The market maintained its upward momentum with the seventh consecutive session of gains, as liquidity remained robust with trading value on HoSE exceeding VND 25,000 billion. Banking stocks continued to be the backbone of the VN-Index, with MBB emerging as the standout performer of the session.

MBB surged 4.68% to VND 25,700, with over 80 million shares changing hands—the highest on the market. The stock also recorded net foreign buying of more than VND 1,000 billion, making it the focal point of the entire trading session.

Other banking stocks such as HDB, LPB, STB, TCB, and ACB also rose by over 1%, contributing to the overall index gains.

The stock market extended its winning streak to seven consecutive sessions.

Despite slight adjustments in the Vingroup trio of VHM, VIC, and VRE, the surge in mid-cap stocks across various sectors maintained market momentum and spread positive sentiment. Stocks like DXG, DIG, PDR, CEO, VPI, and TAL rallied, with some maintaining gains of 3-4%.

Alongside real estate, the securities sector continued to thrive on expectations of improved system liquidity. VIX rose over 3%, SHS nearly 3%, and MBS 1.7%, while leading stocks SSI, HCM, and VCI remained in the green.

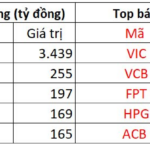

Total trading value on HoSE reached VND 25,300 billion, with VN30 accounting for over VND 14,000 billion, indicating strong focus on leading stocks. The number of gainers was more than double that of decliners, reflecting broad-based sector strength. Steel stocks also rebounded, with HPG up nearly 2% and high liquidity, while NKG and HSG remained positive.

Foreign investors maintained net buying for the third consecutive session, totaling over VND 1,089 billion. Besides MBB, stocks like HPG, VIC, and TCB were also heavily bought. Selling pressure emerged in VHM, MSN, and VIX, but it was insufficient to significantly impact the market.

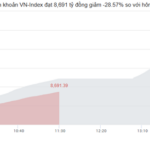

At the close, the VN-Index rose 5.47 points (0.32%) to 1,737.24 points, approaching the strong resistance zone of 1,750-1,760 points. The HNX-Index gained 2.64 points (1.02%) to 262.31 points, and the UPCoM-Index increased 0.78 points (0.65%) to 120.94 points.

Market Pulse 12/05: Foreign Investors Resume Net Selling of Blue-Chip Stocks, VIC Keeps VN-Index in the Green

At the close of trading, the VN-Index rose 4.08 points (+0.23%) to 1,741.32, while the HNX-Index fell 1.66 points (-0.63%) to 260.65. Market breadth favored decliners, with 434 stocks falling and 282 advancing. The VN30 basket mirrored this trend, with 24 stocks declining, 3 advancing, and 3 unchanged.

December 4th: MBB Leads the Market, HDB Surges on Dividend News

At the close of the December 4th session, the banking sector saw 14 out of 27 stocks rise, with 6 declining and 7 remaining unchanged. Notably, MBB and HDB emerged as the top performers among bank stocks on the HOSE exchange, recording the most significant gains.

Anticipated Catalysts for MCH Stock Post HOSE Listing

Hailed as the “missing piece” of Vietnam’s stock market, MCH shares are taking center stage ahead of their upcoming transfer to the HOSE. With the advantages of the transfer, coupled with a favorable macroeconomic backdrop and strong corporate fundamentals, analysts are confident in Masan Consumer’s explosive growth in 2026 and beyond.

VPBankS Anticipated to List on Stock Exchange with Reference Price of VND 33,900 per Share

VPBankS has announced a reference price of 33,900 VND per share for the first trading day of VPX on the Ho Chi Minh City Stock Exchange (HOSE). This comes shortly after the successful completion of its IPO, which involved the issuance of 375 million shares, propelling its equity capital to the forefront of the industry.