Mr. Đặng Thành Duy, CEO of Vinasun, has announced plans to acquire an additional 1.5 million shares of VNS for investment purposes. If the transaction is completed between December 10, 2025, and January 8, 2026, his ownership stake will rise from 5.73% to 7.94%, equivalent to 5.39 million shares. Based on the closing price of 9,120 VND per share on December 6, the deal is valued at approximately 13.7 billion VND.

Alongside Mr. Duy, his family members hold significant shares in Vinasun. His father, Mr. Đặng Phước Thành, who served as Chairman of the Board from 2000 until late 2023, currently owns 24.92% of the company’s capital. His mother, Mrs. Ngô Thị Thúy Vân, holds 11.91%, while his daughter owns only 25 shares.

Mr. Đặng Phước Thành (left) and his son, Mr. Đặng Thành Duy

|

If the acquisition of 1.5 million shares is finalized, the CEO’s family group could increase their combined ownership to a maximum of 44.77% of Vinasun’s capital.

Significant senior leadership changes at Vinasun began in late 2023 when Mr. Tạ Long Hỷ assumed the role of Chairman of the Board. Previously, Mr. Hỷ served as CEO, a position now held by Mr. Đặng Thành Duy, who was formerly the Deputy CEO.

On the HOSE market, VNS shares have declined by 6% over the past three months but have remained relatively stable compared to prices from a year ago. Average daily trading volume remains low, at less than 30,000 shares. Earlier in the year, the stock briefly surpassed its par value in late July, reaching a high of 10,700 VND per share—its peak in over 1.5 years—before retreating and staying below par value since.

| Price movement of VNS shares from early 2025 to present |

In contrast to Mr. Duy’s buying activity, Kim Ngưu Consulting LLC—an entity related to Board Member Đặng Tiến Sỹ—only sold 89,300 out of the 1 million VNS shares it registered to sell from October 31 to November 28, achieving less than 9% of its target. The reason cited was unmet market expectations, preventing the completion of the transaction. Following the sale, Kim Ngưu’s ownership decreased from 12.67% to 12.54%, equivalent to 8.51 million shares.

– 10:03 06/12/2025

Halting the Debt Swap Deal Between Two Real Estate Giants

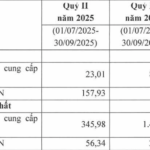

The conversion of Hoang Quan Real Estate’s VND 212 billion debt to Hai Phat Investment into 21.2 million shares has been temporarily halted. This decision follows Hoang Quan Real Estate’s review, which identified the need for additional information and adjustments to the issuance registration dossier.

Tech Titan’s Chairman Scoops Up 5.5 Million Vinasun Shares

The Chairman of HIPT and affiliated entities are set to acquire an additional 5.5 million shares of Vinasun, elevating their ownership stake to nearly 25%.

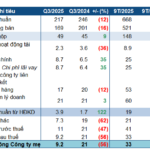

Why Do Many Businesses See Their Profits Vanish?

In this year’s third-quarter financial reporting season, numerous businesses have voiced concerns over significant disparities in their financial performance compared to the same period last year. Some companies have experienced near-total evaporation of sales revenue, resulting in a sharp decline in profits.