I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF DECEMBER 1-5, 2025

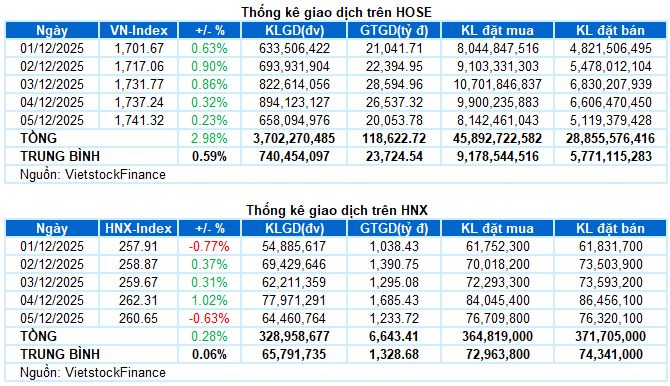

Trading Activity: Key indices showed mixed movements in the December 5th session. The VN-Index rose by 0.23%, closing at 1,741.32 points, while the HNX-Index declined by 0.63%, settling at 260.65 points. For the week, the VN-Index gained a total of 50.33 points (+2.98%), and the HNX-Index edged up by 0.74 points (+0.28%).

The VN-Index kicked off December with a positive week, marking five consecutive sessions of gains. After a recovery phase primarily driven by blue-chip stocks, the market showed broader improvement as buying interest spread across various sectors rather than focusing on a few leading stocks. Foreign trading activity also returned to net buying this week, bolstering investor sentiment despite modest liquidity levels and no significant breakthroughs. Profit-taking pressure emerged in the final session, but the situation remained relatively stable as selling pressure was not accompanied by high volumes. By week’s end, the VN-Index closed at 1,741.32 points, reflecting a nearly 3% increase from the previous week.

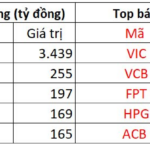

In terms of impact, the top 10 stocks contributed a combined 13.7 points to the VN-Index in the final session, with VIC alone adding over 9 points. Conversely, adjustments in VCB, TCB, and MBB exerted notable pressure, subtracting a total of 3.4 points from the index.

Most sectors retreated in the final session. The energy sector led the decline with a 1.33% drop, primarily due to losses in BSR (-1.62%), PLX (-1.57%), PVS (-2.11%), PVD (-1.88%), MVB (-1.21%), and PVT (-0.53%).

Financial, information technology, and non-essential consumer sectors were also dominated by red, with numerous stocks falling over 1%, including VCB, BID, TCB, LPB, ACB, VPB, MBB, SSI, STB, SHB, VIX; FPT, VEC, POT; MCH, MSN, SAB, MML, ANV, VHC, MPC, HNG, and more.

Meanwhile, the real estate sector stood out with a remarkable 2.41% gain, largely driven by VIC hitting its ceiling price, along with VHM (+1.7%), KSF (+3.48%), SSH (+1.27%), and TAL (+1.68%). However, many other real estate stocks followed the broader market’s adjustment trend, including VRE (-1.74%), KDH (-1.45%), KBC (-2.11%), NVL (-1%), PDR (-1.77%), DXG (-2.61%), CEO (-3.04%), TCH (-1.69%), and others.

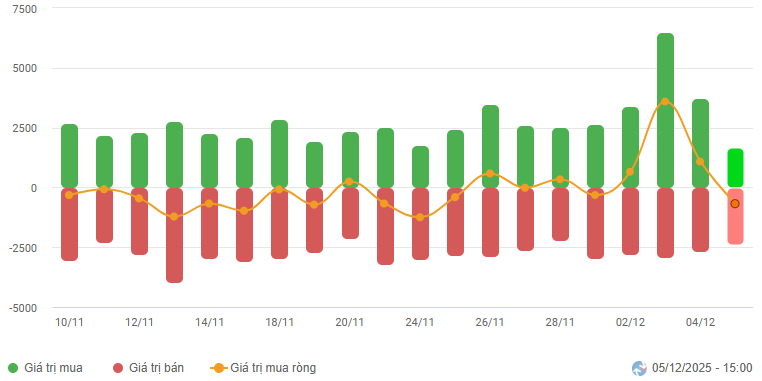

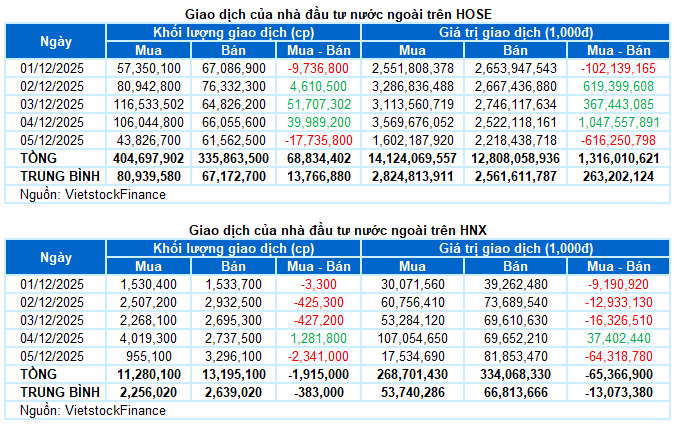

Foreign investors returned to net buying with over 1.2 trillion VND across both main exchanges this week. Specifically, they net bought more than 1.3 trillion VND on the HOSE but remained net sellers with over 65 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

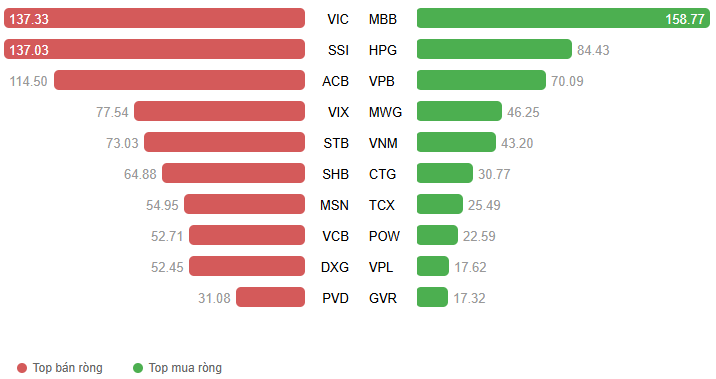

Net Trading Value by Stock Code. Unit: Billion VND

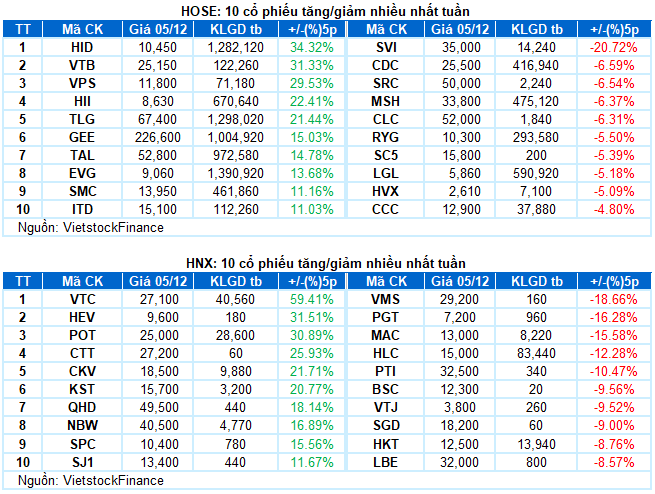

Top Performing Stock of the Week: TLG

TLG +21.44%: TLG saw an impressive breakout this week, testing its previous peak from December 2024 (equivalent to the 66,000-69,500 range), which is also the stock’s historical high. Trading volume surged and remained above the 20-day average, reflecting investor optimism.

Short-term prospects are positive, supported by the MACD indicator widening its gap with the Signal line. However, the Stochastic Oscillator is deeply in overbought territory, and investors should monitor for potential pullbacks if this indicator signals a reversal in upcoming sessions.

Worst Performing Stock of the Week: CDC

CDC -6.59%: CDC experienced a less-than-ideal trading week after falling below its 50-day SMA. Fluctuating trading volumes in recent sessions indicate investor uncertainty.

The Stochastic Oscillator has issued a sell signal, while the MACD remains weak below the zero line. If conditions do not improve, the stock is likely to retest its October 2025 low (around 24,000-25,000) in the coming sessions.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:31 05/12/2025

Market Pulse 12/05: Foreign Investors Resume Net Selling of Blue-Chip Stocks, VIC Keeps VN-Index in the Green

At the close of trading, the VN-Index rose 4.08 points (+0.23%) to 1,741.32, while the HNX-Index fell 1.66 points (-0.63%) to 260.65. Market breadth favored decliners, with 434 stocks falling and 282 advancing. The VN30 basket mirrored this trend, with 24 stocks declining, 3 advancing, and 3 unchanged.