Hybrid Vehicles Flood the Market

In the final months of 2025, Vietnam’s hybrid vehicle segment has seen a surge of new models. This indicates automakers’ thorough preparation for the upcoming year, 2026.

Leading the charge is the Lynk & Co 08, a newcomer featuring Plug-in Hybrid (PHEV) technology with external charging capabilities. This model is expected to bring fresh energy to the gasoline-electric SUV segment.

Hyundai is also in the game, launching the Santa Fe Hybrid on December 3rd. This addition diversifies options for customers in the 7-seater SUV market.

Newly launched Hyundai Santa Fe Hybrid.

Earlier, in September 2025, THACO introduced the 2026 Kia Sorento Hybrid to Vietnam. The continuous arrival of hybrid models has painted a vibrant market picture.

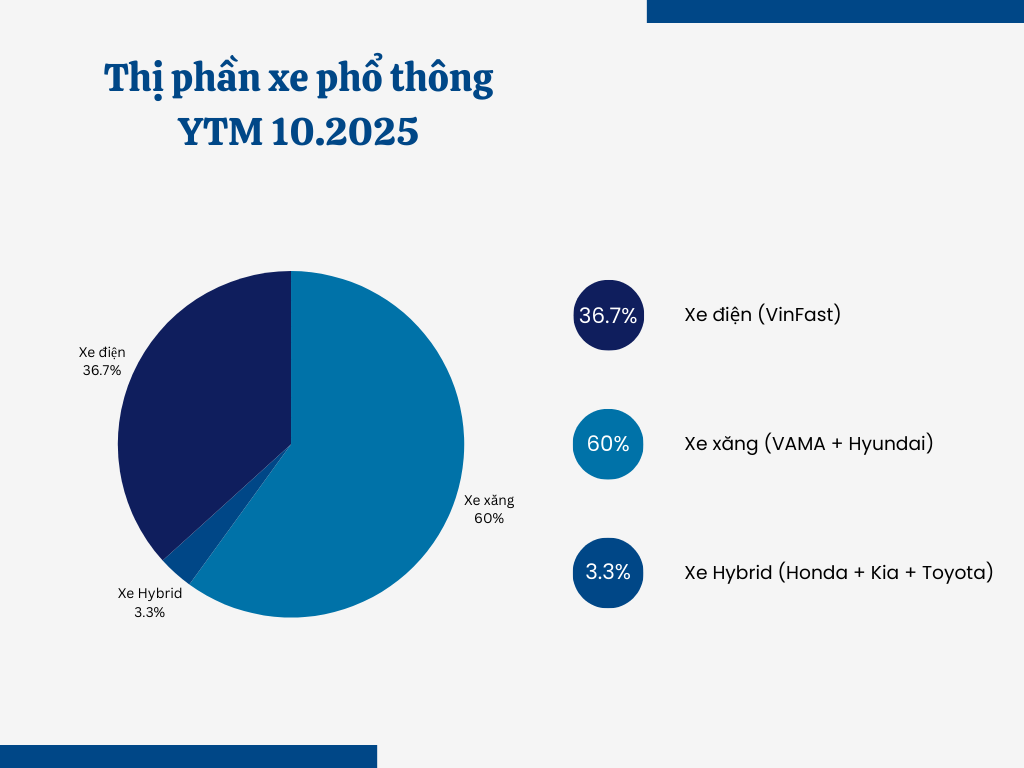

In terms of sales, hybrid vehicles have proven their appeal. From January to October 2025, a total of 11,182 hybrid vehicles were sold, marking a 58% growth compared to the same period in 2024. Hybrids now account for 3.3% of Vietnam’s auto market share.

Can hybrid vehicles become a dominant force in Vietnam’s market?

These figures demonstrate consumers’ growing acceptance and preference for hybrid technology. While market share remains small, the growth rate is noteworthy.

Amid this landscape, VinFast has unexpectedly drawn attention. Previously committed to an all-electric strategy, recent social media and media reports suggest VinFast may be considering gasoline-electric hybrid engines.

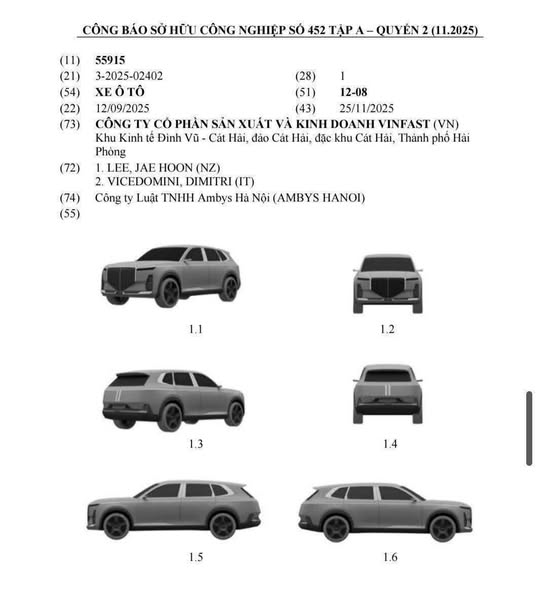

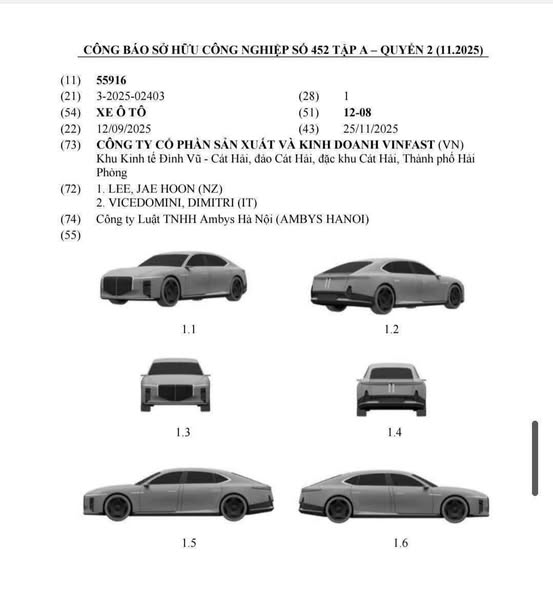

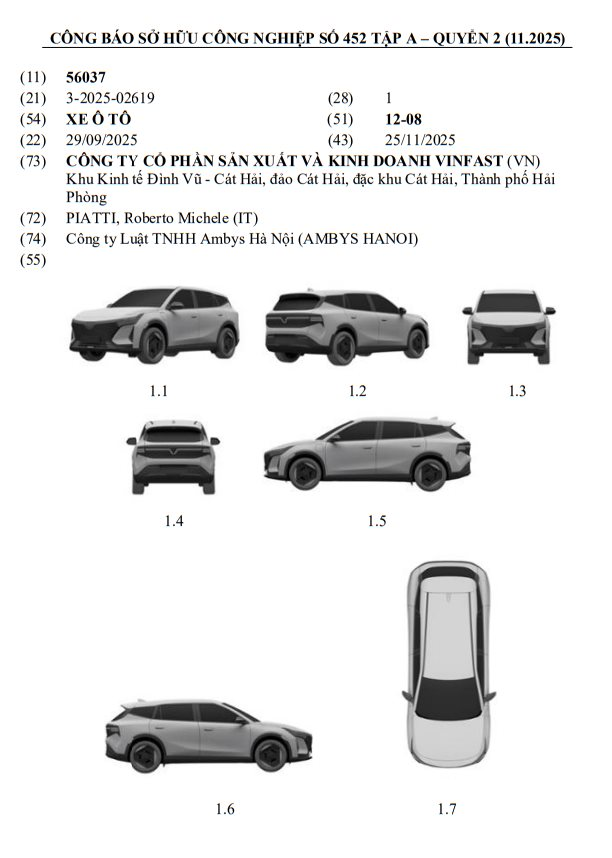

VinFast’s industrial design registrations for new vehicle models.

Rumors gained traction with leaked information about VinFast’s industrial design registrations for three new models, sparking speculation about upcoming hybrid vehicles.

If true, this move would mark a significant shift in VinFast’s strategy, balancing electrification with market demands. It could alleviate consumer concerns about charging infrastructure.

Will 2026 Be the Year of Hybrid Vehicles?

If 2025 was a preparatory phase, 2026 could be the breakout year for hybrids, driven by several factors.

First, Hanoi’s newly adopted Low Emission Zone (LEZ) policy will pilot restrictions in areas within Ring Road 1 starting July 1, 2026. This will gradually limit fossil fuel vehicles that fail to meet emission standards, positioning hybrids as an optimal transitional solution.

Hanoi is implementing measures to reduce pollution, including restricting non-compliant vehicles.

Second, the 30% special consumption tax exemption for hybrids starting January 1, 2026, is a significant boost. Hybrid vehicles will be taxed at 70% of the rate applied to gasoline vehicles with the same engine displacement. This directly impacts retail prices and applies to both imported and domestically assembled vehicles.

Additionally, consumer preferences are shifting toward fuel efficiency. More importantly, hybrids eliminate the need for lengthy charging times, addressing a major concern for potential electric vehicle buyers.

The 2026 hybrid race is not just a trend but a convergence of macro and micro factors: tax incentives, urban environmental pressures, and practical consumer choices.

Revolutionizing Vietnam’s Auto Market: The Rise of Pure Electric Vehicles as the New Industry Pillar

Electric vehicles (EVs) are rapidly emerging as the new driving force behind Vietnam’s automotive market, contributing an impressive 30% to the nation’s overall car consumption. This surge in popularity positions EVs as a pivotal pillar, poised to lead the industry’s sales growth in the coming years.

Vietnam’s Auto Market Shifts Gears: “Double Incentives” Outpaced by “Triple Benefits”

Instead of merely offering registration fee support and loan interest rates, several Vietnamese car manufacturers are now extending their benefits to include long-term maintenance packages. This emerging “triple incentive” trend underscores a shift in consumer behavior, moving from a focus on initial purchase price to a more holistic consideration of total ownership costs.

October Sees a Sharp Rise in Car Sales Across Vietnam

According to the Vietnam Automobile Manufacturers’ Association (VAMA), October sales among VAMA members reached 37,910 units, marking a 24% increase compared to September.

Can the Tet Season Boost Vietnam’s Automotive Market?

As the Vietnamese automotive market enters Q4 2025, the peak shopping season is in full swing with a slew of new models either launched or on the horizon, including the Lynk & Co 08, Mitsubishi Destinator, and Jaecoo J7 AWD. However, many experts predict that the year-end car market in 2025 may not be as vibrant as it was in 2024.