The Ministry of Finance is seeking public input on a draft decree outlining electronic invoicing, tax declaration, and calculation for household businesses and individual traders. A key update is the phased tax declaration timeline based on business commencement.

For businesses starting in the first half of the year, revenue must be declared by June 30, with the first submission due by July 30. Those starting in the second half must declare revenue by January 31 of the following year.

From January 1, 2026, these businesses will self-determine their tax obligations—whether exempt, non-taxable, taxable, or liable—based on declared revenue. Taxable entities must meet the same declaration deadlines for payment.

Subsequent years will follow these regulations. The draft mandates electronic invoicing with tax authority codes or POS/mobile app integration for businesses earning ≥1 billion VND annually.

Graphic: AI – V.Vinh

Tax consultant Nguyen Van Duoc (HCMC Tax Advisory Association) emphasizes that timely revenue declaration is critical for tax liability assessment. Non-compliance may trigger audits for potential evasion. He views this shift from fixed to data-driven taxation as essential for transparency.

For tech-limited small businesses, the draft includes support measures. The tax authority’s system will auto-generate suggested returns for e-invoice users, minimizing errors. Mobile apps from e-invoice providers enable revenue tracking, invoicing, and seamless tax data submission.

Duoc reassures that technology streamlines compliance, reducing manual effort. Priorities are meeting deadlines, accurate reporting to avoid penalties, and understanding obligations—a departure from previous fixed assessments.

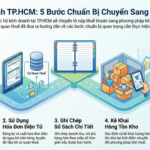

Essential Tax Transition Guide for Small Business Owners

Empower your business with seamless tax compliance. As a sole proprietorship, you can now take control by self-registering, declaring inventory, and opening a dedicated account when transitioning to revenue-based tax filing. Simplify your financial management and stay ahead with ease.