On December 4th, Japan’s Kokuyo Group announced its plan to acquire Thien Long Group Corporation (TLG), Vietnam’s leading stationery manufacturer, through a combination of share purchases and a public tender offer.

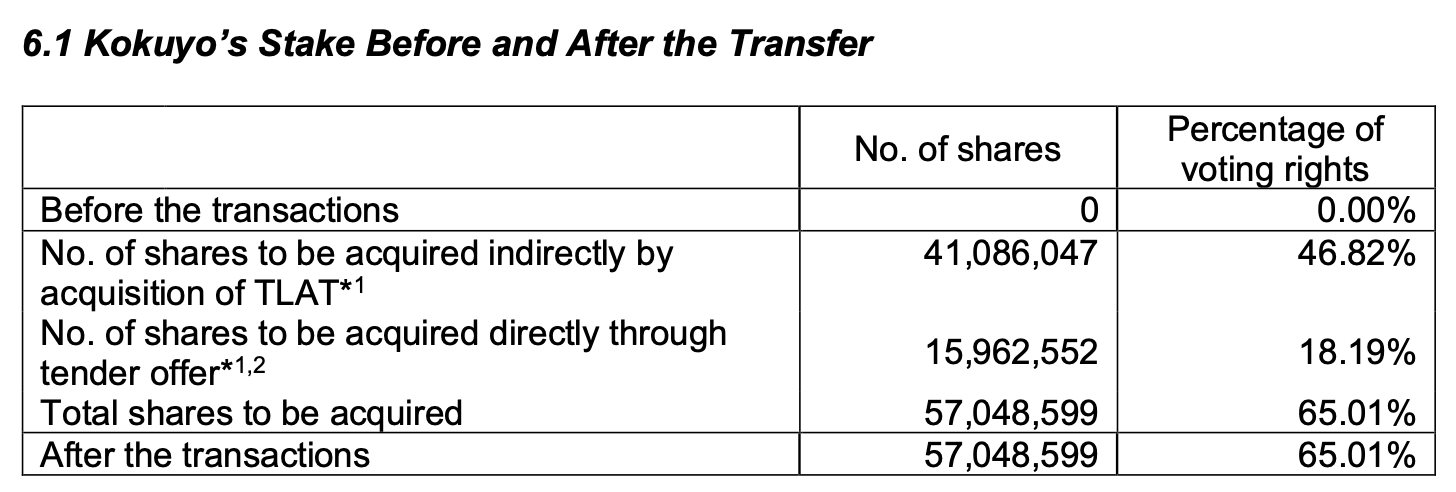

Kokuyo will first acquire all shares of Thien Long An Thinh (TLAT), which holds 46.82% of Thien Long’s shares, owned by the founder and associates.

Subsequently, Kokuyo will launch a public tender offer for an additional 18.19% of Thien Long’s shares. If successful, Kokuyo will hold a total of 65.01%, making Thien Long its subsidiary.

The estimated value of the deal is 27.6 billion Yen (approximately $240 million), or around $3.50 per share, funded by Kokuyo’s own capital. Thien Long’s affiliates, Phuong Nam Cultural JSC and PEGA Holdings JSC, are not included in the deal.

Kokuyo is a renowned Japanese company specializing in stationery, office furniture, and workspace design. It operates across Asia, including China, Thailand, Vietnam, Indonesia, Malaysia, and Singapore.

This acquisition is a strategic move in Kokuyo’s global expansion plan for the stationery industry, aiming to become Asia’s leading brand by 2030. Thien Long’s strong manufacturing capabilities, large market share in Vietnam, and extensive distribution network in ASEAN align perfectly with Kokuyo’s growth strategy.

Combining Kokuyo’s product and marketing expertise with Thien Long’s production and distribution network is expected to create sustainable growth for both companies. ASEAN is projected to become Kokuyo’s next core market after Japan, China, and India.

The TLAT acquisition is expected to close in August 2026, with the public tender offer taking place from October to November 2026, pending regulatory approval. Kokuyo stated that the deal will not significantly impact its 2025 financial results and will provide updates as developments occur.

On the stock market, TLG shares are experiencing a strong upward trend, currently trading at $2.70, approximately 7% below its all-time high reached last year. The company’s market capitalization stands at over $500 million.

In other news, Thien Long’s Board of Directors recently set December 12th, 2025, as the record date for dividend eligibility. The dividend will be paid in both shares and cash.

For the 2024 dividend, the company will issue approximately 8.8 million new shares at a 10:1 ratio, using retained earnings from the audited 2024 consolidated financial statements. This will increase the company’s chartered capital from $36.5 million to $40 million.

Additionally, Thien Long will pay an interim cash dividend for 2025 at a 10% rate, equivalent to $0.04 per share, scheduled for payment on December 26th, 2025. This will amount to approximately $3.5 million in cash dividends.

In terms of financial performance, Thien Long reported a 10.7% year-on-year increase in net revenue to $133 million for the first nine months of the year. However, net profit decreased by 10.7% to $15.6 million, achieving 77% of the revenue target and 84% of the profit target.

“Pen King” Thien Long Responds to Rumors of Japanese Conglomerate Takeover Bid

Amidst current developments, Thiên Long confidently asserts that its production and business operations remain unaffected.

AF8 Forum: When Corporate Governance Becomes the “Global Currency”

At the press conference announcing the 8th Annual Corporate Governance Forum (AF8), industry experts and business leaders unanimously emphasized a critical message: In the context of an upgrading market, corporate governance is no longer merely a compliance exercise but a pivotal factor in attracting foreign investment.

Prime Minister: Logistics Growth Must Outpace GDP by 1.5 Times, Drastically Cutting Costs

Logistics, hailed as the lifeblood of the economy, has been thrust into the spotlight by Prime Minister Phạm Minh Chính. He has set ambitious targets for the sector, demanding annual growth of 15-16%, a contribution of 6-7% to GDP, and a reduction in logistics costs below the current 16%.