Phat Dat Real Estate Development Joint Stock Company (stock code: PDR, HoSE) has recently approved the detailed implementation plan for the Employee Stock Ownership Plan (ESOP) for 2025.

Accordingly, Phat Dat plans to issue 18 million ESOP shares, equivalent to 1.84% of the total outstanding shares.

The purpose of this issuance is to recognize the dedication, effort, and positive contributions of employees to the company’s investment and business activities during the 2023-2024 period. It also aims to foster a strong work ethic and high sense of responsibility among employees participating in the 2025 ESOP program.

Additionally, the program seeks to attract and retain high-quality talent with extensive experience and a long-term commitment to the company.

The offering price is set at 10,000 VND per share. Phat Dat expects to raise 180 billion VND from this issuance. The proceeds will be used to supplement working capital for investment, business operations, and debt reduction.

The ESOP 2025 shares will be restricted from transfer for one year. The implementation is scheduled for Q4/2025 or Q1/2026.

Phat Dat has announced a list of 177 employees eligible to participate in this ESOP issuance. Notably, Board Member and CEO Bui Quang Anh Vu is expected to purchase the highest number of shares at 2.17 million. Vice CEO Nguyen Khac Sinh will acquire 1.7 million shares, while the other three Vice CEOs will each purchase over 1 million shares. Vice Chairman Nguyen Tan Danh is set to buy 451,000 shares, and Board Member Le Quang Phuc will purchase 301,000 shares.

The plan was approved by 503.2 million shares, representing 51.8% of the total voting shares, through a written consent process from November 20 to December 1, 2025.

In terms of business performance, Phat Dat recorded 964.4 billion VND in net revenue and 201.3 billion VND in after-tax profit for the first nine months, marking a 450% and 31% increase, respectively, compared to the same period in 2024.

As of September 30, 2025, Phat Dat’s consolidated total assets reached 24,245 billion VND, a slight 1% increase from the end of 2024. Total liabilities decreased by 4.8% to 12,305 billion VND, while equity rose by 8% to 11,941 billion VND.

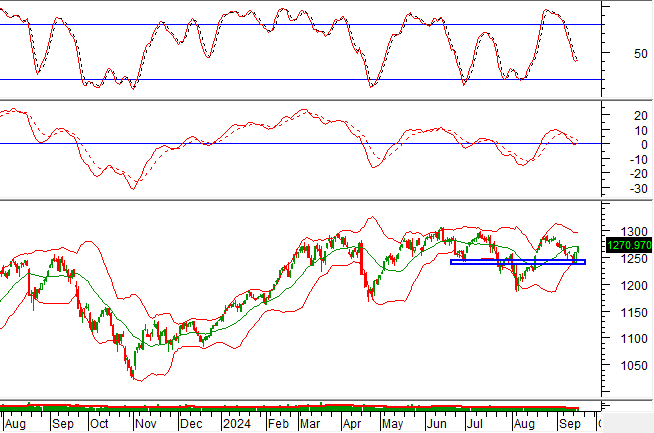

Stock Market Rallies for Seven Consecutive Sessions

Today’s stock market (December 4th) extended its winning streak, marking the 7th consecutive session of VN-Index gains. Blue-chip stocks took turns leading the index higher. Foreign investors signaled optimism with net buying activity over the past three sessions.

Anticipated Catalysts for MCH Stock Post HOSE Listing

Hailed as the “missing piece” of Vietnam’s stock market, MCH shares are taking center stage ahead of their upcoming transfer to the HOSE. With the advantages of the transfer, coupled with a favorable macroeconomic backdrop and strong corporate fundamentals, analysts are confident in Masan Consumer’s explosive growth in 2026 and beyond.

VPBankS Anticipated to List on Stock Exchange with Reference Price of VND 33,900 per Share

VPBankS has announced a reference price of 33,900 VND per share for the first trading day of VPX on the Ho Chi Minh City Stock Exchange (HOSE). This comes shortly after the successful completion of its IPO, which involved the issuance of 375 million shares, propelling its equity capital to the forefront of the industry.