Technical Signals of VN-Index

During the morning trading session on December 4, 2025, the VN-Index paused its upward momentum but remained close to the Upper Band of the Bollinger Bands, with the MACD continuing its ascent.

The index is now approaching its October 2025 peak (equivalent to the 1,760-1,795 point range). This will be a significant challenge in the final weeks of the year.

Technical Signals of HNX-Index

In the morning session on December 4, 2025, the HNX-Index rebounded after testing its November 2025 low (around 255-259 points).

The MACD indicator has issued a buy signal. If the Stochastic Oscillator follows suit in upcoming sessions, the short-term outlook will be highly positive.

ACB – Asia Commercial Bank

In the morning session on December 4, 2025, ACB shares continued to rise, accompanied by a small-bodied candlestick pattern indicating investor hesitation.

A Death Cross between the 50-day SMA and 100-day SMA has emerged, suggesting that medium-term prospects remain uncertain.

Additionally, ACB’s price is retesting its medium-term downtrend line, while the MACD has issued a buy signal but remains below zero. This indicates that ACB’s short-term recovery will face challenges ahead.

VND – VNDIRECT Securities Corporation

VND shares rose for the third consecutive session on December 4, 2025, forming a Three White Soldiers candlestick pattern, reflecting continued investor optimism.

VND’s price continued its recovery after retesting the 200-day SMA, while the Stochastic Oscillator has exited the oversold zone and issued a buy signal, further supporting the short-term outlook.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:06 December 4, 2025

Vietstock Daily 05/12/2025: Aiming for the Previous Peak?

The VN-Index extended its winning streak, holding firm despite intraday volatility and closely tracking the upper Bollinger Band. Trading volume remained above its 20-day average, while the MACD indicator continued to widen its gap with the Signal line, reinforcing the index’s positive short-term outlook. This momentum positions the VN-Index to challenge its October 2025 peak, targeting the 1,760-1,795 point range.

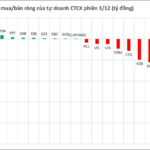

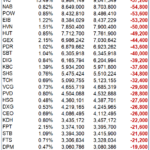

Two Stock Codes Witness Abnormal Net Selling by Securities Firms, Totaling Hundreds of Billions in the December 3rd Session

Proprietary trading desks at securities firms collectively offloaded a staggering VND 625 billion (approximately USD 27 million) in net sales during the period.