Vingroup Joint Stock Company (Stock Code: VIC, HoSE) has recently announced amendments to its business registration, focusing on adjustments to its business sectors.

Specifically, Vingroup has expanded its business sectors from 66 to 81. The primary sector remains real estate, land use rights, and leasing activities.

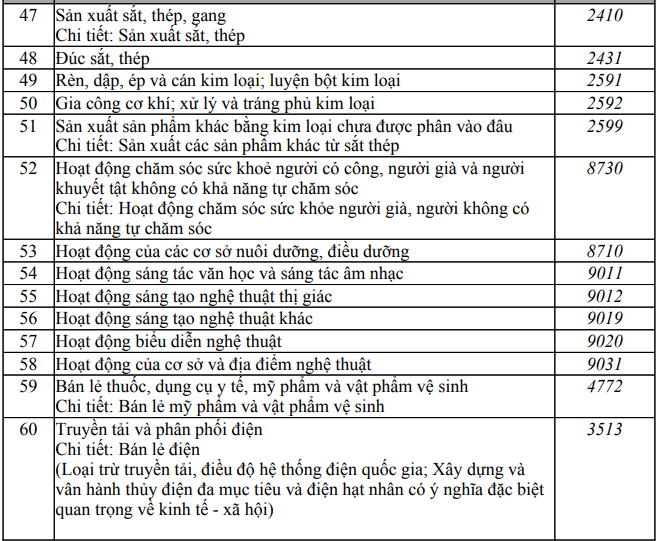

Among the newly added sectors are: Iron and Steel Production (Code 2410); Iron and Steel Casting (Code 2431); Metalworking, Treatment, and Coating (Code 2592); Healthcare Services for Veterans, the Elderly, and Disabled Individuals Unable to Self-Care (Code 8730); Nursing and Convalescent Home Activities (Code 8710); and Electricity Production from Non-Renewable Sources (Code 3511)…

Concurrently, the company has removed Code 9610 “Massage and Health Enhancement Services (excluding sports activities).” This has been replaced by Code 9622 “Beauty Care Services and Other Aesthetic Activities (excluding sports)” and Code 9623 “Spa and Sauna Services.”

Some of the newly added sectors by Vingroup

Vingroup implemented these business sector adjustments following shareholder approval via written consent in November 2025. The newly added sectors are closely related to VinMetal and Vin New Horizon.

In other developments, Vingroup announced that December 8, 2025, is the final registration date for shareholders to exercise their rights to receive shares issued for capital increase from owner’s equity. Today (December 5) is the ex-rights trading date.

Accordingly, Vingroup will issue 3.85 billion bonus shares to shareholders. The rights ratio is 1:1 (meaning each shareholder holding one share will receive an additional new share).

The capital for this issuance is sourced from the share premium reserve based on the audited separate financial statements for 2024. As per the audited 2024 financial statements, the share premium reserve as of December 31, 2024, stands at 39,140.2 billion VND.

Upon completion of this issuance, Vingroup’s chartered capital will increase to 77,335 billion VND.

Billionaire Pham Nhat Vuong’s VinEnergo Appoints New Leadership: Former VinaCapital Executive Takes the Helm

VinEnergo marks its official entry into the renewable energy sector with the addition of electricity production from renewable sources (code 3512) to its business portfolio.

Last Chance to Win Big with Vingroup, Founded by Billionaire Pham Nhat Vuong

The final list of shareholders eligible to receive bonus shares from Vingroup will be confirmed on December 8th.