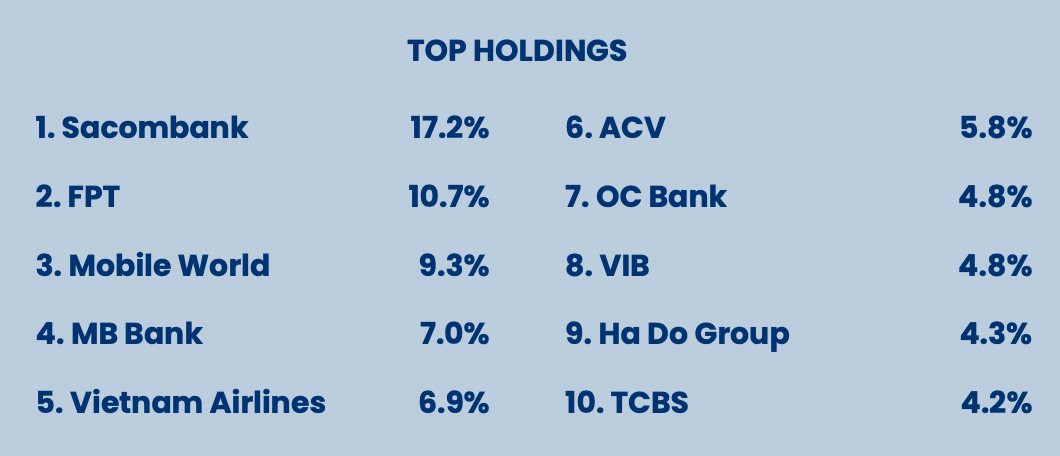

According to a newly released report, the foreign fund Pyn Elite Fund has increased its stake in FPT shares to 10.7% as of the end of November. With assets under management (AUM) exceeding €890 million (approximately $1 billion), the fund’s investment in FPT is valued at nearly $2.9 billion, equivalent to around 30 million shares.

FPT shares re-entered the fund’s top 10 largest holdings in October, with a 6% weighting at the end of the month. At that time, the fund held approximately 16.6 million FPT shares, valued at over $1.7 billion. Notably, in November alone, Pyn Elite Fund acquired an additional 13 million FPT shares.

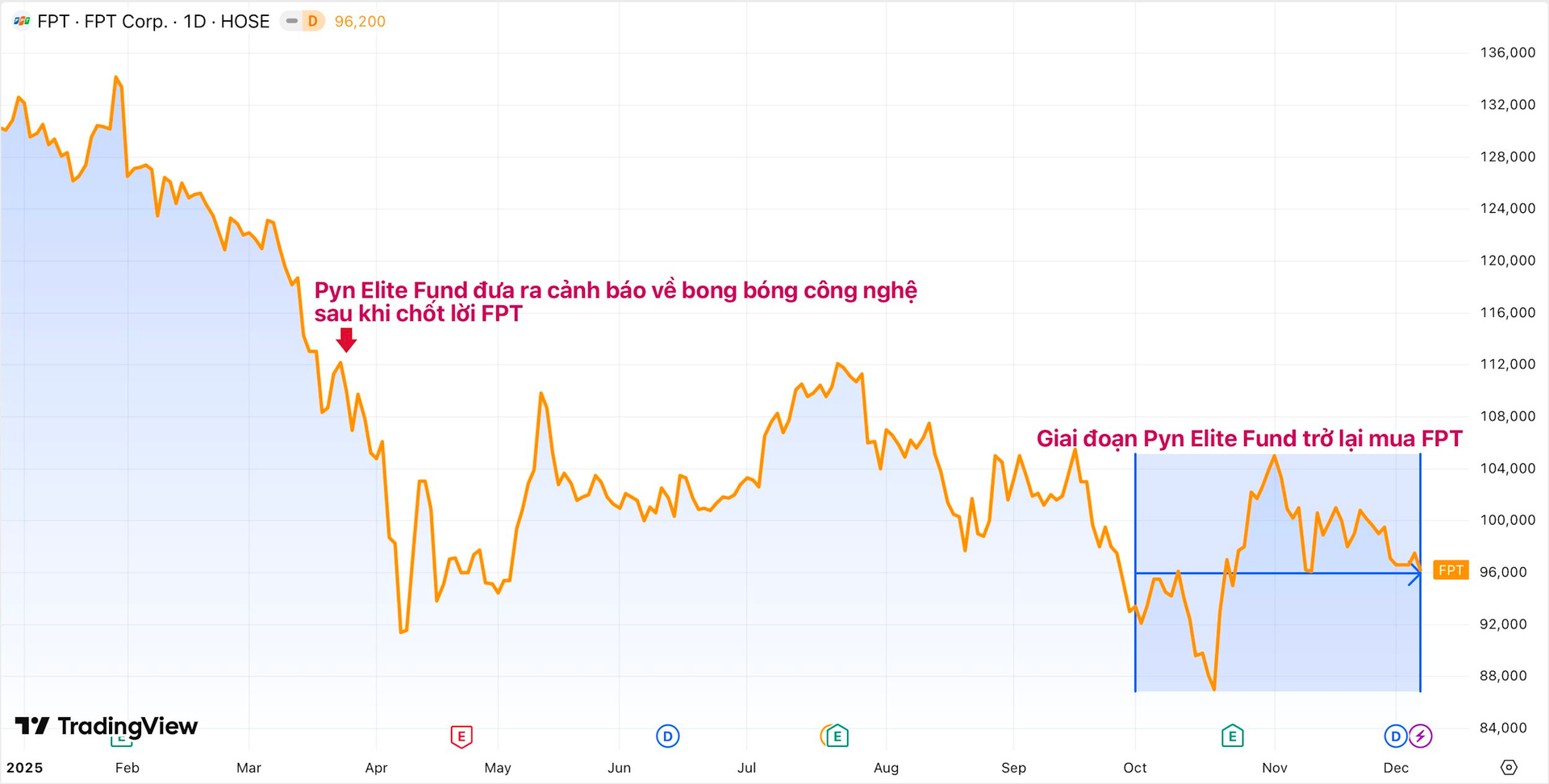

Pyn Elite Fund disclosed that it divested from FPT in 2024 when the stock peaked but continued to monitor the company, recently reacquiring its shares. FPT’s stock has declined by approximately 30% since the end of last year, primarily due to weaker IT backlogs amid trade tariff uncertainties and investor concerns about the impact of GenAI.

However, the fund notes that recent indicators have turned more positive. FPT’s backlog has rebounded since July, maintaining robust growth momentum. New order volumes surged by 22% year-over-year in the first 10 months of 2025, with October reaching a record high.

Given that backlogs typically convert to revenue within 6–9 months, Pyn Elite Fund believes the conservative 15-17% growth forecast for next year may be understated. With sustained demand recovery in the U.S. and Asian markets, FPT is well-positioned to surpass market expectations and skepticism.

Notably, the fund’s perspective has shifted dramatically in just a few months. In March, Petri Deryng, head of Pyn Elite Fund, warned investors about a potential tech bubble, drawing parallels to the dot-com crash of the early 2000s.

“The dot-com bubble burst in 2000-2002 had a profound impact, not only on U.S. tech stocks but also on the Finnish stock market. The fallout extended to other markets, though many non-tech stocks recovered faster than their tech counterparts,” stated Petri Deryng.

Deryng emphasized the difficulty in determining whether the market is entering an early collapse phase or merely experiencing profit-taking. This perspective could be construed as constructive if not for its timing, following Pyn Elite Fund’s profit-taking in FPT and CMG shares.

Yeah1 to Dissolve Technology Subsidiary Due to Strategic Misalignment

Yeah1 has officially approved the dissolution of a subsidiary operating in the technology sector, as this division no longer aligns with the company’s strategic vision.