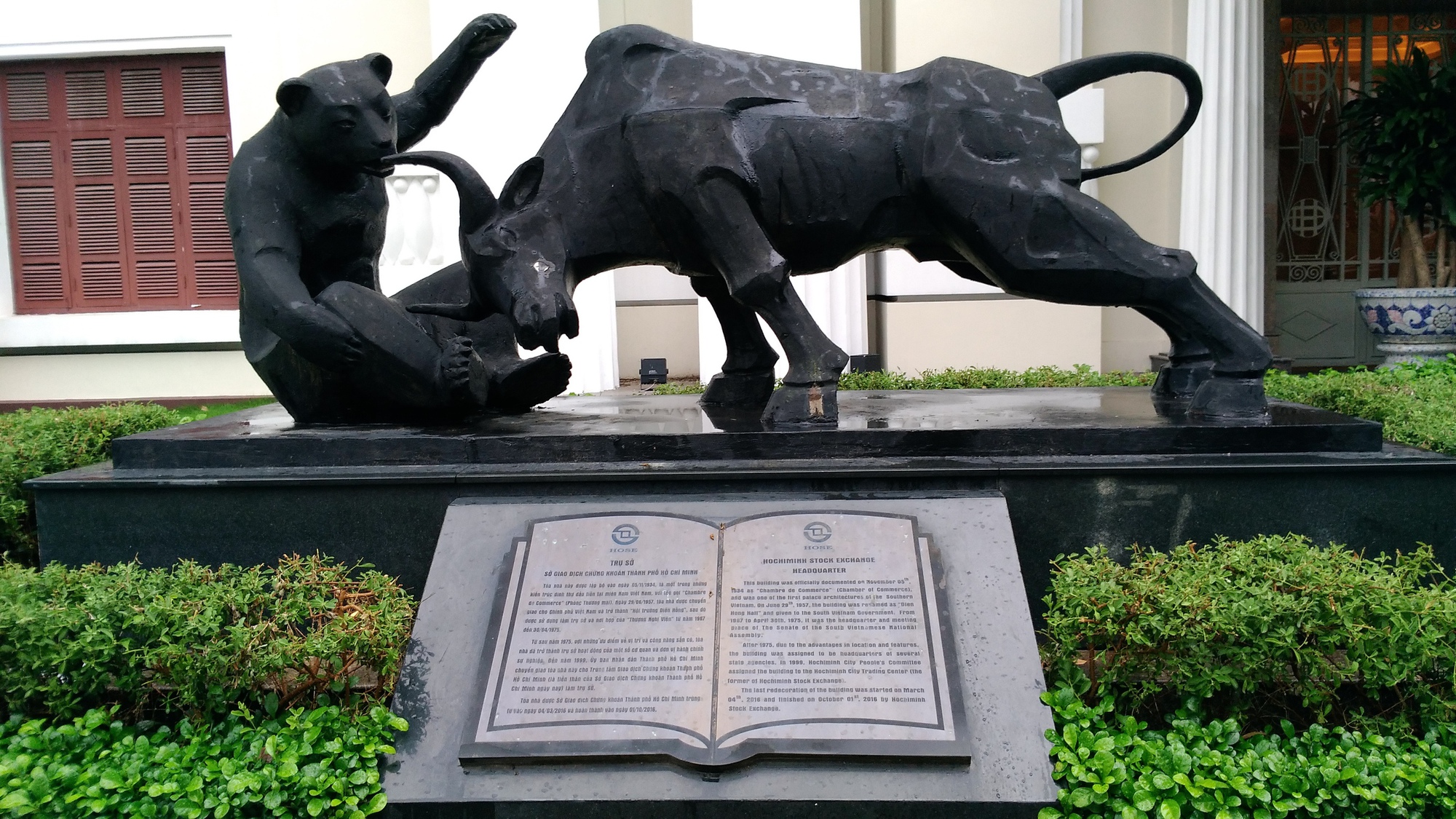

In recent days, investors have been drawn to a new symbol outside the Ho Chi Minh City Stock Exchange (HoSE) headquarters at 16 Vo Van Kiet Street: a gleaming golden “charging bull” statue, poised aggressively forward.

This artwork replaces the previous “bull-bear” statue group installed in July 2020 when HoSE officially began operations at this location. The new statue is still under final touches, hence the surrounding area is cordoned off.

Reporters from Nguoi Lao Dong Newspaper reached out to HoSE leadership for insights into this symbolic change but have yet to receive a response.

The newly unveiled “Charging Bull” statue at HoSE, replacing the previous bull-bear confrontation imagery.

In stock market parlance, the “bull” and “bear” are iconic symbols. The bull (bull) represents upward price trends (uptrend) with its forward-charging horns, while the bear (bear) signifies downward trends (downtrend), its clawing and pinning motion reflecting market pessimism.

Thus, investors refer to prolonged price increases as a “bull market” and deep declines as a “bear market.”

The previous bull-bear confrontation statue.

The original “bull-bear confrontation” statue at HoSE since 2020 symbolized the perpetual tug-of-war between buying and selling forces in the market.

Now, the new “charging bull” statue is seen by investors as a fresh signal, embodying hopes for a sustained market growth cycle in the coming period.

This new symbol isn’t just a visual change but carries a profound message: Vietnam’s stock market is striving for robust advancement rather than focusing on opposition.

The new “Charging Bull” statue at HoSE (Vo Van Kiet)

Analysts argue this message is particularly timely as 2025 marks a pivotal year for Vietnam’s stock market. In October 2025, FTSE Russell officially upgraded Vietnam from frontier to secondary emerging market status. This upgrade is expected to attract tens of billions in foreign investment, targeting more stable, long-term capital flows.

2025 also marks the 25th anniversary of Vietnam’s stock market, with significant milestones. As of October 31, 2025, HoSE lists 670 securities, including 394 stocks, with a total listed volume of nearly 195.24 billion securities.

Market capitalization exceeds 7.25 quadrillion VND, equivalent to 63.02% of 2024 GDP and over 94.18% of total market capitalization. HoSE currently hosts 50 companies with over $1 billion in market cap, including 3 exceeding $10 billion.

Close-up of the new bull statue at HoSE

Finnish Fund Elevates Stake in Ha Do Group to Over 10%

Pyn Elite Fund has successfully acquired 955,600 shares of HDG, elevating its ownership stake to 10.01% of Ha Do Group’s total capital.

Đạt Phương Plans to Offer Nearly 17.8 Million Shares for Sale

The Board of Directors of Dat Phuong has officially adopted a resolution to implement the private placement of shares, as previously approved by the General Meeting of Shareholders.