FLC Faros Construction JSC (stock code: ROS) has announced a new Board of Directors resolution appointing Ms. Pham Tu Anh, aged 32, as the new Chairwoman, replacing Mr. Dao Danh Ngoc after just three months in office.

Ms. Tu Anh has held multiple management positions within the FLC ecosystem and is the wife of Mr. Trinh Van Nam, who recently joined the FLC Group’s Board of Directors. During an extraordinary shareholder meeting three months ago, the leadership affirmed that these personnel changes would not impact the company’s business direction.

This marks the third chairmanship change this year, with a common thread being that leaders stepped down due to “personal reasons.”

Previously, in mid-January, Mr. Le Tien Dung resigned, and the position was handed over to Mr. Do Manh Hung. Mr. Hung held the role until September before stepping down.

FLC Faros is part of the FLC ecosystem, founded by former Chairman Trinh Van Quyet. Mr. Quyet still holds over 23.7 million shares, equivalent to approximately 4% of the company’s capital.

ROS once created a rare phenomenon in the stock market, with over 30 ceiling sessions in its first three months of listing, driving its price up ninefold compared to its debut. By mid-2017, the stock peaked at nearly 220,000 VND per share (unadjusted price), becoming one of the highest-priced stocks on the market and even entering the VN30 index. ROS’s market capitalization once exceeded 100 trillion VND, rivaling leading industry stocks at the time.

However, the trend reversed in 2018. ROS entered a prolonged decline, particularly plummeting after FLC Chairman Trinh Van Quyet’s indictment, causing the stock price to fall below 3,000 VND. By September 2022, the stock was officially delisted from HoSE due to violations of information disclosure obligations.

Since March 2022, banks have collectively halted disbursements of previously approved loans and stopped granting new credit limits, as the company was identified as a related party in the case. The tightening of bank capital severely reduced financial resources, nearly halting business operations. To adapt, FLC Faros was forced to restructure debt, streamline its workforce, and suspend non-essential projects.

To alleviate financial pressure and raise capital for production and business activities, in early September 2025, FLC Faros approved a plan to issue 6 million shares. The expected issuance price is no less than 10,000 VND per share, potentially raising a minimum of 60 billion VND. This offering targets professional securities investors, strategic investors, partners, creditors, and the company’s customers.

Foreign Blockades Unleash Massive Sell-Off: VN-Index Plunges as Over 1.3 Trillion VND Dumped – Which Stocks Took the Biggest Hit?

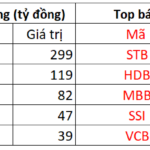

Foreign investors’ trading activity has once again turned negative, with a net sell-off of VND 1,350 billion across the entire market.

FLC’s Fate Hangs in the Balance: Will Trịnh Văn Quyết Make a Historic Appearance at the Upcoming Congress, Three Years After the Landmark Event?

FLC stands at a pivotal moment, poised for a transformative restructuring after more than three turbulent years. The extraordinary shareholders’ meeting on November 11th will not only chart the conglomerate’s future but also reignite speculation: Will Trịnh Văn Quyết reemerge after his prolonged absence?

Trịnh Văn Quyết Pays Nearly 2 Trillion VND in Legal Fines, Retains Assets, and FLC Prepares for Revival

At the pinnacle of his success, Mr. Quyết held a staggering 135 million shares of FLC, 2.6 million shares of ART, and 318.5 million shares of ROS.