As of the end of December 5th, Bao Tin Minh Chau and Bao Tin Manh Hai increased gold bar prices by 700,000 VND/tael compared to the previous session, trading at 153 – 154.5 million VND/tael and 153.1 – 154.9 million VND/tael, respectively. SJC, DOJI, and PNJ gold bar prices surged by 1.1 million VND/tael today, now listed at 152.9 – 154.9 million VND/tael. Phu Quy and Mi Hong are buying and selling at 151.9 – 154.9 million VND/tael and 153.5 – 154.9 million VND/tael, respectively (up 1 – 1.1 million VND/tael today).

Gold ring prices at Bao Tin Minh Chau and Bao Tin Manh Hai decreased by approximately 400,000 VND/tael at the end of the day, after previously surging by 1.1 million VND/tael, now at 151 – 154 million VND/tael. SJC increased gold ring prices by 600,000 VND/tael today, reaching 150 – 152.5 million VND/tael. PNJ, DOJI, and Phu Quy maintained their gold ring prices at 150 – 153 million VND/tael.

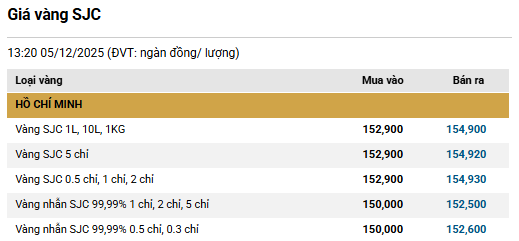

Gold prices at SJC

———————–

As of 1:00 PM, gold bar prices across brands surged by up to 1.1 million VND/tael compared to the previous close. SJC and PNJ are both listed at 152.9 – 154.9 million VND/tael. Bao Tin Minh Chau increased gold bar prices to 153.4 – 154.9 million VND/tael. Phu Quy and Mi Hong are trading at 151.9 – 154.9 million VND/tael and 153.5 – 154.9 million VND/tael, respectively.

Gold ring prices at Bao Tin Minh Chau and Bao Tin Manh Hai also increased by 1.1 million VND/tael (compared to yesterday’s close), now trading at 151.4 – 154.4 million VND/tael. SJC adjusted gold ring prices up by 600,000 VND/tael, reaching 150 – 152.5 million VND/tael. PNJ, DOJI, and Phu Quy maintained their gold ring prices at 150 – 153 million VND/tael.

———————–

As of 9:00 AM, gold bar prices across brands rose by 400,000 VND/tael compared to the previous close. SJC, DOJI, and PNJ are listed at 152.2 – 154.2 million VND/tael. Bao Tin Minh Chau and Mi Hong are trading at 152.7 – 154.2 million VND/tael and 153 – 154.2 million VND/tael, respectively. Phu Quy is buying and selling at 151.2 – 154.2 million VND/tael.

Gold ring prices at some brands increased by 300,000 – 400,000 VND/tael since the morning. Specifically, Bao Tin Minh Chau and Bao Tin Manh Hai are listed at 150.7 – 153.7 million VND/tael, up 400,000 VND/tael. Phu Quy increased gold ring prices by 300,000 VND/tael, reaching 150.3 – 153.3 million VND/tael. SJC, DOJI, and PNJ have not adjusted their gold ring prices.

———————–

As of early morning, gold bar prices across brands remained unchanged. Yesterday (December 4th), gold bar prices decreased by 500,000 – 800,000 VND/tael. Major gold traders are selling at 153.8 million VND/tael. SJC, DOJI, and PNJ are buying at 151.8 million VND/tael, while Phu Quy, Bao Tin Minh Chau, and Mi Hong are buying at 150.8 – 152.3 – 153.4 – 152.5 million VND/tael, respectively.

Gold ring prices decreased by 600,000 – 700,000 VND/tael during yesterday’s session. DOJI, PNJ, and Phu Quy adjusted gold ring prices down to 150 – 153 million VND/tael. Bao Tin Minh Chau and Bao Tin Manh Hai saw gold ring prices drop by up to 1 million VND/tael, then rebound by 300,000 VND/tael, now trading at 150.3 – 153.3 million VND/tael. SJC gold ring prices hit their lowest level since early December (149.4 – 151.9 million VND/tael).

According to Reuters, global gold prices remained largely unchanged on Thursday, as rising U.S. Treasury yields offset support from a weaker U.S. dollar. Markets await U.S. inflation data on Friday for clues on the Federal Reserve’s monetary policy direction ahead of its December meeting.

At the time of reporting, spot gold was trading around $4,202 per ounce.

“Rising interest rates are creating headwinds for gold’s upward trend, while the weaker USD is providing support,” said Edward Meir, analyst at Marex.

U.S. 10-year Treasury yields rose, while the U.S. dollar index fell to a one-month low, making gold more attractive to international investors.

Data released on Thursday showed initial jobless claims fell to 191,000 last week—the lowest in over three years and significantly below economists’ forecasts of 220,000. Meanwhile, Wednesday’s ADP report indicated U.S. private sector employment declined by 32,000 jobs in November, the sharpest drop in over two and a half years.

A Reuters poll of over 100 economists predicts the Fed will cut its benchmark rate by 25 basis points at its December 9–10 policy meeting, as the central bank aims to support a cooling labor market. Lower interest rates typically benefit non-yielding assets like gold.

Investors are closely monitoring the Personal Consumption Expenditures Price Index (PCE)—the Fed’s preferred inflation gauge—scheduled for release on Friday.

“Markets are unlikely to see significant volatility until next week, and gold prices will likely continue trading in a relatively quiet range,” Meir noted, adding that gold is unlikely to revisit its near-$4,400 per ounce peak this year.

December 6th: Gold Bars and Ring Prices Plunge Simultaneously

Gold bar prices plummeted by up to 700,000 VND per tael, while gold ring prices dropped approximately 500,000 VND per tael compared to the previous day’s close.