Introducing a groundbreaking initiative that brings a privilege traditionally reserved for credit cardholders to debit card users, VIB has set a record as the first bank to implement installment payments on international debit cards.

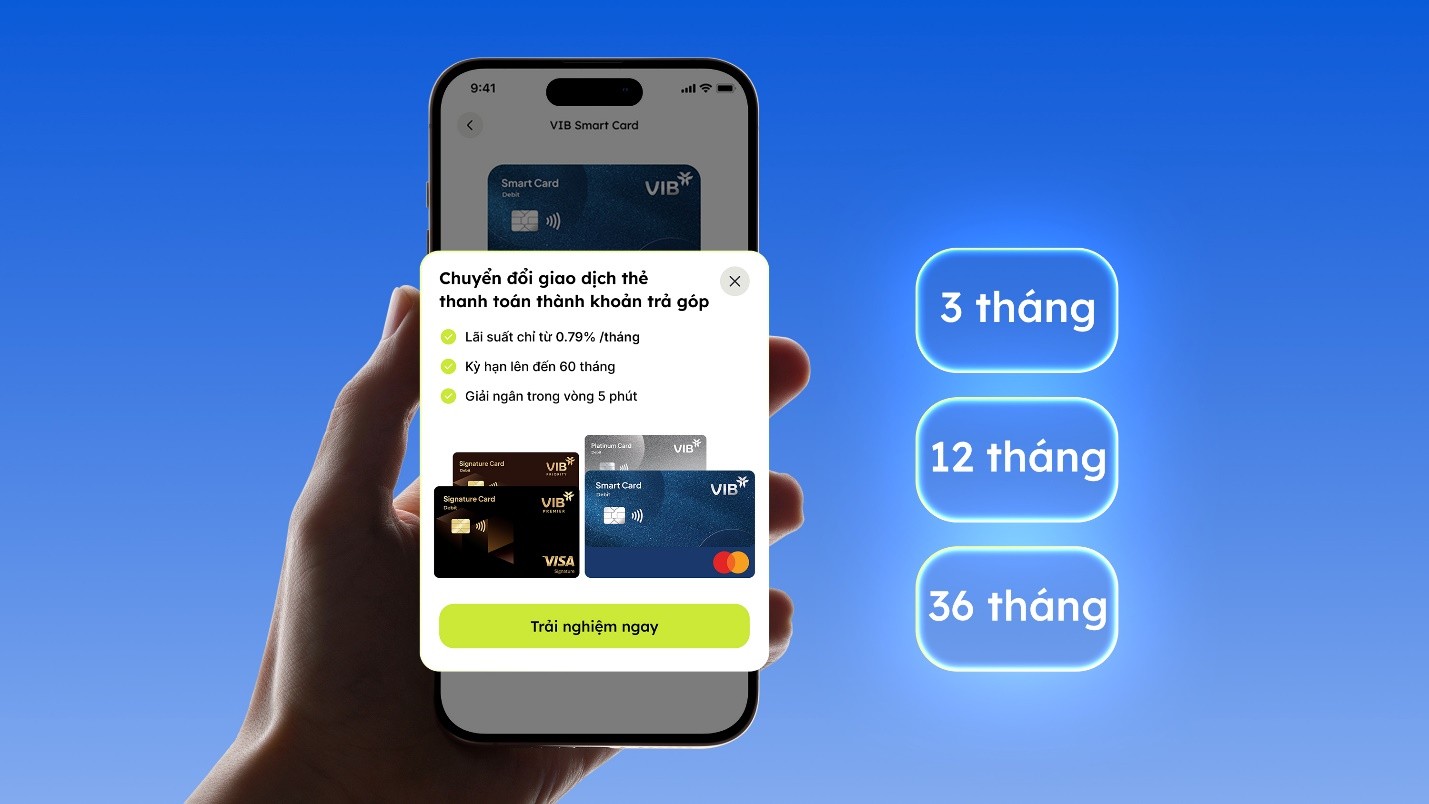

This solution allows cardholders to convert spending transactions into installment plans with just a few taps on the Max app, fully digitized. It opens up flexible access for millions of debit card users who have yet to embrace credit cards.

A Market of Over 125 Million Debit Cards and the Installment Gap

According to market data, Vietnam currently has over 125 million debit cards in circulation, while the number of credit cards is only approaching 13 million. This significant gap highlights a high demand for flexible spending, which remains unmet by suitable products.

VIB’s installment solution for international debit cards is seen as the answer to this gap. Customers can still shop using their VIB debit card with their existing account balance, but now have the option to convert transactions into installments when managing cash flow or optimizing personal budgets.

The decision to convert can be made at the time of purchase or after the transaction is complete, offering greater flexibility compared to other installment methods that rely on point-of-sale staff or consultants.

Leveraging Data and AI for Credit Limit Approval

At the core of this solution is VIB’s data analytics and artificial intelligence (AI) system. Instead of relying on paper documents and lengthy approval processes, the system evaluates based on transaction history, cash flow, spending behavior, and other financial indicators.

Credit limit approvals are automated and instantaneous. Each customer receives a limit tailored to their financial capacity, ensuring personalization while optimizing risk control. Timely payments are recorded on CIC and within the bank’s system, paving the way for access to higher-tier credit products like credit cards, auto loans, or mortgages in the future.

A “Dual-Benefit” Model – Flexibility Meets Value Optimization

In terms of cost, VIB offers competitive interest rates starting at 0.79%/month (approximately 9.5%/year) for transactions from 3 million VND, with terms ranging from 3 to 60 months. Notably, customers can enjoy 0% interest and no additional fees at over 100 VIB partners across electronics, technology, education, travel, and fashion sectors.

A key differentiator is that even after converting transactions to installments, customers continue to earn cashback and rewards as per their debit card’s benefits. This privilege, once exclusive to credit cards, is now uniquely offered by VIB for debit card installment plans.

A Piece of the “Actionable Finance” Ecosystem

The installment solution for debit cards is not just a feature but part of VIB’s “actionable finance” ecosystem. This ecosystem empowers users to manage personal finances through digital tools: from cash flow management and budgeting to smart investing and flexible, responsible credit access.

According to VIB representatives, expanding installment capabilities on debit card infrastructure helps reshape Vietnamese spending and cash flow management habits—especially among young adults building financial independence. Instead of relying solely on credit, users learn to manage money proactively and disciplinedly, while remaining flexible to seize life’s opportunities.

This innovative value has earned VIB recognition from the Vietnam Records Organization as the first bank to enable individual customers to register for installments via international debit cards—a milestone in setting new trends for next-generation personal finance: proactive, flexible, and fully digitized, further solidifying VIB’s leadership in financial innovation.

VIB Honored by JP Morgan with the “2025 Outstanding International Payment Quality Award”

On November 28, 2025, JP Morgan, a leading American bank, awarded Vietnam International Bank (VIB) the prestigious “Outstanding USD International Payment Quality Award 2025.” This accolade recognizes VIB’s exceptional achievement in automating international payment transactions, with an impressive 99.94% success rate in meeting global standards.

Over 1.7 Million Customers Receive Payment Risk Alerts

The State Bank has implemented a range of digital solutions to enhance system security, manage customer data effectively, and combat high-tech crime.

Strategic Partnership Signed Between Funding Societies Vietnam and Nam A Bank

On November 7th, Funding Societies Vietnam, a member of the Funding Societies Group – Southeast Asia’s leading financial platform for small and medium-sized enterprises (SMEs), signed a Memorandum of Understanding (MoU) with Nam A Commercial Joint Stock Bank – An Dong Branch. This partnership aims to pursue foreign currency funding for Vietnamese SMEs.