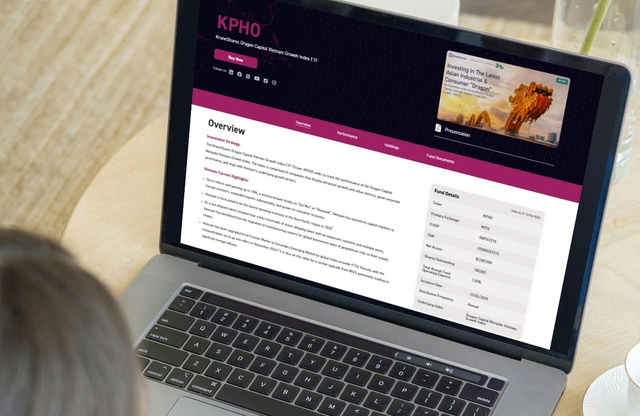

KPHO offers investors access to a curated selection of Vietnamese companies, leveraging a fundamental and specialized growth analysis approach in one of Southeast Asia’s most dynamic and promising economies.

Dragon Capital, among Vietnam’s largest fund managers by assets under management, will serve as the designated manager for KPHO. With over three decades of on-the-ground expertise in Vietnam, Dragon Capital’s deep local market insights and robust product foundation will enable KPHO to capitalize on high-growth opportunities within Vietnam’s equity market.

“We believe Vietnam is emerging as a key growth driver among global emerging markets,” said Jonathan Krane, CEO of KraneShares. “With its favorable demographics, skilled young workforce, and rising foreign direct investment, the country is poised to benefit from global supply chain diversification and surging consumer demand. Partnering with Dragon Capital, we’re proud to offer investors a transparent, rules-based vehicle to participate in Vietnam’s compelling growth story.”

Vietnam remains one of the world’s fastest-growing economies, recording a 7.5% year-on-year GDP growth in the first half of 2025—among the strongest in the Asia-Pacific region. With a median age of 33, Vietnam boasts a stable and expanding workforce, fueling export-driven growth and robust domestic consumption.

KPHO’s ETF portfolio uniquely combines the DCVFM VN Diamond ETF (representing high-growth stocks inaccessible to foreign funds) with globally accessible growth equities. Unlike other U.S.-listed Vietnam investment products, KPHO overcomes traditional ownership limits, enabling global investors to participate in the nation’s high-growth phase.

Vietnam has been upgraded from Frontier to Secondary Emerging Market status by FTSE Russell, effective September 2026, and is under review for a similar reclassification by MSCI. Dragon Capital estimates these upgrades could attract up to $25 billion in new capital—9% of Vietnam’s current market capitalization.

“As one of the world’s fastest-growing economies, Vietnam is poised for a golden era of opportunity,” said Dominic Scriven, Chairman and Co-Founder of Dragon Capital. “Our partnership with KraneShares combines Dragon Capital’s 30+ years of local expertise with KraneShares’ global distribution network to deliver KPHO. This ETF provides investors with efficient, comprehensive access to Vietnam’s equity market at a pivotal moment, as the country nears inclusion in major global indices like FTSE Emerging and MSCI Emerging Markets—a milestone set to attract significant foreign investment and unlock global portfolio diversification opportunities.”

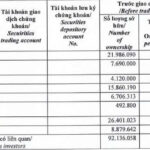

As of October 31, 2025, Dragon Capital-managed ETFs dominate 78.2% of Vietnam’s market. The DCVFMVN30 ETF’s net asset value exceeds VND 5,892 billion, the DCVFMVN DIAMOND ETF stands at VND 13,647 billion, and the DCVFM VNMIDCAP ETF surpasses VND 360 billion. All funds delivered outstanding 12-month returns of 42.5%, 18.1%, and 22.8%, respectively, through October.

MBS Partners with Dragon Capital to Distribute Open-Ended Fund Certificates on MFUND Platform

MBS and Dragon Capital have officially partnered to distribute open-ended fund certificates via the MFUND platform. This collaboration between a leading billion-dollar market cap securities firm and a top fund manager is poised to enhance product accessibility, foster long-term investment trends, and elevate capital professionalism in the market.

Vietnam’s Recovery Phase: Corporate Profits Poised to Rise, Says Dominic Scriven (Dragon Capital)

At the Annual Listed Companies Conference held on the afternoon of December 3rd, Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, delivered a keynote address. His presentation focused on assessing the global and Vietnamese macroeconomic landscape, emphasizing the critical roles of policy, public investment, and capital markets. Additionally, he provided insightful analysis and predictions regarding the Vietnamese stock market.

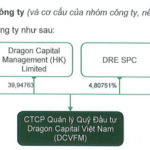

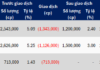

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.