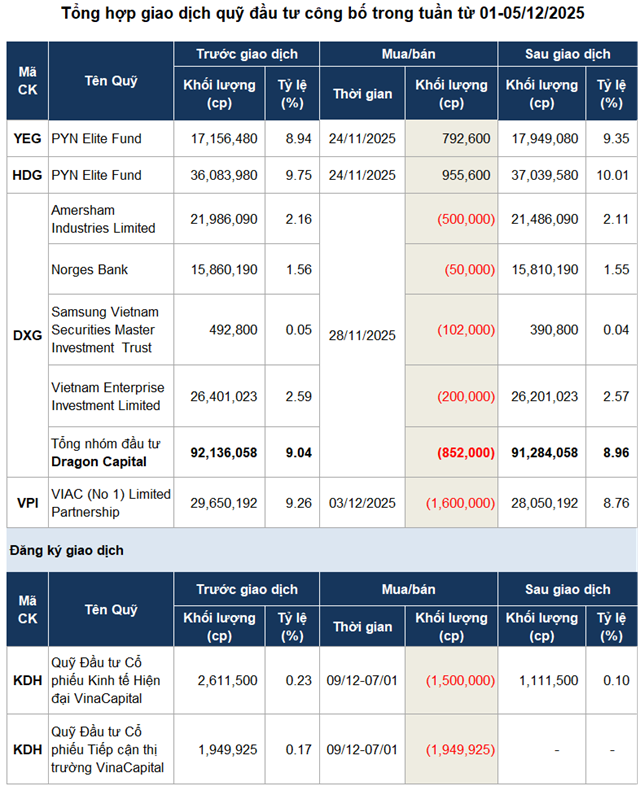

Specifically, the sole selling force announced this week came from VIAC Limited Partnership, a member fund of Vietnam Oman Investment (VOI) under the Oman National Investment Committee. The fund sold 1.6 million shares of VPI (Van Phu Real Estate Development JSC) on December 3rd, reducing its ownership to 8.76% (over 28 million shares), estimated to yield approximately 88 billion VND.

| VPI stock performance from the beginning of 2024 to December 5, 2025 |

In the market, VPI shares closed at 57,500 VND per share on December 5th, down 6% from its one-year peak (61,400 VND per share on October 16, 2025), but still up 19% from the low recorded on May 15.

Also on December 3rd, funds under VinaCapital Asset Management JSC registered to divest from Khang Dien House Trading and Investment JSC (HOSE: KDH) to restructure their portfolio, with the transaction period from December 9, 2025, to January 7, 2026.

Among them, the VinaCapital Modern Economic Equity Fund plans to sell 1.5 million shares out of the 2.6 million it currently holds, while the VinaCapital Market Access Equity Fund intends to sell its entire stake of over 1.9 million shares.

| KDH stock performance from the beginning of 2025 to December 5 |

VinaCapital’s divestment intention comes as KDH shares have fallen 8% from their August peak, but remain up 55% from the low during the tariff-related volatility in April.

| HDG stock performance from the beginning of 2025 to December 5 |

Conversely, buying activity announced this week actually occurred in late November, with PYN Elite Fund reporting additional purchases of 792,600 YEG (YeaH1) shares and 955,600 HDG (Ha Do) shares on November 24th via order matching. Post-transaction, PYN Elite’s ownership in YeaH1 rose to nearly 9.4%, while its stake in Ha Do reached approximately 10%.

| YEG stock performance from the beginning of 2025 to December 5 |

Notably, these two stocks have shown contrasting price movements. While HDG has gained over 20% since the beginning of the year, YEG has dropped more than 27% during the same period.

Source: VietstockFinance

|

– 07:28 07/12/2025

Pyn Elite Fund Re-Enters FPT Just Months After Profiting at Peak and Warning of Tech Bubble

Pyn Elite Fund’s perspective on FPT shares has undergone a dramatic shift in just a matter of months.

Finnish Fund Elevates Stake in Ha Do Group to Over 10%

Pyn Elite Fund has successfully acquired 955,600 shares of HDG, elevating its ownership stake to 10.01% of Ha Do Group’s total capital.