Cargo handling at Hai Phong International Container Port, Cat Hai Town, Hai Phong City, Vietnam. (Photo: Vu Sinh/TTXVN)

|

Amid global economic pressures from slowing trade and policy uncertainties, Vietnam stands out as a regional exception.

Recent international reports highlight growing confidence in Vietnam’s economic outlook for 2025, driven by the resilience and sustainability of its key growth pillars.

With a GDP growth of 8.23% in Q3/2025, Vietnam leads the six largest economies in the Association of Southeast Asian Nations (ASEAN-6), outpacing Thailand, Indonesia, Malaysia, the Philippines, and Singapore.

This marks Vietnam’s second-highest growth quarter from 2011 to 2025, surpassed only by the post-COVID-19 recovery surge. Over nine months, GDP grew by 7.85%, solidifying Vietnam’s position as one of the region’s fastest-growing economies.

International organizations commend not only Vietnam’s growth rate but also its balanced growth structure.

All three economic sectors expanded robustly: industry and construction grew by 8.69% (with manufacturing nearing 10%), services by 8.49% fueled by vibrant trade and tourism, and agriculture by 3.83%, playing a crucial role in stabilizing food supply and curbing inflation.

Despite complex weather challenges in Q3/2025, manufacturing maintained steady growth. The November 2025 Purchasing Managers’ Index (PMI) reached 53.8, slightly lower than the previous month but remaining above 50, indicating continued business improvement and five consecutive months of manufacturing recovery.

Processing shrimp for export. (Photo: TTXVN)

|

The latest customs data reveals Vietnam’s impressive trade expansion.

As of November 15, 2025, trade turnover surpassed $801 billion, an all-time high. Exports shifted toward high-tech and value-added products, reflecting Vietnam’s upgraded position in the global value chain.

Vietnam’s export market map has transformed significantly: from over 20 markets in 1991, primarily in Asia-Pacific, to trade relations with over 230 countries and territories by 2025.

Recovery is further bolstered by key drivers. Foreign direct investment (FDI) disbursement in the first 10 months of 2025 reached $21.3 billion, the highest 10-month figure in five years.

Domestic consumption rebounded strongly, with 10-month retail sales up 9.3% year-on-year, while tourism surged with 15.4 million international visitors in the first nine months of 2025, among the world’s fastest-growing destinations.

Major international financial institutions have revised Vietnam’s growth forecasts upward. In late October 2025, HSBC and Standard Chartered raised their 2025 predictions to 7.9% and 7.5%, respectively. In November, UOB increased its forecast to 7.7%.

Most recently, S&P Global raised Vietnam’s 2025 growth forecast to 7.7% and 6.7% for 2026.

The Organisation for Economic Co-operation and Development (OECD) acknowledges challenges from weakening global demand but affirms Vietnam’s positive trajectory, forecasting 6.2% growth in 2026 and 5.8% in 2027.

However, international organizations highlight risks Vietnam cannot ignore. Weakening global demand in 2026 may impact exports, especially with potential U.S. tax increases and stricter origin rules. Natural disasters and supply chain disruptions could raise input costs, pressuring businesses.

Domestically, inflation may rise due to strong internal demand and the end of VAT reductions in late 2026, ahead of 2027 tax adjustments. Public investment disbursement, though improving, needs acceleration for broader impact.

The OECD recommends institutional reforms to enhance productivity and growth quality, including market-oriented monetary policies, increased service sector competition, a level playing field for private and state enterprises, and reducing informal labor for better resource allocation.

Processing mangoes for export to the U.S., Europe, South Korea, and Japan at An Giang Fruit and Vegetable JSC in Lam Dong Province. (Photo: Vu Sinh/TTXVN)

|

Regionally, the stark divergence among ASEAN-6 economies highlights Vietnam’s position. In Q3/2025, Malaysia grew by 5.2%, and Indonesia maintained stability around 5%, rare expansions amid slowing global trade.

Conversely, other major economies face growth pressures. The Philippines’ GDP dropped to 4%, below forecasts, reflecting weak household consumption and private investment. Singapore’s growth slowed to 2.9%, down from 4.5% in Q2/2025, as manufacturing faced international trade and tax challenges.

Thailand remains the region’s laggard with 1.2% Q3/2025 growth, its lowest since 2021. Weak goods production and insufficient tourism growth highlight structural issues, lowering 2025-2026 forecasts to 1.2-2.2%.

Vietnam’s exceptional growth positions it as a new ASEAN driver, with expansion rates far surpassing regional peers.

This growth disparity, according to international observers, signals Vietnam’s entry into a new development phase, where policy flexibility, infrastructure quality, and economic openness will sustain its status as one of Asia’s fastest-growing economies in the coming years.

Diệu Linh

– 10:30 05/12/2025

Vietnam’s Recovery Phase: Corporate Profits Poised to Rise, Says Dominic Scriven (Dragon Capital)

At the Annual Listed Companies Conference held on the afternoon of December 3rd, Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, delivered a keynote address. His presentation focused on assessing the global and Vietnamese macroeconomic landscape, emphasizing the critical roles of policy, public investment, and capital markets. Additionally, he provided insightful analysis and predictions regarding the Vietnamese stock market.

EU Names Vietnam ASEAN’s Top Destination, Pledges to Boost High-Quality Investment

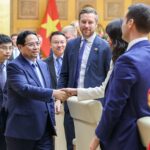

At the Prime Minister’s meeting on November 27th, nearly 40 leading EU businesses reaffirmed Vietnam’s status as a strategic destination, citing its high growth, macroeconomic stability, and rapid green and digital transformation. They pledged to expand investments and support efforts to lift the IUU “yellow card.”

No Additional Land Fees Proposed for Businesses Without Fault

HoREA emphasizes that the addition of this regulation aims to safeguard the legitimate rights and interests of investors in the event of policy changes.