Vietnam’s retail market continues its recovery following the impact of Covid-19. According to a report by SHS Research, the cumulative retail sales of goods and services for the first nine months of 2025 reached nearly VND 5.2 trillion, marking a 9.6% increase year-on-year. While traditional retail channels still dominate, their share is gradually declining, making way for modern retail and e-commerce.

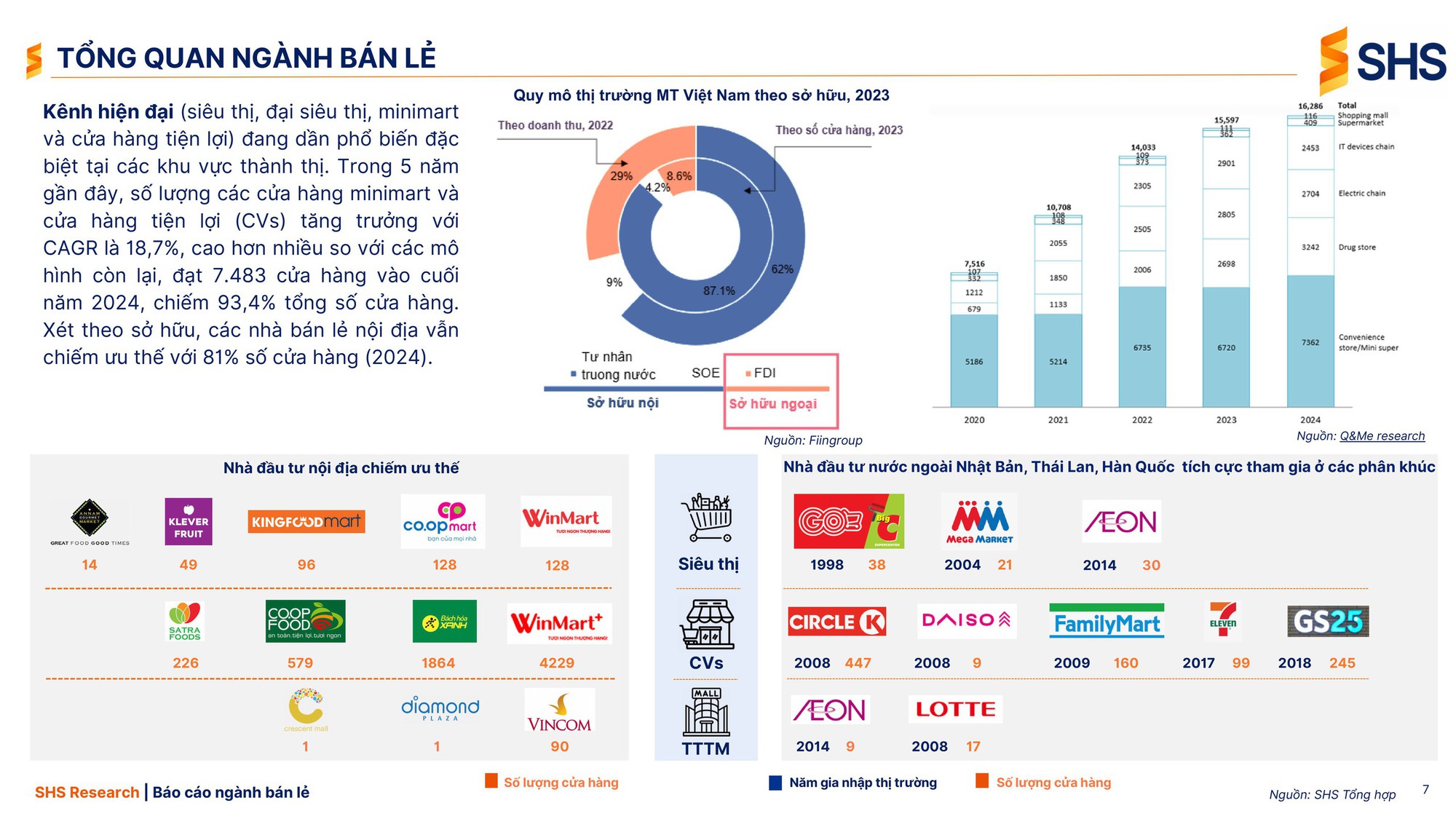

SHS Research reports that Vietnam currently has approximately 1.4 million convenience stores and over 8,300 markets, most of which are small-scale. However, the number of modern retail stores is growing rapidly, particularly minimarts and convenience stores.

By the end of 2024, Vietnam had 7,483 minimarts and convenience stores, accounting for 93.4% of all modern retail outlets. The growth rate of these stores has reached a CAGR of 18.7% over the past five years.

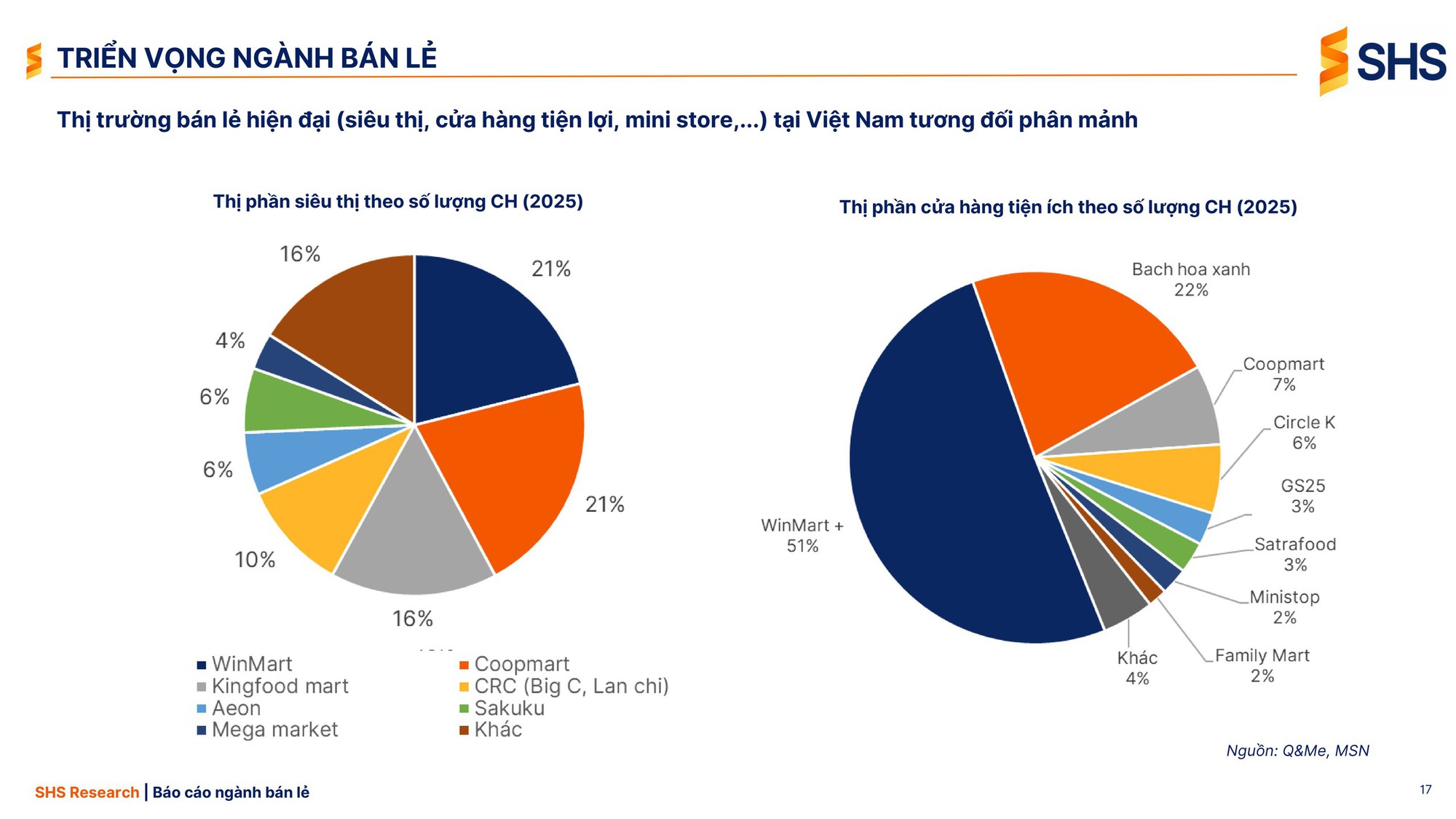

In terms of ownership, domestic retailers hold 81% of modern retail stores, outpacing foreign investors. The market remains fragmented, as indicated by a consolidated report from Fiingroup and SHS.

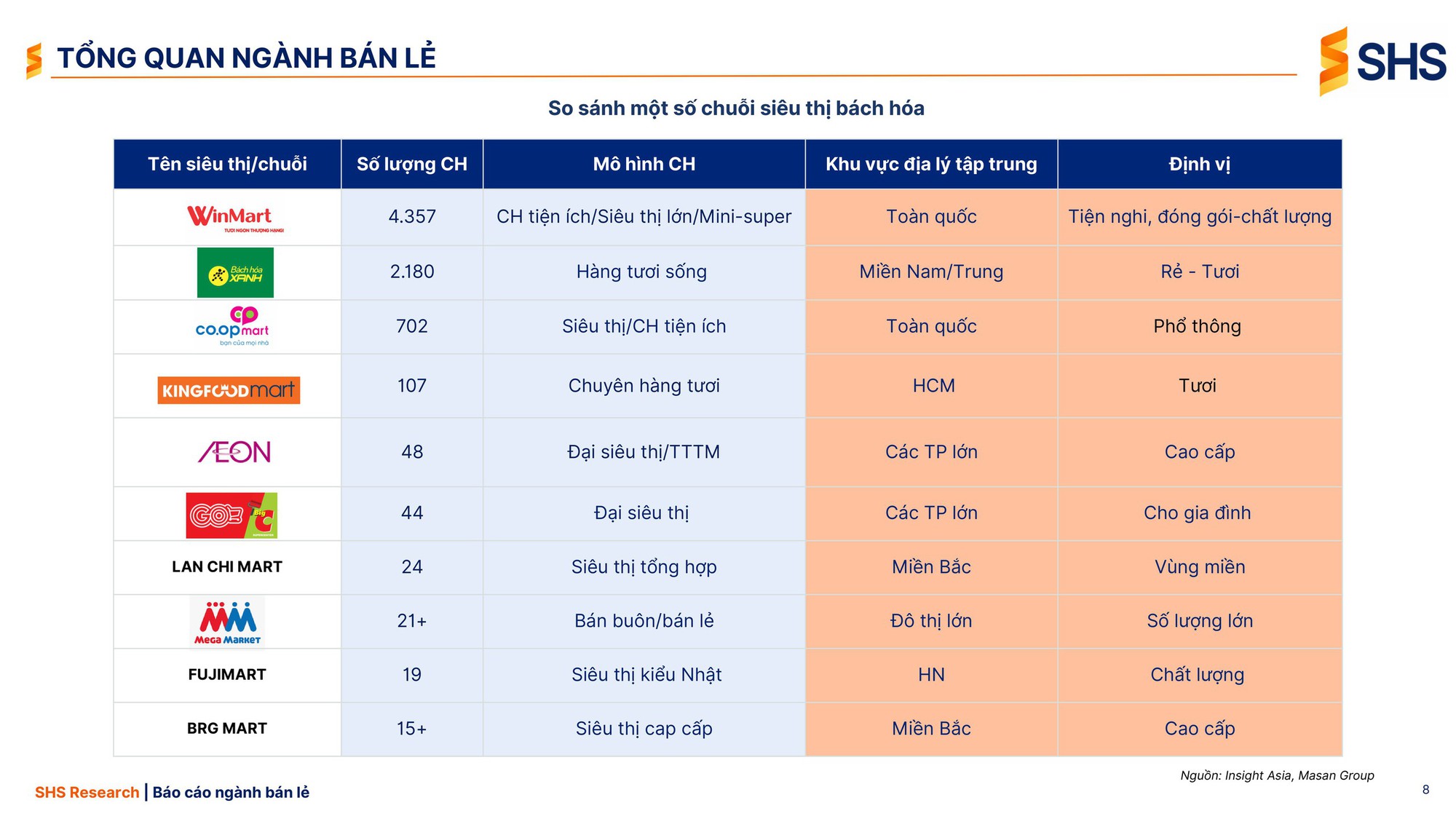

Notable chains include:

WinCommerce (WinMart/WinMart+/Win): With 4,357 stores nationwide, WinCommerce operates convenience stores, large supermarkets, and mini-supers. In Q3 2025, they opened 146 new WinMart+ stores, primarily in the North and Central regions. By October 2025, the total reached 4,357 stores, an increase of 529 from 2024.

Revenue in Q3 grew by 22.6% YoY, with same-store sales (LFL) up 10.6%, the highest ever. Over nine months, WinCommerce achieved VND 243 billion in net profit, compared to a loss of VND 204 billion in the same period in 2024.

Bách Hóa Xanh (MWG): Operating 2,180 stores in the South and Central regions, MWG focuses on fresh produce. By the report’s release, BHX estimated a net profit of VND 255 billion for nine months, with an expected full-year profit of at least VND 600 billion. Revenue growth is significant, contributing increasingly to MWG’s total sales. MWG is expanding BHX to the North, beyond its traditional Southern and Central markets.

Co.opmart/Co.opXtra: With 702 stores, Saigon Union positions this chain as a mass-market retailer.

AEON, Japan’s retail giant, operates 48 hypermarkets and shopping centers in major cities, targeting the premium segment.

Central Retail, Thailand’s retail leader, operates 44 Go!/BigC hypermarkets, also focusing on large urban areas.

Smaller, regionally focused chains include Lan Chi, FujiMart, and BRG Mart.

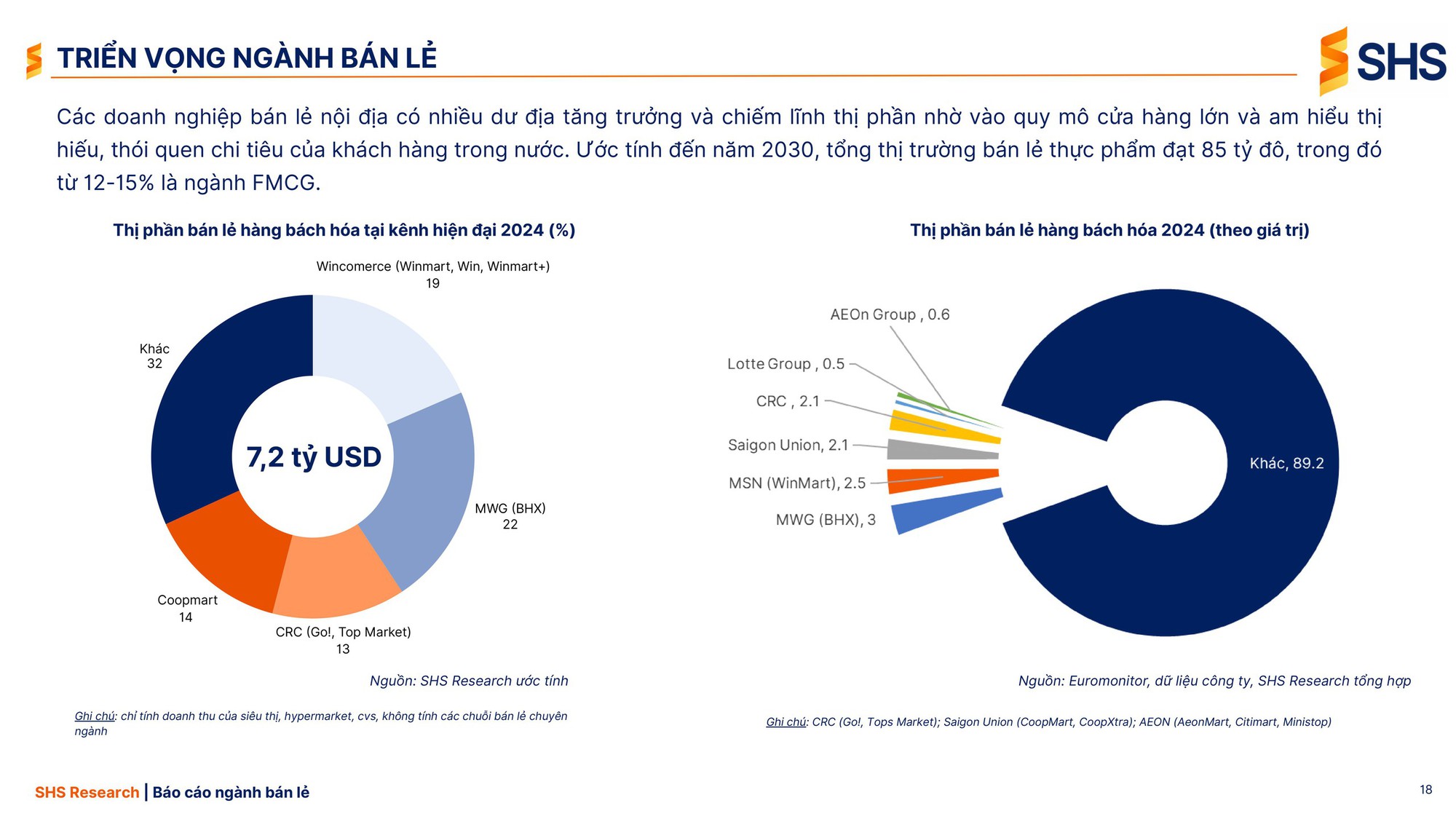

SHS Research highlights that domestic retailers have significant growth potential and market share due to their large store networks and deep understanding of local consumer preferences. By 2030, the total food retail market is projected to reach $85 billion, with 12-15% attributed to FMCG.

Compared to other Southeast Asian countries, Vietnam’s modern retail share in the FMCG sector remains low at approximately 19%, with potential to triple and reach 50-60%.

Rural areas, home to over 60% of the population, represent a significant opportunity for retailers as consumers increasingly prioritize product quality and safety.

The report emphasizes the impact of the new tax policy (Decree 70/2025) in promoting transparency and reducing traditional trade, which currently holds 70% of the fresh food market. This shift is expected to boost modern retail to 35% by 2030, ahead of previous forecasts.

SSI Securities Upgrades Forecast for The Gioi Di Dong, Q4 Profit Expected to Double to VND 1.7 Trillion

Following a record-breaking net profit in Q3/2025, SSI Research has revised its full-year 2025 net profit forecast upward to VND 6,700 billion.

WinCommerce’s Remarkable Comeback: Revolutionizing Vietnam’s Retail Landscape

WinCommerce is entering a pivotal new phase in Vietnam’s retail industry, following five years of aggressive restructuring that has generated a remarkable VND 4 trillion in profit. This transformation not only highlights the company’s robust resilience but also demonstrates how a standardized retail model can capitalize on the market’s growth cycle at the perfect moment.

Where Does Vietnam’s Retail Industry Stand Today?

Vietnam’s retail market is poised for explosive growth, with projections reaching $309 billion by 2025 and soaring to $547 billion by 2030, fueled by a robust CAGR of 12.05%. This unprecedented expansion presents a golden opportunity for businesses equipped with the operational prowess, scalability, and supply chain optimization strategies needed to dominate market share.

What Enables Masan Consumer to Sustain Superior Profitability Across Economic Cycles?

In a volatile global economy, Masan Consumer (UPCoM: MCH) consistently delivers exceptional profitability, ranking among the top FMCG companies in the region with the highest profit margins. In 2025, the company was recognized by S&P Global as one of the world’s leading sustainable consumer goods enterprises.