Market sentiment remained cautious as the stock market experienced a tug-of-war in the final session of the week. The VN-Index closed up 4.08 points (0.23%) at 1,741 points. Liquidity improved, with trading value on HOSE nearing VND 20 trillion.

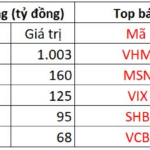

Foreign trading was a downside, as foreign investors turned net sellers with a total of VND 678 billion.

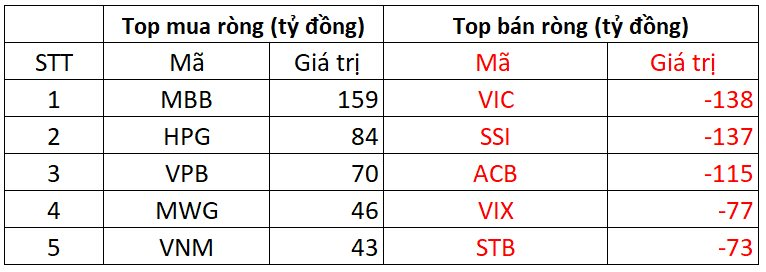

On HOSE, foreign investors net sold VND 605 billion

On the buying side, MBB was the most purchased stock by foreign investors on HOSE, with a value of over VND 159 billion. HPG followed closely, with VND 84 billion bought. Additionally, VPB and MWG were bought for VND 70 billion and VND 46 billion, respectively.

Conversely, VIC was the most sold stock by foreign investors, with VND 138 billion. SSI and ACB were also heavily sold, with VND 137 billion and VND 115 billion, respectively.

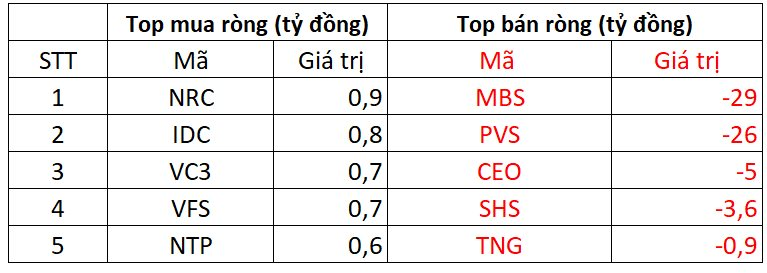

On HNX, foreign investors net sold VND 64 billion

On the buying side, NRC was the most purchased stock with a value of VND 1 billion. IDC followed with VND 1 billion. Foreign investors also bought VC3, VFS, and NTP for a few billion dong each.

On the selling side, MBS faced the most selling pressure from foreign investors, with nearly VND 29 billion sold. PVS followed with VND 26 billion, and CEO, SHS, and TNG were sold for a few billion dong each.

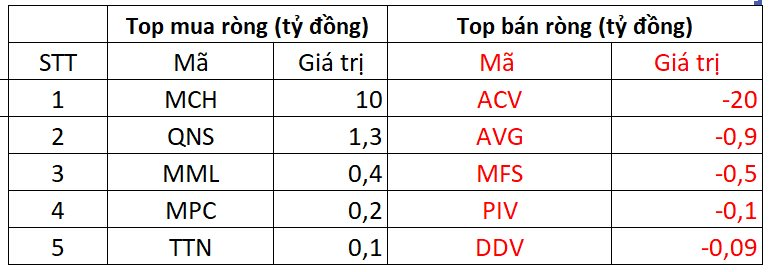

On UPCOM, foreign investors net sold VND 9 billion

On the buying side, MCH was purchased by foreign investors for VND 10 billion. QNS and MML were also bought for a few billion dong each.

Conversely, ACV was sold by foreign investors for VND 20 billion. Foreign investors also net sold AVG, MFS, and others.

Phat Dat to Issue 18 Million Shares to 177 Employees

Phát Đạt plans to issue 18 million ESOP shares to 177 employees. Among them, Board Member and CEO Bùi Quang Anh Vũ will receive the largest allocation.

Stock Market Week 01-05/12/2025: Extending the 4-Week Winning Streak

The VN-Index trimmed its gains in the final session of the week but still concluded a robust trading week, surging over 50 points compared to the previous week. Broader buying momentum, coupled with foreign investors returning to net buying, signaled optimism as the index approaches its October 2025 peak (around 1,760-1,795 points).