The December 4th trading session witnessed a notable development in the currency market as the State Bank of Vietnam (SBV) raised the repo rate for collateralized loans (OMO) to 4.5% per annum from the 4% level maintained since September 2024.

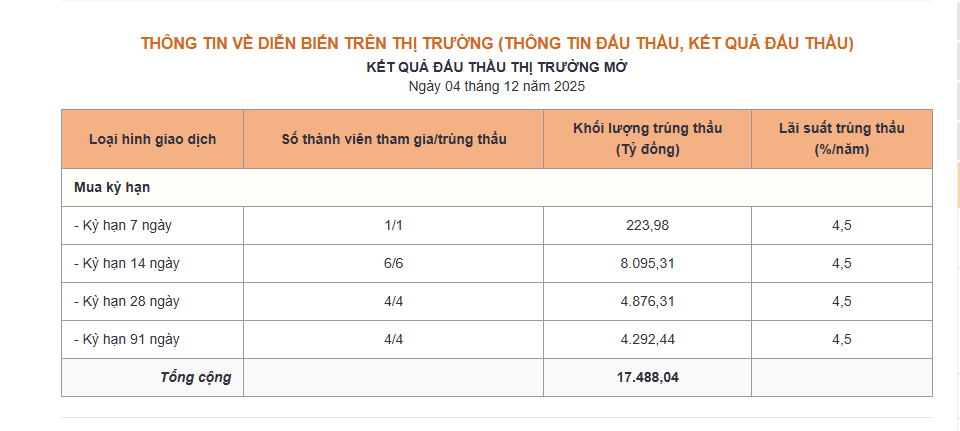

Specifically, the SBV offered a total of VND 25 trillion across four tenors: VND 1 trillion for 7-day tenor, VND 10 trillion for 14-day tenor, and VND 7 trillion each for 28-day and 91-day tenors, all at a rate of 4.5% per annum. The auction results showed VND 17.488 trillion successfully bid, including VND 224 billion for 7-day tenor, VND 8.095 trillion for 14-day tenor, VND 4.876 trillion for 28-day tenor, and VND 4.292 trillion for 91-day tenor. Meanwhile, VND 14.277 trillion matured, and the SBV did not issue new treasury bills. Thus, the SBV net injected over VND 3.211 trillion into the market during the session, bringing the total OMO outstanding to VND 361.407 trillion.

Source: SBV

This marks the first OMO rate hike by the regulator in 19 months. The last adjustment occurred in mid-May 2024, when the winning bid rate was increased from 4.25% to 4.5% per annum. Subsequently, the SBV reduced this rate twice in August and September 2024, to 4% per annum, maintaining it until the December 3, 2025 session.

The SBV’s OMO rate increase comes amid rising interbank rates, which have reached their highest levels since October 2022, indicating a significant increase in interbank borrowing demand. On December 3, the average overnight VND interbank rate hit 7.48% per annum, while the 1-week and 2-week rates rose to 7.49% and 7.48% per annum, respectively.

The hike in the OMO winning bid rate is seen as a reflection of the system’s liquidity status. While the regulator continues to inject liquidity regularly via OMO to offset maturing loans, the rate increase signals that credit institutions must pay higher costs to access support funds, thereby pushing VND interest rates to a new equilibrium.

Analysts suggest this move signals the SBV’s intent to ensure the market accurately assesses system liquidity, discouraging banks from over-relying on cheap funding from the regulator. The market is now watching whether this adjustment marks the start of a tighter regulatory cycle or is merely a short-term measure to stabilize year-end supply and demand.

In the short term, the OMO rate adjustment is deemed appropriate, allowing the market to operate more in line with market signals. Long-term implications suggest monetary policy may be entering a new phase of refinement—more flexible, practical, and reflective of the economy’s capital supply and demand dynamics.

With the OMO rate increase, interbank rates are likely to remain higher than in Q3, at least until seasonal cash flows return to the system.

Earlier, the money market signaled VND liquidity shortages within the banking system. This occurred during the year-end peak for banks, with credit growth expected to reach around 20% by year-end 2025. This pressured banks’ capital balancing, especially as deposit growth lagged significantly behind credit expansion.

To support banks, the SBV has maintained a net liquidity injection stance, pushing OMO outstanding to a record high of over VND 360 trillion. According to the SBV, open market operations aim to promptly and fully meet banks’ liquidity needs, enabling them to access low-cost funds and continue reducing lending rates in line with government directives.

Additionally, in mid-November, the SBV introduced 105-day OMO tenors and expanded bidding volumes for longer tenors.

Credit Growth Outpaces Deposits at Many Banks

In the first nine months, several major banks, including VPBank, ACB, SHB, and MB, reported lending growth far outstripping deposit growth. This forced banks to raise deposit rates to attract funds and maintain capital adequacy ratios. In November, over 20 banks increased deposit rates, with adjustments ranging from 0.2% to 0.5% per annum across most tenors, and some banks raising rates by 0.7% to 0.8% for short tenors.

Industry-wide, credit growth reached 13.4% by September 2025—the highest in years. Deposit growth, however, stood at 9.7%, creating a significant gap with credit expansion.

Central Bank Officially Activates Additional Tool to Inject Vietnamese Dong into Banking System

The State Bank has initiated foreign currency swap transactions with credit institutions to alleviate the VND liquidity crunch, as interbank interest rates surge past 7%, reaching a three-year high.

Credit Reaches VND 18.2 Trillion as of November 27, Up 16.56% Year-to-Date

Credit growth is showing promising signs, with a positive trajectory compared to previous years. As of November 27, 2025, the economy’s credit reached over 18.2 million billion VND, marking a 16.56% increase from the end of 2024. This growth is particularly notable when compared to the same period in 2024, which saw an 11.47% increase from the end of 2023, and the end of 2024, which recorded a 15.09% rise from the end of 2023.

Bank Introduces Instant Transfer Fees Starting December 1st

Indovina Bank (IVB) has unexpectedly announced a new policy for 24/7 instant money transfer fees, effective December 1, 2025. The policy includes waivers exclusively for customers with high-value transactions.

Central Bank Plans to Repeal 18 Outdated or Ineffective Legal Documents

The State Bank of Vietnam (SBV) is currently drafting and seeking feedback on a Circular to repeal several legal documents issued by the Governor of the SBV. This review is conducted in accordance with the Law on Promulgation of Legal Documents and its guiding decrees, with the aim of eliminating documents that have expired, lack a legal basis for application, or are no longer aligned with current management practices.