Technical Signals of VN-Index

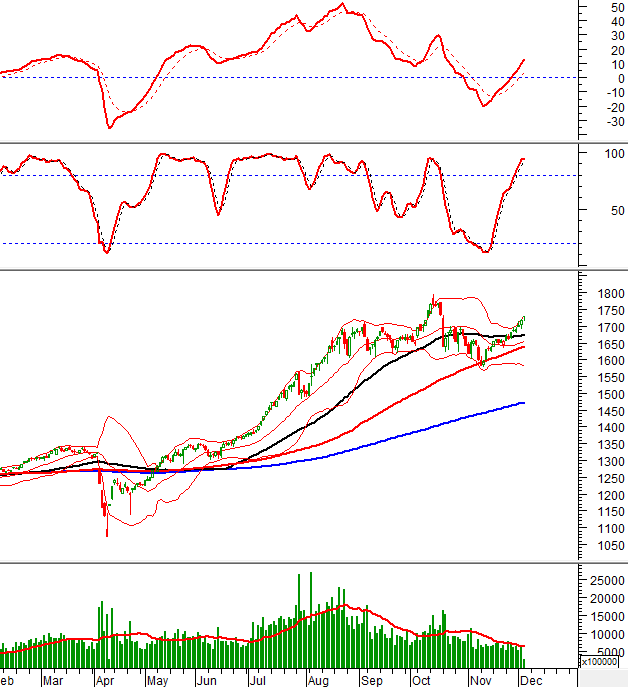

During the morning trading session on December 3, 2025, the VN-Index continued its upward trend, closely following the Upper Band of the Bollinger Bands amid the widening of this range.

The index is currently positioned above both the Middle Band of the Bollinger Bands and the 50-day SMA, indicating that short-term risks remain relatively low.

Technical Signals of HNX-Index

In the morning session on December 3, 2025, the HNX-Index experienced significant volatility while testing the previous November 2025 lows (around the 255-259 point range).

Trading volume has consistently remained below the 20-day average, suggesting that substantial breakthroughs are unlikely to occur.

FRT – FPT Digital Retail Joint Stock Company

During the morning session on December 3, 2025, FRT share prices continued to rise, accompanied by a Big White Candle pattern and a surge in trading volume exceeding the 20-session average, indicating heightened investor activity.

FRT prices are currently retesting the neckline (around 148,000-151,000) of the Ascending Triangle pattern, while the MACD indicator has issued a buy signal. If conditions continue to improve, the potential price target is the 172,000-173,000 range.

MWG – Mobile World Investment Corporation

MWG share prices rose during the morning session on December 3, 2025, accompanied by a White Marubozu candle pattern and increased trading volume surpassing the 20-session average, reflecting investor optimism.

Currently, MWG prices have crossed above the 50-day SMA, and the MACD indicator has reissued a buy signal, approaching the zero line. If positive signals persist, the short-term recovery momentum will be further strengthened.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:12 December 3, 2025

SSI Securities Upgrades Forecast for The Gioi Di Dong, Q4 Profit Expected to Double to VND 1.7 Trillion

Following a record-breaking net profit in Q3/2025, SSI Research has revised its full-year 2025 net profit forecast upward to VND 6,700 billion.

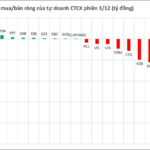

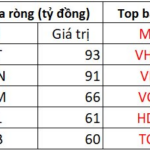

Foreign ETF Funds Witness Heavy Selling as Index Nears 1,700-Point Milestone

After a 4-week period of silence, the VanEck Vectors Vietnam ETF (VNM ETF) shifted to net selling during the week of November 21-28, 2025, coinciding with the VN-Index approaching the 1,700-point milestone.