The development of this Circular aims to eliminate outdated regulations, ensuring legal consistency and transparency. This initiative facilitates easier compliance for organizations and individuals within the banking sector.

Draft Circular repealing several legal documents issued by the Governor of the State Bank of Vietnam

According to the Draft Circular, 18 legal documents will be entirely repealed, including:

1. Decision 96/1997/QĐ-NH2 on the issuance of cash withdrawal forms.

2. Decision 353/1997/QĐ-NHNN2 on the “Electronic Money Transfer Regulations.”

3. Decision 543/2002/QĐ-NHNN on the development, issuance, management, and use of digital signatures on electronic documents in interbank electronic payments.

4. Decision 674/2002/QĐ-NHNN allowing six State Bank units to directly participate in the interbank electronic payment system, using interbank settlement accounts for mutual money transfer transactions.

5. Decision 376/2003/QĐ-NHNN on the preservation and storage of used electronic documents for accounting and capital settlement by payment service providers.

6. Decision 1509/2003/QĐ-NHNN on the State Bank’s lending regulations to state-owned commercial banks secured by special bond pledges.

7. Decision 457/2003/QĐ-NHNN on the technical procedures for interbank electronic clearing payments.

8. Decision 35/2006/QĐ-NHNN on risk management principles in electronic banking activities.

9. Circular 23/2011/TT-NHNN on implementing the administrative procedure simplification plan for payment activities and other areas under the Government’s Resolution on simplifying administrative procedures managed by the State Bank of Vietnam.

10. Circular 03/2015/TT-NHNN guiding the implementation of certain articles of Decree 26/2014/NĐ-CP on the organization and operation of banking inspection and supervision.

11. Circular 25/2015/TT-NHNN guiding preferential loans for social housing policies.

12. Circular 26/2015/TT-NHNN guiding procedures for mortgaging and releasing collateral for housing construction projects and future housing.

13. Circular 08/2019/TT-NHNN amending and supplementing certain articles of Circular 03/2015/TT-NHNN dated March 20, 2015, on guiding the implementation of Decree 26/2014/NĐ-CP on the organization and operation of banking inspection and supervision.

14. Circular 13/2019/TT-NHNN amending and supplementing certain articles of related Circulars on licensing, organization, and operation of credit institutions and foreign bank branches.

15. Circular 21/2019/TT-NHNN amending and supplementing certain articles of Circulars regulating cooperative banks, people’s credit funds, and the safety guarantee fund for the people’s credit fund system.

16. Circular 05/2020/TT-NHNN on refinancing for the Vietnam Bank for Social Policies under Decision 15/2020/QĐ-TTg of the Prime Minister on implementing support policies for individuals affected by the COVID-19 pandemic.

17. Circular 12/2020/TT-NHNN amending and supplementing certain articles of Circular 05/2020/TT-NHNN on refinancing for the Vietnam Bank for Social Policies under Decision 15/2020/QĐ-TTg of the Prime Minister.

18. Circular 20/2021/TT-NHNN amending and supplementing certain articles of Circular 25/2015/TT-NHNN guiding preferential loans for social housing policies.

Central Bank Unexpectedly Raises Interest Rates on Forward Purchases to 4.5%: What’s Behind the Move?

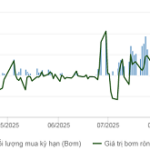

Following the overnight interbank interest rate surge to 7.48% per annum on December 3rd, the State Bank of Vietnam (SBV) unexpectedly adjusted the repo rate for collateralized lending from 4% to 4.5% per annum on December 4th. This move has sparked market speculation about potential ripple effects on the broader interest rate landscape in the interbank market, where transactions occur between banks, businesses, and individuals.

“A Detailed Roadmap is Essential to Eliminate the Credit Room Allocation Mechanism”

The proposal was put forth by Nguyen Thi Viet Nga, Deputy Head of the Hai Phong City Delegation, during the morning plenary discussion session on December 3rd.

Central Bank’s Record Net Injection in 10 Months

During the week of November 24 to December 1, the State Bank of Vietnam (SBV) significantly expanded its liquidity support to the system, injecting a net of VND 98,980 billion into the open market operations (OMO). This marks the seventh consecutive week of net injections and represents the highest level since late January this year.