On December 3, 2025, Thuong Dinh Shoe Joint Stock Company (stock code: GTD) submitted an explanation to the State Securities Commission and the Hanoi Stock Exchange regarding the consecutive ceiling price increase of GTD shares over five sessions from November 26, 2025, to December 2, 2025.

The company’s leadership confirmed that its production and business operations remain normal, with no unusual fluctuations observed.

Thuong Dinh Shoe stated that the share price increase is an objective market dynamic driven by supply and demand, and the company pledged not to manipulate the trading price in any way.

Previously, the company had submitted a similar explanation for the five consecutive ceiling price sessions from November 19 to November 25, 2025.

The continuous rise in GTD shares followed the announcement that the Hanoi People’s Committee plans to divest from Thuong Dinh Shoe.

Thuong Dinh Shoe Company.

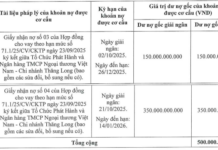

On November 20, 2025, the Hanoi People’s Committee announced plans to auction over 6.3 million GTD shares, equivalent to nearly 69% of the company’s equity. This represents the entire stake held by the committee in the iconic shoe brand.

The starting price was set at VND 20,500 per share, totaling over VND 130 billion for the entire lot. This price is approximately 50% higher than the market price of GTD shares at the time of the announcement.

With a 69% ownership stake, the investor replacing the Hanoi People’s Committee could gain controlling interest in Thuong Dinh Shoe.

Recently, the Hanoi People’s Council approved a pilot project to develop commercial housing on various land types, including the Thuong Dinh Shoe factory site. The area will be transformed into a mixed-use development featuring commercial housing, offices, services, and the Thuong Dinh Multi-Level School.

Thuong Dinh Shoe will act as the project’s investor, with an estimated investment of VND 1,600 billion. The project, including factory relocation and construction, is slated for completion by 2030.

The company expressed its desire to relocate its headquarters and factory from 277 Nguyen Trai Street as early as 2019 due to high costs. During the 2019 annual meeting, the leadership announced plans to move the production facility to Ha Nam by the end of 2018, as outlined in the prospectus.

In addition to its main site, the company owns 17,587 m² in the Dong Van Industrial Park, Ha Nam, and 18,403 m² in the same park in Duy Minh Commune, Ha Nam, leased until 2054. It also leases properties in central Ton Duc Thang Street, Dong Da District, and Ha Dinh, Thanh Xuan District.

Beyond its Hanoi headquarters, Thuong Dinh Shoe operates an export shoe factory in the Dong Van Industrial Park, Ha Nam. According to the company, this facility has a single fabric shoe production line with a monthly capacity of 50,000 to 60,000 pairs, employs 150 workers, and primarily serves the domestic market.

Upper Dinh Shoe Stock Surges with 11 Consecutive Circuit Limits: Leadership Responds

At the close of trading on December 3rd, GTD shares hit their upper limit for the 11th consecutive session, reaching 52,200 VND per share, a staggering 342% surge compared to the November 18th session.

Hà Nội Seeks to Divest from Once-Iconic Shoe Brand, Sparking Stock Market Speculation

Starting at an initial price of 20,500 VND per share, the Hanoi People’s Committee stands to generate a minimum revenue of 130.9 billion VND should the entire lot of shares be successfully auctioned.