I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 4, 2025

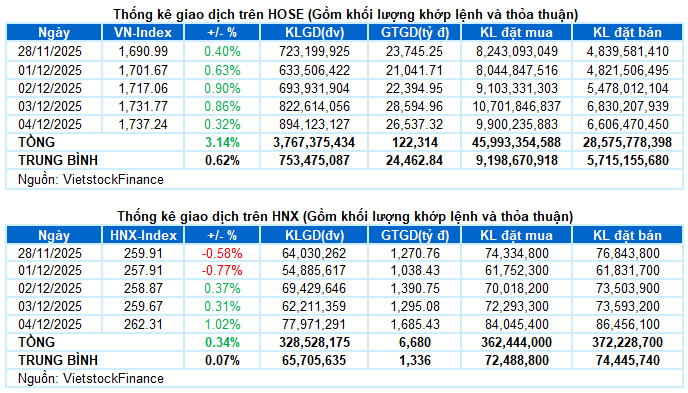

– Major indices maintained their upward trend during the December 4 trading session. The VN-Index rose by 0.32%, reaching 1,737.24 points, while the HNX-Index surged by 1.02%, closing at 262.31 points.

– Trading volume on the HOSE increased by 5.8%, exceeding 762 million units. The HNX recorded over 70 million matched units, an 18.2% rise compared to the previous session.

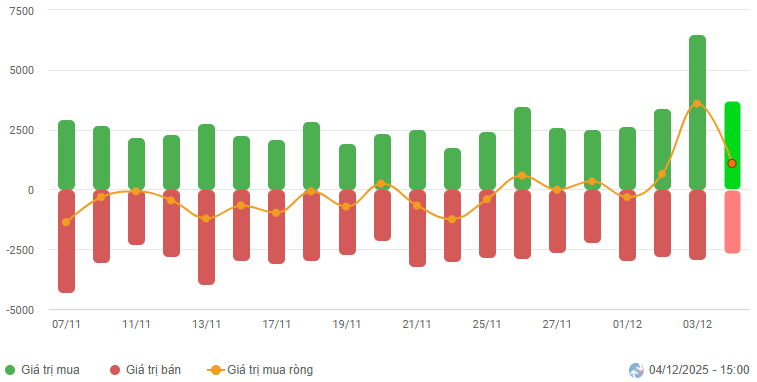

– Foreign investors continued their net buying trend, with over 1 trillion VND on the HOSE and 37 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

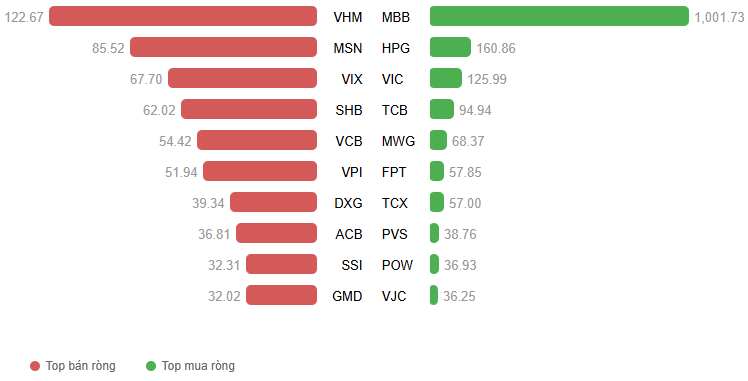

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced volatility during the December 4 session. The VN-Index started positively but faced adjustment pressure from Vingroup’s major stocks, leading to fluctuations below the reference level. However, the overall market sentiment remained positive, with widespread green across sectors, indicating healthy capital rotation. In the afternoon session, buying momentum returned to leading stocks, helping the VN-Index recover and extend its winning streak to seven consecutive sessions, closing at 1,737.24 points.

– In terms of impact, MBB contributed the most positively, adding 2.17 points to the VN-Index. HPG, VPL, and TCB collectively added 2.5 points. Conversely, VIC, VHM, and VJC exerted significant downward pressure, subtracting 4.53 points from the index.

Top Influencing Stocks on the Index. Unit: Points

– The VN30-Index gained 7.54 points (+0.38%), reaching 1,979.53 points. The basket showed mixed performance, with 16 gainers, 10 losers, and 4 unchanged stocks. MBB stood out with a 4.7% increase, also leading foreign investors’ net buying list with over 1,000 billion VND in today’s session. Conversely, VJC faced strong profit-taking pressure, dropping 3.7%, while VNM and SAB adjusted by 1.9% each.

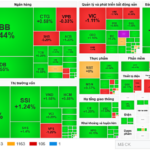

Green dominated most sectors. The non-essential consumer sector led with a 1.24% gain, thanks to significant contributions from VPL (+2%), MWG (+1.3%), FRT (+2.19%), HUT (+1.2%), HHS (+2.85%), STK (+1.51%), VGG (+1.83%), and HTM (+7.69%).

Materials and energy sectors also rose over 1%, with notable performers like HPG (+1.87%), KSV (+4.06%), DCM (+1.03%), DPM (+1.07%), NKG (+1.56%); PVD (+1.92%), PVS (+1.85%), PVT (+1.33%), BSR (+0.98%), PLX (+1.01%), and PVP (+1.73%).

On the downside, essential consumer and real estate sectors lagged with a 0.3% decline. Adjustment pressure came from leading stocks like VNM (-1.86%), MSN (-0.87%), SAB (-1.93%); VIC (-0.89%), VHM (-1.5%), and VRE (-0.29%). However, many others attracted buying interest, such as HAG (+1.69%), QNS (+2.04%), HNG (+1.72%), MPC (+1.76%); DXG (+3.23%), DIG (+2.97%), CEO (+1.54%), PDR (+2.03%), VPI (+3.64%), TCH (+2.22%),…

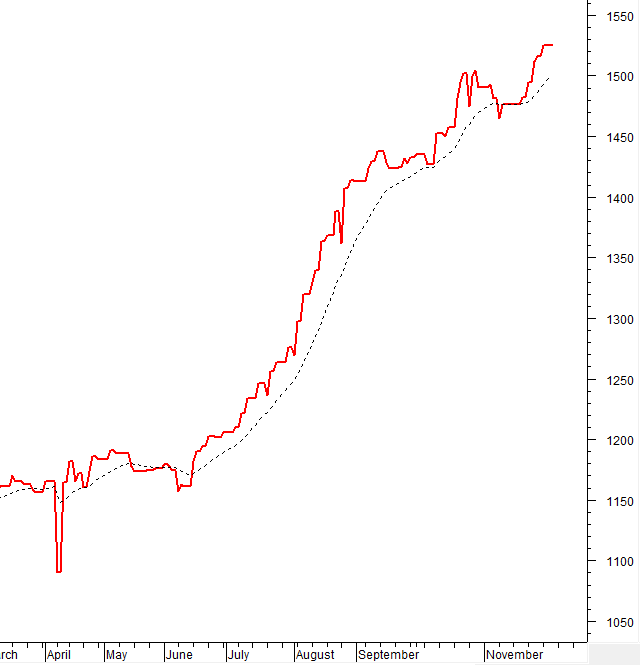

The VN-Index maintained its upward streak despite session volatility, staying close to the Upper Band of Bollinger Bands. Trading volume remained above the 20-day average, while the MACD indicator widened its gap with the Signal line, reinforcing the index’s short-term positive outlook and targeting the October 2025 peak (1,760-1,795 points).

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Sustaining the Upward Trend

The VN-Index maintained its upward streak despite session volatility, staying close to the Upper Band of Bollinger Bands.

Trading volume remained above the 20-day average, while the MACD indicator widened its gap with the Signal line, reinforcing the short-term positive outlook.

The index is targeting the October 2025 peak (1,760-1,795 points), a significant challenge for year-end.

HNX-Index – MACD Signals a Buy

The HNX-Index extended its recovery for the third consecutive session, forming a Big White Candle pattern. The index is approaching the Middle Band of Bollinger Bands, with trading volume surpassing the 20-day average.

The MACD has crossed above the Signal line, signaling a buy. If the Stochastic Oscillator confirms this in upcoming sessions, the recovery outlook will be further strengthened.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn will be mitigated.

Foreign Capital Movement: Foreign investors continued net buying on December 4, 2025. Sustained buying in upcoming sessions will further enhance market optimism.

III. MARKET STATISTICS ON DECEMBER 4, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:26 December 4, 2025

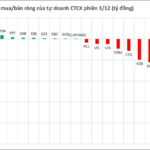

Two Stock Codes Witness Abnormal Net Selling by Securities Firms, Totaling Hundreds of Billions in the December 3rd Session

Proprietary trading desks at securities firms collectively offloaded a staggering VND 625 billion (approximately USD 27 million) in net sales during the period.