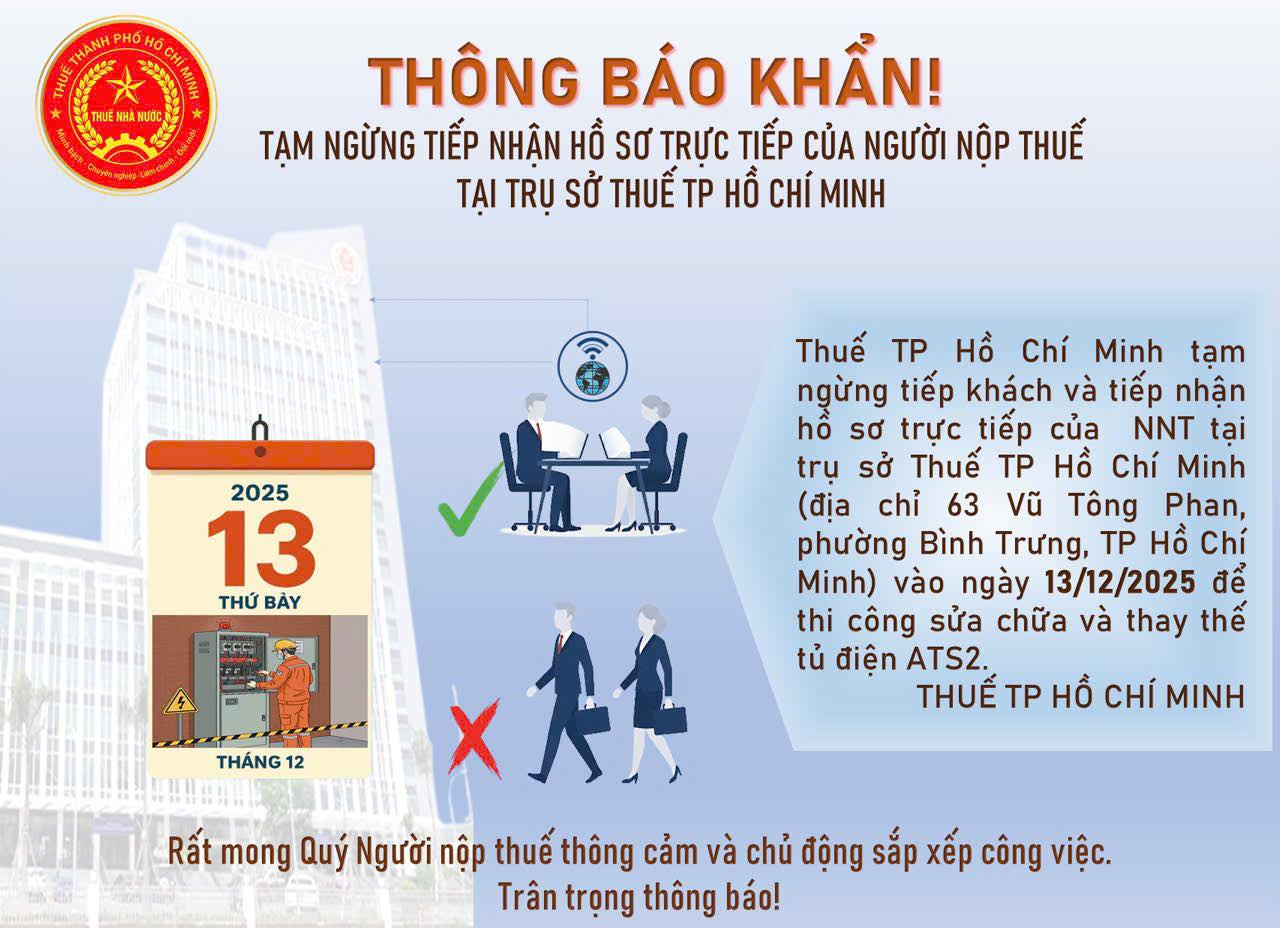

The official Facebook page of the Ho Chi Minh City Tax Department has issued an urgent notice regarding the temporary suspension of in-person tax filing services at their headquarters.

Specifically, the Ho Chi Minh City Tax Department will halt in-person services and tax filings at their headquarters (63 Vu Tong Phan, Binh Trung Ward, Ho Chi Minh City) on December 13, 2025 (Saturday). This suspension is due to essential maintenance work, including the repair and replacement of the ATS2 electrical cabinet, to ensure the safety and stability of the tax authority’s infrastructure in the future.

The department advises citizens, businesses, and organizations to proactively adjust their schedules to minimize inconvenience during this maintenance period. All in-person transactions at the headquarters should be avoided or rescheduled. In-person filing services will resume immediately upon completion of the maintenance work.

As of October 31, 2025, the Ho Chi Minh City Tax Department recorded 44,121 businesses registered to use electronic invoices (e-invoices) generated from cash registers. In 2025 alone, 32,323 businesses joined, accounting for 73.3% of the total registered units, a 174% increase compared to the end of 2024.

Among household businesses, 26,785 households registered to use e-invoices from cash registers, representing 18% of the national scale. This figure increased by 984% compared to the cumulative total at the end of 2024 and by an additional 13% compared to September 2025. The actual usage rate of e-invoices among these households reached 81%, a 4 percentage point increase from the previous month.

Regarding tax management in the e-commerce and digital platform business sectors, the Ho Chi Minh City Tax Department is currently monitoring 399,021 taxpayers (TPs), with a total revenue of 35,357 billion VND, a 52.4% increase compared to the same period in 2024.

Within this, the business sector comprises 40,199 TPs, contributing 34,636 billion VND, a 52% increase from the previous year.

For household and individual businesses, there are 358,822 TPs engaged in e-commerce activities, generating 722.3 billion VND, a 72.5% increase compared to the same period in 2024. Notably, 49,602 TPs have filed and paid taxes online through the dedicated e-portal for household and individual businesses, with a total revenue of over 520 billion VND.

Da Nang Transitions to Contract Households: VNPAY Supports Digital Invoicing and Payments

On November 12, 2025, VNPAY and the Da Nang Tax Department signed a cooperation agreement to launch the “60-Day Campaign,” aimed at assisting businesses in transitioning from lump-sum tax to self-assessment. This initiative also promotes cashless payments and the adoption of digital solutions in tax management.

“Deputy Director of the Tax Department: The More Transparent and Open Businesses Are, the Less Likely They Are to Face Administrative Violations”

Mr. Mai Sơn, Deputy Director of the Tax Department, emphasizes: “The more transparent and compliant business households are, the less likely they are to face administrative violations. With proper collaboration with tax authorities, those who adhere to regulations will not be subject to inspections. In practice, audits are only conducted when there is a perceived risk.”

Century Yarn Boosts Chartered Capital to Over 1.4 Trillion VND Post-Dividend Payout

On October 31, 2025, Sợi Thế Kỷ successfully completed the issuance of nearly 43.5 million dividend-paying shares to 1,544 shareholders, thereby increasing its chartered capital to over 1,401.2 billion VND.

ACB Partners with Ho Chi Minh City Tax Department to Lead Support for Business Households Transitioning Under Decision 3389/QĐ-BTC

ACB (Asia Commercial Bank) has officially partnered with the Ho Chi Minh City Tax Department to launch a comprehensive solution tailored for business households during the transition phase under Decision 3389/QD-BTC. This pioneering initiative by ACB aims to empower business households, alleviating the pressures of change, optimizing operations, and fostering business expansion.