Public Outcry Over the New “Digital Gold”

By the end of 2025, the global and Vietnamese tech markets witnessed an unprecedented surge in the prices of RAM and computer memory—components that had historically enjoyed stable supply and rarely experienced significant price hikes.

While morning financial news focused on the rising prices of gold jewelry and bullion, a silent yet severe crisis unfolded in bustling tech hubs. Here, small RAM modules, once considered disposable components, transformed into “digital gold bars,” with prices fluctuating hourly, leaving consumers and businesses in an unprecedented dilemma.

This surge in RAM prices is not merely a cyclical supply-demand adjustment but a symptom of a deep structural fracture in the global tech economy, triggered by the insatiable demand from artificial intelligence (AI) and strategic shifts among major chip manufacturers.

To understand why a small RAM module has become so expensive, we must examine the global semiconductor industry, dominated by three giants: Samsung Electronics, SK Hynix, and Micron Technology. These companies control over 90% of the world’s DRAM supply, and their decisions create ripple effects across the entire consumer market.

In Q3 2025, the global DRAM industry saw a remarkable revenue surge to $41.4 billion, a 30.9% increase from the previous quarter. However, this growth wasn’t driven by higher sales volumes to consumers but by rising average prices and a boom in high-end memory orders.

Data from TrendForce reveals a shift in the industry’s power dynamics. SK Hynix, by swiftly capitalizing on AI demand and becoming a key supplier of High Bandwidth Memory (HBM) to NVIDIA, led with $13.75 billion in revenue. Samsung, despite its production scale, trailed with $13.5 billion, while Micron secured third place with $10.65 billion. Notably, all three giants have shifted their strategies, prioritizing profit optimization over market share expansion.

After years of losses due to declining PC and smartphone demand, these companies are now leveraging the AI boom to recover. They recognize that in the AI era, memory is no longer a commodity but a scarce strategic resource.

As a result, they prioritize production of high-margin products like HBM and DDR5 for servers, leaving the traditional consumer segment (DDR4, standard DDR5) in short supply.

Why is AI Consuming PC RAM?

A common question arises: “Why does Google or Microsoft building AI data centers affect my ability to buy RAM for my gaming PC?” The answer lies in the physical production process of semiconductors.

Both HBM (used in AI) and standard DRAM (used in PCs/laptops) are produced from the same silicon wafers. However, HBM production is far more complex and resource-intensive. An HBM chip consists of multiple stacked DRAM layers connected via Through-Silicon Via (TSV) technology.

Technical analyses show that producing the same memory capacity requires three times more wafer area for HBM than for standard DRAM. Additionally, HBM has a lower yield rate, leading to higher material waste.

When Samsung and SK Hynix shifted 30% of their production capacity to HBM to meet lucrative orders from NVIDIA and hyperscalers like AWS and Google Cloud, the supply of wafers for traditional DRAM was drastically reduced.

This shift created a negative “equilibrium effect” for end-users. Limited production resources were redirected toward higher-profit AI applications, leaving a significant void in the consumer market. According to Gerry Chen, CEO of TeamGroup, this structural shift has severely constrained the supply of standard memory, with the situation expected to worsen in 2026.

The impact on the supply chain was immediate and severe. Memory module manufacturers (brands like Kingston, Transcend, ADATA), entirely dependent on the “Big Three” for chips, faced dire circumstances.

A notable example is Transcend, a 32-year partner of Samsung, which was abruptly cut off from supplies and received indefinite delivery delays in Q4 2025.

Astonishingly, long-term supply contracts were canceled, replaced by monthly or even weekly pricing. SanDisk, a major NAND Flash supplier, raised prices by 50% in a single announcement.

With unstable input supplies and soaring import costs, module manufacturers passed these increased costs to distributors and ultimately consumers. This mechanism explains why RAM prices in a small Hanoi store fluctuate in sync with AI data centers in the U.S.

Is RAM the New Gold?

2025 will be remembered as a stellar year for gold, with a 57% price increase in the first 10 months, reaffirming its status as a safe haven amid geopolitical instability and currency inflation.

However, in the shadows of gold’s brilliance, RAM prices have surged even more dramatically, establishing it as a new “industrial gold.”

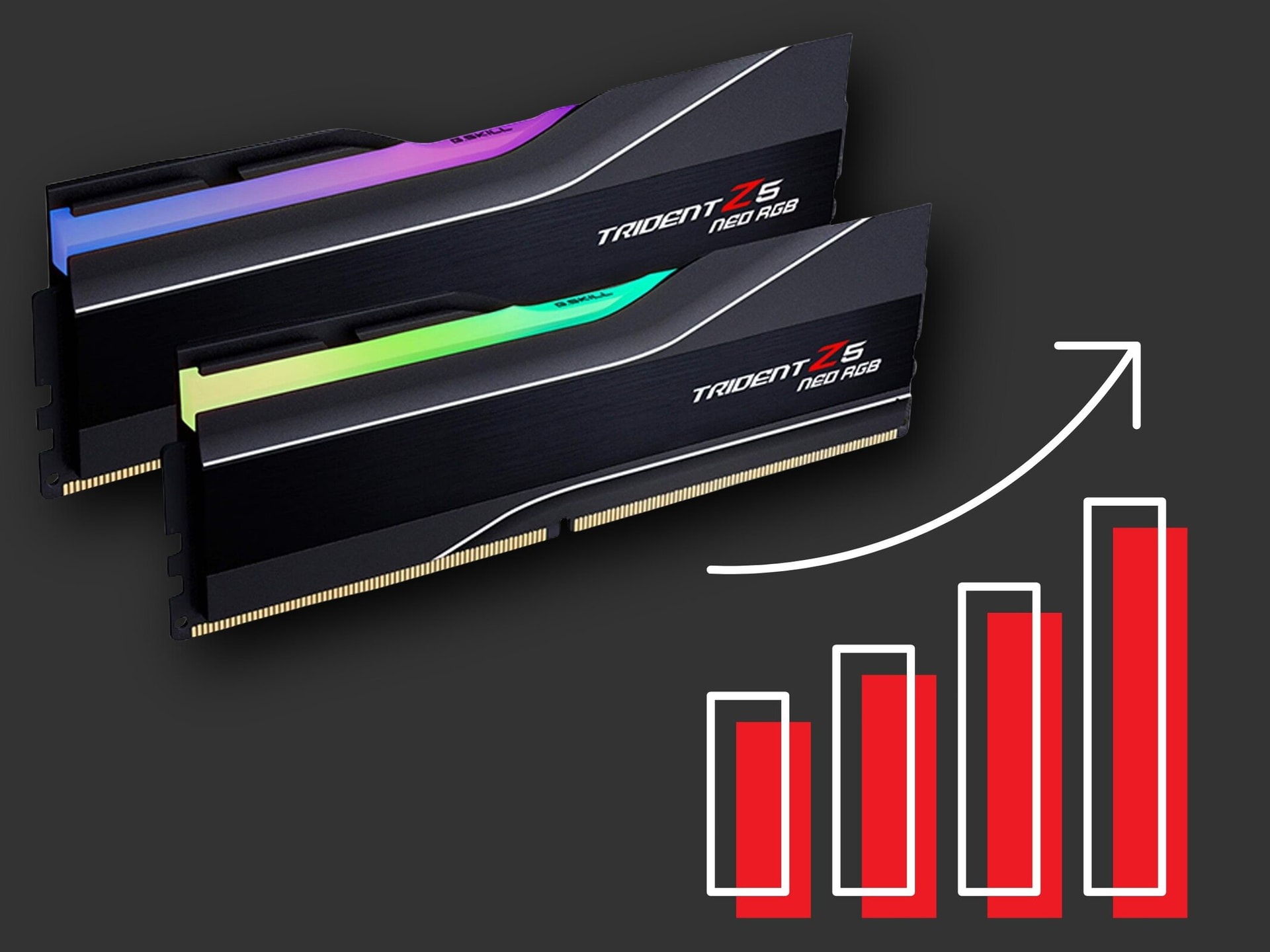

TrendForce data confirms that DRAM contract prices rose by 171.8% year-over-year in Q3 2025, far outpacing gold’s 57% increase and making RAM the fastest-rising commodity in the tech sector.

This creates an economic paradox: While people buy gold to preserve wealth, businesses and computer users are forced to purchase RAM at exorbitant prices to maintain operations, as if investing in a speculative asset.

A 64GB DDR5 RGB RAM kit, priced at $200 in early 2025, now costs $500, a 2.5x increase in just seven months. For many, upgrading a computer now feels as painful as buying gold at its peak to pay off debt.

On Vietnamese retail websites, users notice rapid price changes. Gaming PCs once marketed as “affordable” at 15-20 million VND are now incomplete due to the high costs of RAM and SSDs.

An 8GB DDR4 3200MHz RAM module, once a standard for office PCs, has risen from 350,000 VND to 600,000-700,000 VND. 16GB kits from brands like Kingston or Corsair have increased by 20-40%, surpassing 1 million VND.

For gamers and professionals, the situation is worse. Prices for 32GB or 64GB DDR5 kits have risen by 25-50%. Some RGB or high-speed (6000MHz+) RAM models have increased by over 1 million VND per kit since mid-2025.

SSDs, especially NVMe Gen 3 and Gen 4, have also been affected due to shared semiconductor resources. Prices for 500GB SSDs have risen by 200,000 VND, while 1TB models have increased by 500,000 VND.

Price chaos is widespread. The same product can vary by hundreds of thousands of VND between stores, depending on their inventory timing. Many small retailers advertise low prices online but claim stockouts or demand higher prices when customers inquire.

On forums, users share bittersweet stories of saving year-end bonuses to upgrade their PCs for games like GTA VI, only to find their dreams shattered by current prices.

One VOZ forum member lamented, “Once upon a time, buying RAM cost a bowl of pho; now it costs as much as gold.”

Based on industry data and expert statements, the short- to medium-term outlook is bleak.

Analysts predict DDR5 prices will rise by 30-50% quarterly in the first half of 2026. Shortages will worsen as distributor inventories deplete by Q1 2026.

Smartphones will also be affected. Xiaomi and Realme warn that rising memory costs could increase phone prices by 20-30% by mid-2026, with fewer affordable models offering 12GB/16GB RAM.

Facing this grim outlook, Vietnamese consumers need practical strategies.

Experts advise against waiting for price drops in the near term (3-6 months). If you need a computer for work or study, buy now. Prices are expected to rise in 2026, and delaying could cost you more.

Vietnam Faces Shortage of 27,000 Semiconductor Engineers

The global semiconductor industry is experiencing a rapid surge in demand for skilled professionals, presenting Vietnam with a unique opportunity to establish itself as a key player in this high-tech sector. However, this growth also brings significant challenges, particularly in training and preparing a robust workforce of engineers to meet the industry’s evolving needs.

FPT Joins Semiconductor Alliance, Boosting University-Industry Collaboration

At the semiconductor alliance launch ceremony held at Hanoi National University, FPT Corporation representatives emphasized that the formation of the semiconductor alliance presents a pivotal opportunity for Vietnam to bridge two significant gaps in its semiconductor ecosystem. This initiative also lays the groundwork for universities, research institutions, and businesses to collaboratively seize opportunities within the strategic industry of the 21st century.

Chinese Business Leaders Pledge $10 Billion in Revenue Commitments to Vietnam During Meeting with General Secretary

The conglomerate’s leadership has announced significant investments in science, technology, and innovation across Bac Ninh and other Vietnamese localities.