The stock market recorded a surge of over 50 points in the first week of December. Large-cap stocks continued to be the driving force, supporting the index in reclaiming previous resistance levels, with a notable emphasis on the Vingroup family of stocks. Additionally, liquidity in the week’s sessions showed improvement compared to the 20-session average. By the end of the week, the VN Index rose by 50.33 points (+2.98%) to close at 1,741.32.

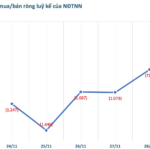

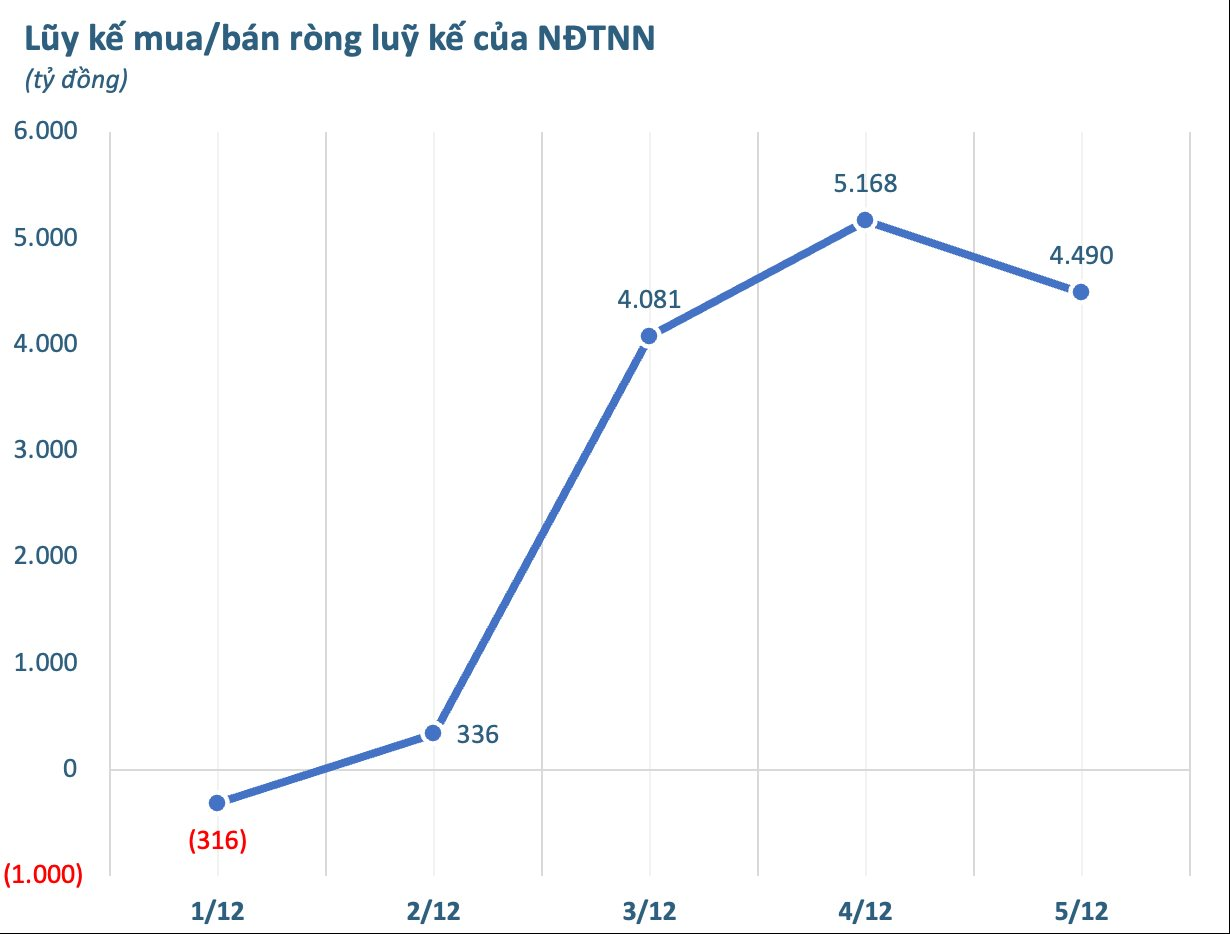

In terms of foreign investor trading value, this group unexpectedly returned to net buying this week after months of consistent selling. Specifically, they exhibited strong buying pressure in the middle three sessions before shifting to net selling on the final day. Over the 5 sessions, foreign investors net bought VND 4,490 billion across the market.

On individual exchanges, foreign investors net bought VND 4,576 billion on HoSE, net sold VND 65 billion on HNX, and net sold VND 21 billion on UPCoM.

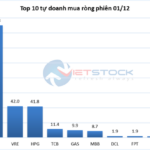

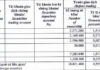

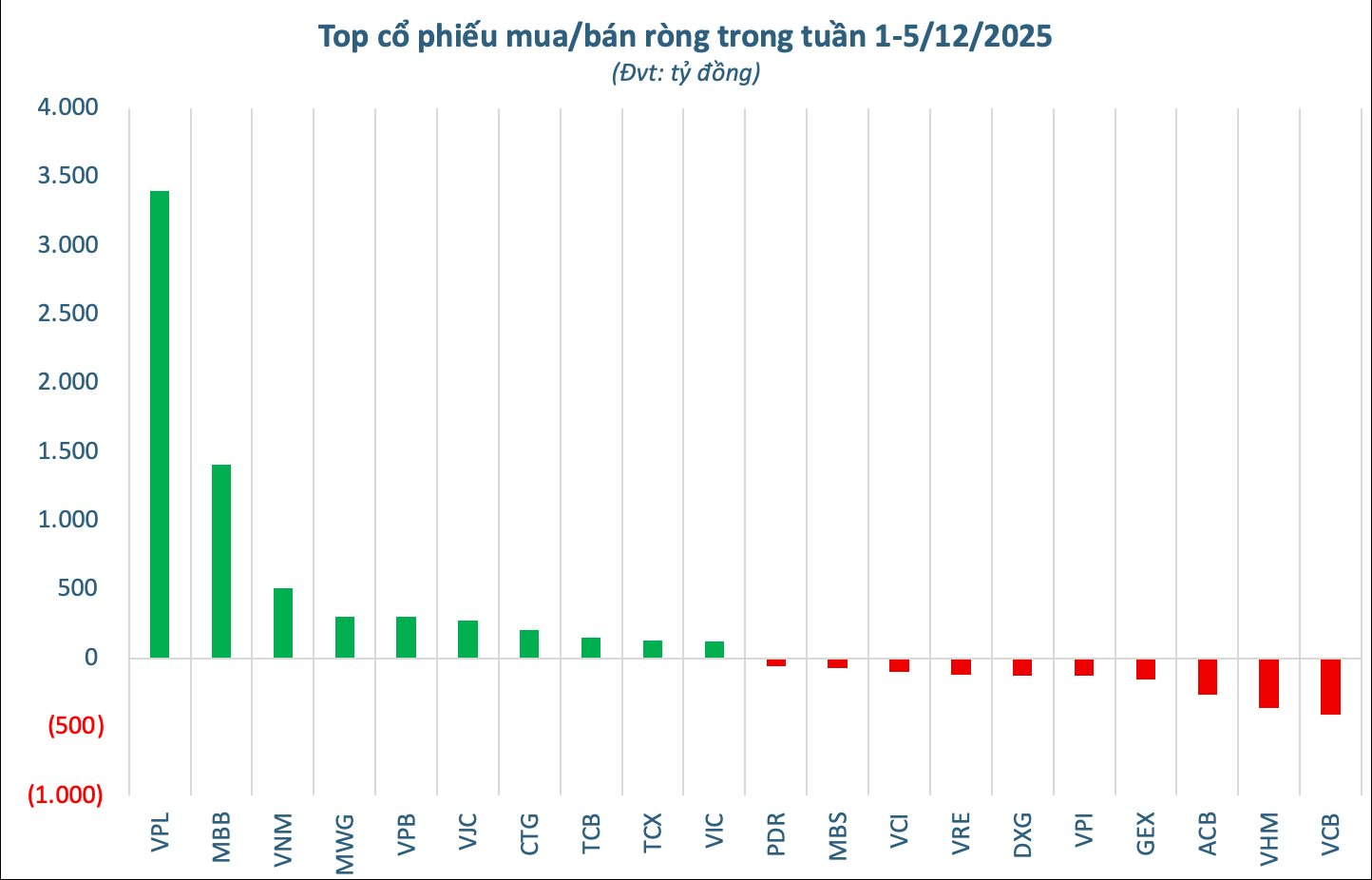

Analyzing by individual stocks, Vingroup-affiliated stocks led the net buying activity, with VPL topping the list at a remarkable VND 3,394 billion. This was followed by MBB (VND 1,407 billion), VNM (VND 505 billion), MWG (VND 303 billion), and VPB (VND 299 billion). Other notable stocks attracting foreign inflows included VJC (VND 272 billion), CTG (VND 202 billion), TCB (VND 149 billion), TCX (VND 132 billion), and VIC (VND 121 billion).

Conversely, VCB was the most heavily net sold stock of the week, with a value of VND 409 billion, significantly outpacing other stocks. VHM followed with net selling of VND 363 billion, while ACB (VND 268 billion) and GEX (VND 158 billion) also faced notable outflows. Other stocks under capital withdrawal pressure included VPI (VND 131 billion), DXG (VND 127 billion), VRE (VND 122 billion), VCI (VND 99 billion), MBS (VND 72 billion), and PDR (VND 58 billion).

VN-Index Surges Past 1,700 Points, Yet Investor Portfolios Continue to Shrink

Amidst the market’s deceptive “green exterior, red core” dynamics, the majority of investors find their accounts lingering in the red, underscoring the prevailing challenges in navigating such volatile conditions.

Foreign Block Selling Cools Down in Late November, Contrasting with Over 600 Billion VND Inflow to Acquire a Single Stock

Foreign investors continued their net selling streak, but the pressure eased significantly. Notably, they unexpectedly turned net buyers in the Wednesday and Friday sessions.