According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s seafood exports to Japan reached USD 1.445 billion in the first 10 months of 2025, marking a 15.2% increase compared to the same period last year. VASEP highlights this as a positive development amidst Japan’s economic challenges, including inflation, a weakening yen, and prolonged domestic consumption decline.

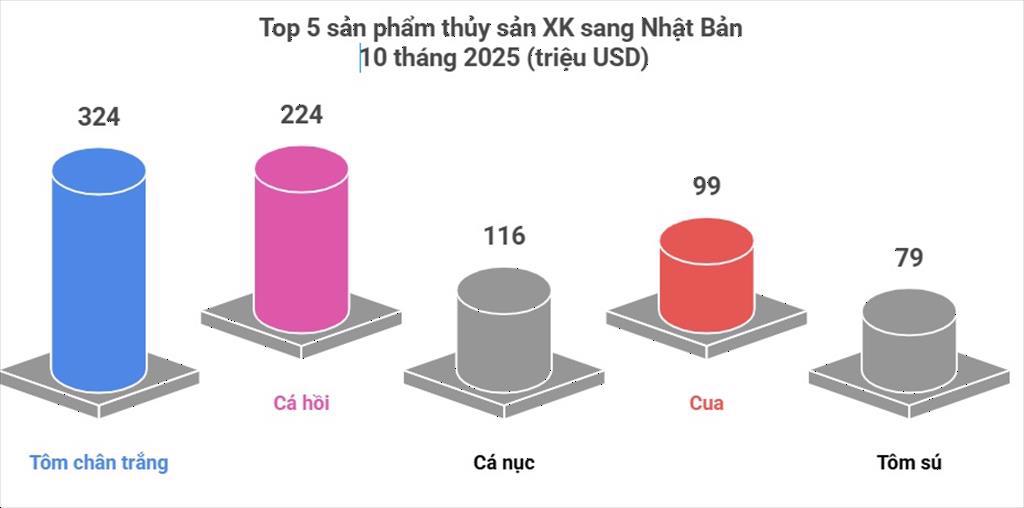

VASEP further notes several key highlights in this year’s export landscape. Whiteleg shrimp, a strategic product for Vietnam, continues to lead with USD 324.1 million, up 15.1%, accounting for over 22% of total exports.

Following closely is salmon, with exports reaching USD 224 million (a 9.45% increase), demonstrating sustained competitiveness despite growing competition from rivals.

The most surprising performer is mackerel, with a remarkable 35.6% growth, reaching USD 116.6 million. This surge reflects not only Vietnamese enterprises’ flexible supply capabilities but also aligns perfectly with Japan’s consumer trends, where cost-conscious shoppers favor affordable, convenient, and easy-to-prepare products.

Conversely, crab exports saw a healthy 24.2% increase, nearing USD 100 million, while black tiger shrimp exports dipped slightly by 3.27%, indicating intensifying competition in this traditional segment.

Japan’s seafood market is undergoing significant restructuring, with self-sufficiency rates dropping to 59%—a prolonged low with no recovery in sight. Per capita consumption has also declined to 23.2 kg/year, making imports, consistently above USD 20 billion annually, crucial for meeting national demand.

Weak purchasing power has shifted Japanese consumers toward affordable, reliable, and convenient products, benefiting staple seafood like mackerel, tuna, and herring.

VASEP observes that while Japanese demand remains subdued, opportunities for Vietnamese seafood arise from shifting consumption patterns.

Vietnam holds a strong advantage in staple fish products, aligning with Japan’s fastest-growing segment—affordable, easy-to-prepare items suited to cost-saving trends.

Vietnamese whiteleg shrimp maintains high competitiveness due to consistent quality and large-scale production, meeting stringent Japanese retail standards.

Advanced processing capabilities are a strategic asset, enabling Vietnamese firms to produce value-added, convenient products that align with Japan’s preference for ready-to-eat items.

Long-standing relationships and reliability, highly valued by Japanese importers, give Vietnamese businesses a unique, hard-to-replicate edge.

These factors position Vietnam to expand its market share in Japan, particularly in frozen, processed, and value-added segments, which are projected to accelerate further.

China, EU Intensify Hunt for Vietnam’s Affordable, Nutritious, and Delicious Export Sensation: Global Favorite Generates Nearly $300 Million Since Year-Start

Vietnam’s exports of this product to the EU have skyrocketed, boasting a remarkable 73% growth rate.

Seafood Exports to the U.S. Face Turbulence Amid Retaliatory Tariffs

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports are experiencing significant growth, reflecting the industry’s relentless efforts amidst a volatile market. However, over the past three months, seafood exports to the U.S. have begun to decline due to the impact of retaliatory tariffs.

Vietnam’s Seafood Exports Projected to Hit $10.5 Billion in 2023

The Vietnam Association of Seafood Exporters and Producers (VASEP) forecasts that the country’s seafood export turnover will reach a record-breaking $10.5 billion this year.