On December 5th, the market faced significant profit-taking pressure, leading to adjustments in various stock groups, particularly mid-range real estate and securities—sectors that had previously surged.

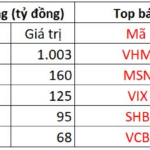

However, the decline didn’t escalate into a negative chain reaction, thanks to a sudden influx of capital into blue-chip stocks. VIC, from Vingroup, emerged as the focal point.

The stock soared to its ceiling (7%) on the day of rights issue for bonus shares at a 1:1 ratio, closing at 142,800 VND per share (post-adjustment price).

The substantial capital flow into the market’s largest stocks lifted the VN-Index by over 4 points, ending at 1,741.32. Despite the market’s breadth favoring declines (211 red, 101 green, 54 unchanged), this upward momentum persisted.

Within the same group, VHM (Vinhomes) maintained its strength, rising 1.7% to 107,000 VND. Thanks to this duo, the real estate sector’s index grew by 2.39%, leading the market.

Ironically, while real estate giants thrived, mid-range property stocks plummeted. Popular stocks like CEO (-3%), DXG (-2.6%), and DIG (-1.2%) were bathed in red.

VIC stock versus the rest of the market. Image: AI – V.Vinh

Similarly, after propelling the index past the 1,730 mark in previous sessions, banking and securities stocks entered a necessary cooldown period.

The VN30 basket dipped 4.03 points (-0.20%) to 1,975.5, primarily due to weakness in the financial sector. Most banking stocks declined: MBB (-2.1%), TCB (-2%), STB (-2%), VPB (-1.3%)…

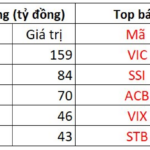

Securities stocks fared no better, with widespread declines. Leading stocks like SSI (-1.7%), VND (-1.6%), and HCM (-0.7%) retreated under selling pressure. The overall financial sector index fell 1.25%, becoming the market’s heaviest drag.

Another drawback was foreign investors’ aggressive net selling, totaling 605.21 billion VND across the market, ending their prior intermittent net buying streak.

The focal point of net selling was VIC (137.96 billion VND) and SSI (136.68 billion VND). Conversely, they heavily accumulated MBB (158.94 billion VND) and HPG (84.33 billion VND). VIC’s net selling by foreigners, despite its ceiling rise, highlights the overwhelming domestic buying power.

Market liquidity dipped compared to mid-week surges, with HoSE trading value exceeding 20,053 billion VND. This reflects investor risk aversion as the weekend approaches.

Nonetheless, the first week of December concluded with three consecutive VN-Index gains, firmly establishing the 1,740+ price range.

Analysts note that the December 5th session underscores the stabilizing role of large-cap stocks in the VN-Index amid hesitant and cautious capital flows. The polarization between long-term attractive stocks and highly speculative ones is increasingly evident.

VIC’s surge also boosted the net worth of billionaire Pham Nhat Vuong (Vingroup Chairman) to 24.7 billion USD, nearly quadrupling since the year’s start and setting a new global wealth ranking peak.

Technical Analysis for the Afternoon Session of December 5th: Uptrend Continues

The VN-Index extended its winning streak to an impressive eight consecutive sessions, despite trading near its October 2025 peak. Meanwhile, the HNX-Index experienced a mild pullback as it retested the middle band of the Bollinger Bands indicator.

Stock Market Update December 4: Capital Flows Shift to Real Estate Stocks

Market volatility has emerged among the “blue-chip” stocks, yet capital flows have shifted towards real estate and equities, propelling the VN-Index to its second consecutive session of gains, with trading volumes reaching billions of dollars.

Stock Market Week 01-05/12/2025: Extending the 4-Week Winning Streak

The VN-Index trimmed its gains in the final session of the week but still concluded a robust trading week, surging over 50 points compared to the previous week. Broader buying momentum, coupled with foreign investors returning to net buying, signaled optimism as the index approaches its October 2025 peak (around 1,760-1,795 points).