According to the draft proposed by the Ministry of Finance, the principles for tax declaration, calculation, and the use of electronic invoices by business households and individual business owners are as follows:

1. Business households and individual business owners must accurately, honestly, and fully declare all contents in the tax declaration file, other revenue items for each type of tax, and other revenue. They must also self-calculate the amount of tax and other revenue to be paid, except in cases where tax calculation, other revenue, tax notification, and other revenue are conducted by the tax authority.

2. In cases where organizations or individuals deduct tax, declare tax, or other revenue on behalf of, or pay tax or other revenue on behalf of the taxpayer as per the provisions of tax laws and other laws, the business household or individual business owner is not required to pay the amount of tax or other revenue that has been deducted, declared, or paid on their behalf.

3. For value-added tax (VAT) and personal income tax (PIT): Business households and individual business owners shall base their actual annual revenue from the production and business of goods and services to self-determine whether they fall under the non-taxable, non-tax-paying, taxable, or tax-paying categories as per the provisions of VAT and PIT laws effective from January 1, 2026.

a) If determined to be subject to VAT and PIT, the business household or individual business owner shall self-calculate the VAT and PIT payable as per the provisions of VAT and PIT laws and declare and pay taxes to the tax authority as stipulated in Article 5 of this Decree.

b) If self-determined to be non-taxable or non-tax-paying for VAT and PIT, the business household or individual business owner shall notify the tax authority of their actual revenue generated during the year as stipulated in Article 4 of this Decree.

4. For VAT, PIT, special consumption tax, natural resources tax, and environmental protection tax:

a) If the business household or individual business owner uses electronic invoices with a tax authority code, the tax authority’s information management system shall support the determination of VAT, PIT, special consumption tax, natural resources tax, and environmental protection tax (if applicable) payable and update the data for the taxpayer.

b) If electronic invoices are not used, the business household or individual business owner shall self-determine the tax payable as per the regulations.

5. For environmental protection fees and other payable fees, the business household or individual business owner shall self-determine the environmental protection fees and other payable fees as per the regulations.

6. When a business household or individual business owner temporarily suspends business operations:

a) For business households required to register with the business registration authority, they shall follow the procedures for temporary suspension of business operations as stipulated in Decree No. 168/2025/NĐ-CP of the Government on enterprise registration.

b) For business households or individual business owners not required to register with the business registration authority, they must submit a written notification to the directly managing tax authority as per the tax management laws to update their status as “temporarily suspended business.”

c) During the temporary suspension period, the business household or individual business owner is not required to submit tax declaration files, except in cases where the suspension is not for a full month if declaring taxes monthly, or not for a full quarter if declaring taxes quarterly.

7. Tax payment deadline and tax declaration file submission location

a) The tax payment deadline is the last day of the tax declaration file submission period. In cases of supplementary tax declaration, the tax payment deadline is the tax declaration file submission deadline for the tax period with errors or omissions.

b) Business households or individual business owners shall submit tax declaration files electronically or directly (in cases where electronic submission is not possible) to the directly managing tax authority where the business household or individual business owner conducts production and business activities.

8. Use of electronic invoices:

a) Business households or individual business owners with annual revenue of VND 1 billion or more must use electronic invoices with a tax authority code or electronic invoices generated from cash registers connected to the tax authority’s data system as stipulated in Clause 8, Article 1 of Decree No. 70/2025/NĐ-CP dated March 20, 2025, of the Government.

b) Business households or individual business owners with annual revenue below VND 1 billion are not required to use electronic invoices with a tax authority code or electronic invoices generated from cash registers connected to the tax authority’s data system. If they meet the conditions for information technology infrastructure and have a need to use electronic invoices, the tax authority encourages and supports them to register for the use of electronic invoices with a tax authority code or electronic invoices generated from cash registers connected to the tax authority’s data system. If they do not register for electronic invoices but have a need to use them, they shall declare and pay taxes before being issued electronic invoices with a tax authority code by the tax authority for each transaction of selling goods or providing services.

c) The procedures and forms for registering the use of electronic invoices shall be implemented as guided by the Ministry of Finance.

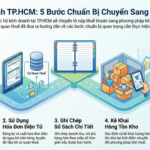

Essential Tax Transition Guide for Small Business Owners

Empower your business with seamless tax compliance. As a sole proprietorship, you can now take control by self-registering, declaring inventory, and opening a dedicated account when transitioning to revenue-based tax filing. Simplify your financial management and stay ahead with ease.

Anticipated 90% Tax Exemption for Businesses: Lingering Concerns Remain

The proposed tax threshold for business households, set at 500 million VND, is five times higher than the current level but still falls short of alleviating concerns among small business owners. Experts suggest considering actual net profit margins by industry, advocating for a lighter approach for low-margin sectors and a firmer stance on high-profit businesses.