Technical Signals of VN-Index

During the morning trading session on December 5, 2025, the VN-Index continued its upward trend, marking the 8th consecutive session of gains, despite nearing the previous October 2025 peak (equivalent to the 1,760-1,795 point range).

Trading volume has consistently remained above the 20-day average in recent sessions, indicating investors are not overly cautious.

Technical Signals of HNX-Index

During the morning trading session on December 5, 2025, the HNX-Index experienced a slight correction while retesting the Middle Band of the Bollinger Bands.

Both the MACD and Stochastic Oscillator indicators have signaled a buy, suggesting a positive short-term outlook.

DBC – Dabaco Group Joint Stock Company

During the morning trading session on December 5, 2025, DBC shares rose alongside trading volume exceeding the 20-session average, reflecting investor optimism.

Currently, DBC prices continue to hover near the Upper Band of the Bollinger Bands, with the MACD indicator maintaining an upward trajectory after a buy signal. This suggests a positive short-term outlook remains intact.

EIB – Vietnam Export-Import Commercial Joint Stock Bank

During the morning trading session on December 5, 2025, EIB shares increased, accompanied by a Bullish Engulfing candlestick pattern and trading volume surpassing the 20-session average, indicating investor confidence.

However, EIB prices are currently testing the medium-term downward trendline, while the Stochastic Oscillator is entering overbought territory. If the indicator generates a sell signal in upcoming sessions and exits this zone, correction risks may re-emerge.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:07 December 5, 2025

Derivatives Market Week of December 8–12, 2025: Overall Market Liquidity Remains Sluggish

On December 5, 2025, the VN30 and VN100 futures contracts diverged in their performance. The VN30-Index reversed its trend, closing lower after five consecutive sessions of gains, accompanied by a small candlestick pattern that signaled cautious sentiment among investors.

Stock Market Update December 4: Capital Flows Shift to Real Estate Stocks

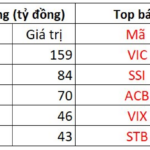

Market volatility has emerged among the “blue-chip” stocks, yet capital flows have shifted towards real estate and equities, propelling the VN-Index to its second consecutive session of gains, with trading volumes reaching billions of dollars.

Stock Market Week 01-05/12/2025: Extending the 4-Week Winning Streak

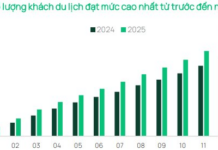

The VN-Index trimmed its gains in the final session of the week but still concluded a robust trading week, surging over 50 points compared to the previous week. Broader buying momentum, coupled with foreign investors returning to net buying, signaled optimism as the index approaches its October 2025 peak (around 1,760-1,795 points).