-on-quarter.

Following the new high in Q3/2025 net profit, SSI Research revised its 2025 net profit forecast upward to VND 6.7 trillion (an 80% year-on-year increase from the previous estimate of VND 5.83 trillion) and 2026 to VND 8 trillion (a 19% year-on-year increase from VND 6.88 trillion). For Q4/2025 alone, net profit is projected at VND 1.7 trillion, doubling year-on-year.

SSI Research believes that despite 2025 profits peaking, MWG can sustain growth in 2026. This is driven by the recovery in the technology and electronics segment, fueled by device upgrade demand and tax incentives, while BHX is expected to become a long-term growth pillar through expansion and margin improvement. SSI notes that while the technology and electronics segment will continue to grow, it will be at a moderate pace due to modern retail penetration reaching around 80%.

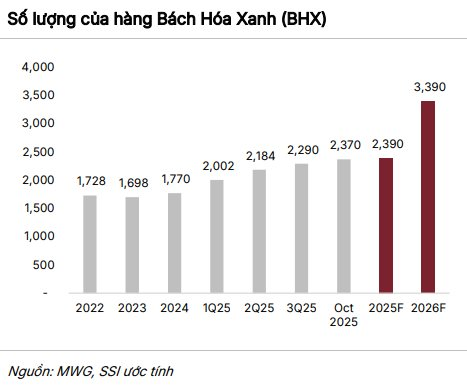

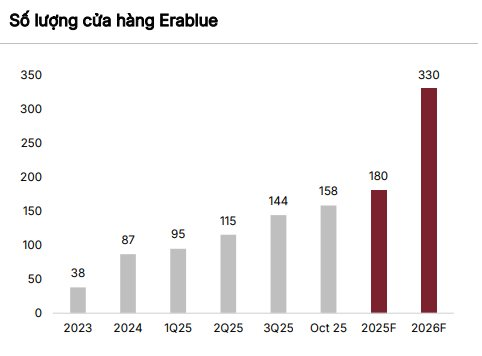

For Bach Hoa Xanh (BHX), SSI anticipates significant benefits from the tax policy shift for individual business households, moving from lump-sum tax to revenue-based taxation. This policy is expected to accelerate the transition from traditional to modern retail. BHX improved its margins in Q3/2025, prompting SSI to raise its 2025–2026 profit forecasts.

According to management, MWG plans to open 620–1,000 new BHX stores in 2025–2026. In 2026, Capex will focus on IT, warehousing, and logistics to support network expansion and operational optimization. Most new stores will be in the Central and Southern regions, with cautious expansion in the North starting from Ninh Binh. SSI views the North as a potential market but highly competitive due to WinMart’s strong presence and local consumer behavior insights.

Challenging conditions for traditional grocery stores, coupled with the revenue-based tax policy effective from June 2025 for businesses with revenue over VND 1 billion (expanding to under VND 1 billion in 2026), will favor modern retail’s market share growth.

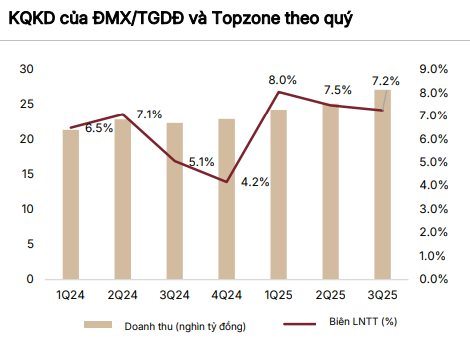

For the technology and electronics segment, SSI believes that demand for new phones, laptops, and upcoming tax reductions will continue to support profit growth. Strong Q3 performance led SSI to raise its 2025–2026 profit forecasts.

Growth in 2026 is expected to remain stable, driven by device upgrade cycles, increased TV demand due to the FIFA World Cup, and fiscal stimulus measures. Key policies include a 2% VAT reduction for technology and electronics from July 2025 to 2026 and the removal of the 10% special consumption tax on air conditioners from January 2026.

From November 2025, heavy rains, storms, and flooding in the Central and Central Highlands regions are expected to impact MWG’s technology and electronics segment. According to management, approximately 50 stores (1% of the total network) had to temporarily close due to extreme weather.

While short-term demand for technology and electronics may weaken, SSI notes that negative impacts will be partially offset by increased demand for essential goods before and during the storms. Notably, any property damage is covered by insurance, minimizing financial risks for the company.

As a result, the net impact of this natural disaster on MWG’s consolidated results is expected to be negligible.

Seizing Opportunities Amid Regulatory Scrutiny: MWG CEO on Tax, Counterfeit, and Substandard Goods Crackdown

The MWG Group’s mini-supermarket chain is set to launch its first store in Ninh Binh this November. According to MWG’s CEO, Mr. Vu Dang Linh, this food retail system has the potential to open over 1,000 stores annually in the upcoming period.