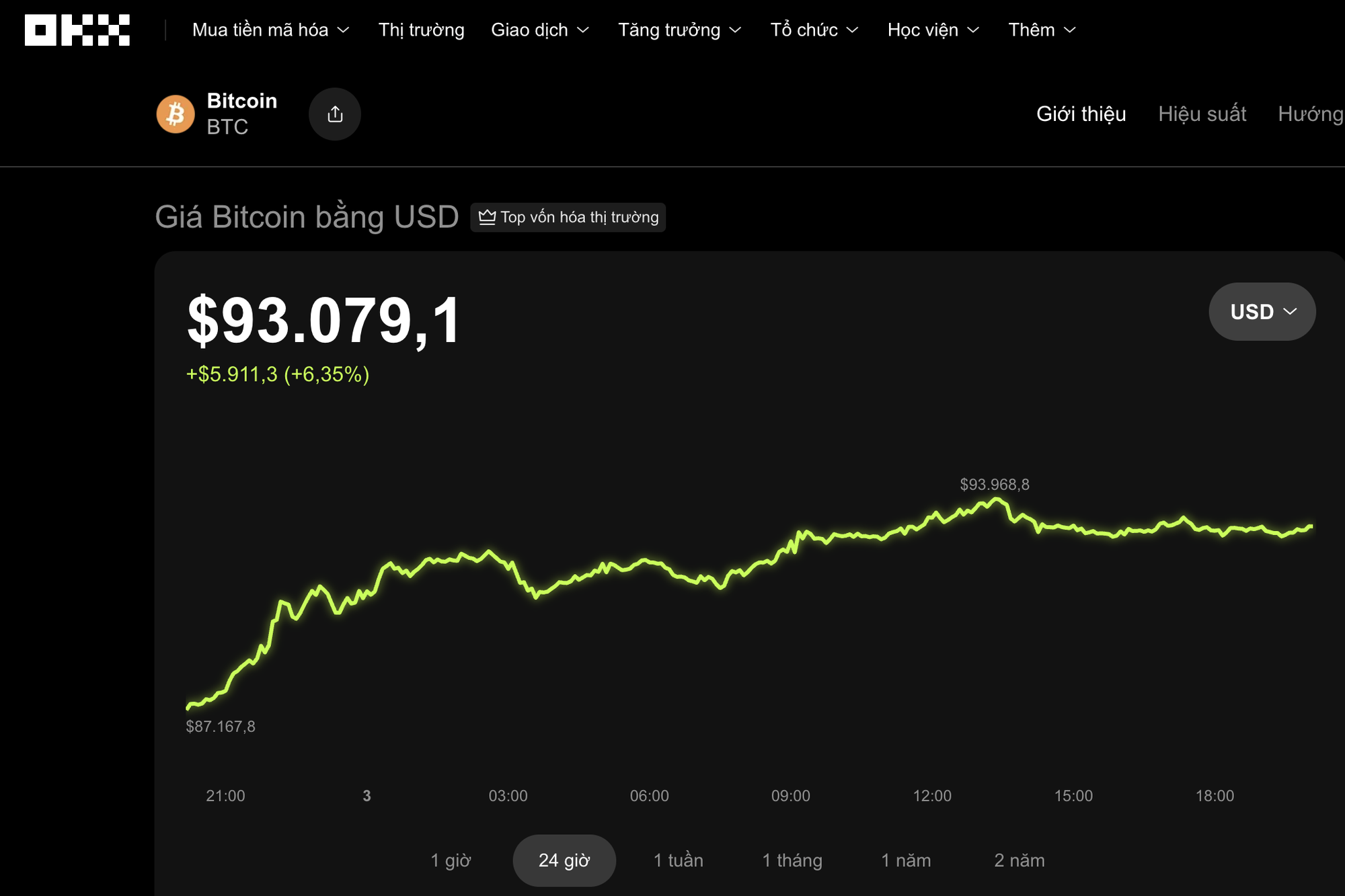

On the evening of December 3rd, the cryptocurrency market witnessed a robust recovery. Data from the OKX exchange reveals that Bitcoin surged by over 6% in the past 24 hours, trading around $93,000.

Several other cryptocurrencies also experienced significant gains, with Solana rising more than 10% to $142; Ethereum climbing nearly 10% to $3,080; BNB increasing by over 7% to $902; and XRP gaining almost 7% to $2.10.

According to Cointelegraph, macro expert Gert Van Lagen noted the emergence of a familiar signal on Bitcoin’s long-term chart, often indicative of an impending substantial price surge.

This signal originates from an indicator measuring the divergence between the upper and lower price bands, reflecting market volatility. Currently, the indicator is at its lowest level ever on the monthly timeframe.

Bitcoin surges to the $93,000 region. Source: OKX

Historically, whenever this indicator drops to such low levels, Bitcoin typically enters a period of robust growth.

“In the past, each time this signal appeared, Bitcoin’s price rose sharply in a vertical manner,” Van Lagen commented.

He cited the example from early November 2023, when a similar signal emerged, and Bitcoin’s price subsequently doubled within four months.

Van Lagen suggests that Bitcoin may currently be preparing for a final upward push to new highs before entering a correction cycle.

He likened the current price pattern to “Google’s stock before its final surge just before the 2008 financial crisis,” where decreasing volatility eventually led to a significant downward movement.

Despite this, the market remains cautious this week, awaiting more definitive confirmation signals.

Today, Bitcoin reached its highest level in over two weeks, nearing $94,000, following rumors that the U.S. might appoint a Federal Reserve Chair more favorable toward the cryptocurrency sector.

Trader Daan Crypto Trades noted that Bitcoin has formed a new peak and higher lows, indicating a resumption of the short-term uptrend. However, he emphasized the need to monitor Bitcoin’s ability to sustain its current price range to confirm a sustainable rally.

Another critical factor is the $93,500 price zone, which marks the opening level of 2025.

Today’s Crypto Market, December 1st: Investors Fear Bitcoin Could Drop to $40,000

Many traders are sounding the alarm, cautioning that if Bitcoin fails to reclaim the $88,000–$89,000 range soon, its price could plummet back to November’s lows, potentially even dropping as far as $50,000.