On December 4th, VNPT Vinaphone hosted a webinar titled “End of Presumptive Tax – What Should Business Households Prepare For?” The event aimed to guide business households through the transition process, ensuring they are well-prepared and can effectively adapt to the new tax declaration method in compliance with regulations.

During the webinar, Mr. A., a store owner, asked: “Currently, my in-store sales are sluggish, and I’m considering closing the store to shift to online sales. Will I still need to declare taxes as I did when operating the physical store?”

In response, Ms. Hoàng Hồng Liên, Director of Tax & Business Consulting at Nexia STT, explained that online sales still require tax declaration, but it is divided into two scenarios:

Scenario One: If Mr. A. sells on e-commerce platforms with integrated payment systems, such as Shopee or Lazada, where taxes and other deductions are withheld before the final net income is paid, the platform will handle tax declaration and payment on his behalf.

Scenario Two: If Mr. A. sells through online channels without integrated payment systems, he must independently declare and pay taxes for the undeclared portion.

Ms. Liên advised Mr. A. to consolidate all income for declaration. Taxes already withheld by online platforms will be deducted, and he will only need to pay the remaining amount.

From January 1, 2026, households and individual businesses will pay taxes based on actual revenue, replacing the presumptive tax model (Illustrative image, source: Internet)

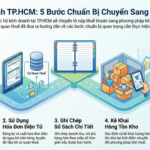

Additionally, regarding the transition from presumptive tax to declaration, Ms. Liên outlined five preparatory steps as part of the Tax Department’s 60-day campaign:

Step One: Proactively seek information and thoroughly understand relevant legal provisions, including the amended Personal Income Tax Law (expected to be approved by the National Assembly) and its guiding documents.

Business households should register for and purchase electronic invoice software and sales software connected to tax authorities. They must also implement invoice and document management systems to be ready for the new regulations by January 1, 2026.

Step Two: Register for an Etax electronic transaction account, VNeID digital identification, and a digital signature to facilitate online transactions related to tax obligations and public services.

Step Three: Complete administrative procedures electronically.

Step Four: Ensure financial transparency by maintaining a separate business account to track cash flow for tax declaration and financial management. According to Ms. Liên, this not only supports tax compliance and transparency but also enhances credibility, potentially enabling a transition to a formal enterprise and access to credit.

Step Five: Determine revenue and management thresholds. Business households should proactively calculate revenue, identify thresholds, and select appropriate tax declaration and management methods or consider adjusting their business model based on actual conditions.

Essential Tax Transition Guide for Small Business Owners

Empower your business with seamless tax compliance. As a sole proprietorship, you can now take control by self-registering, declaring inventory, and opening a dedicated account when transitioning to revenue-based tax filing. Simplify your financial management and stay ahead with ease.

Anticipated 90% Tax Exemption for Businesses: Lingering Concerns Remain

The proposed tax threshold for business households, set at 500 million VND, is five times higher than the current level but still falls short of alleviating concerns among small business owners. Experts suggest considering actual net profit margins by industry, advocating for a lighter approach for low-margin sectors and a firmer stance on high-profit businesses.