MARKET ANALYSIS FOR THE WEEK OF DECEMBER 1-5, 2025

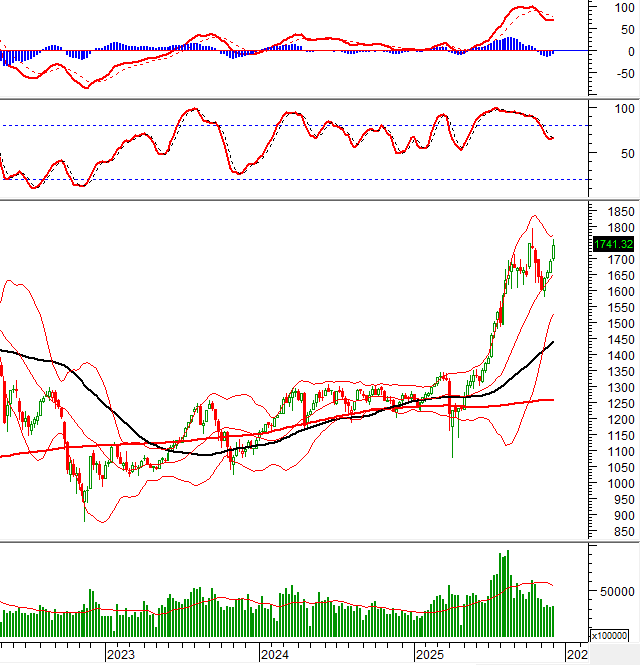

During the week of December 1-5, 2025, the VN-Index extended its winning streak to four consecutive weeks, despite trading volumes remaining relatively unchanged.

The Stochastic Oscillator has signaled a buy, while the MACD is narrowing its gap with the Signal line. If the MACD confirms a buy signal in the coming sessions, the outlook will become even more optimistic.

The index is approaching its historical peak of 1,760-1,795 points, a critical level that will determine the potential for further upward momentum in the final weeks of the year.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator Signals Sell

On December 5, 2025, the VN-Index edged higher for the eighth consecutive session, albeit with reduced trading volume below the 20-session average, indicating investor hesitation.

The index is nearing its October 2025 high (1,760-1,795 points), while the Stochastic Oscillator has entered the overbought territory with a sell signal. Without improvement, a correction risk may emerge if the indicator exits this zone in upcoming sessions.

HNX-Index – Remains Below Middle Band

On December 5, 2025, the HNX-Index reversed lower after three positive sessions, with trading volume surpassing the 20-session average, reflecting subdued investor sentiment.

Additionally, the index remains below the Bollinger Bands’ Middle line, and a death cross between the 50-day and 100-day SMA has formed, suggesting persistent bearish sentiment.

If the medium-term downtrend continues without improvement, the March 2025 high (243-250 points) could serve as a critical support level for the HNX-Index.

Capital Flow Analysis

Smart Money Movement: The VN-Index Negative Volume Index remains above the 20-day EMA. Continued strength in the next session would mitigate sudden downside risk (thrust down).

Foreign Capital Flow: Foreign investors turned net sellers on December 5, 2025. Prolonged selling by foreign investors in upcoming sessions would further dampen market sentiment.

Technical Analysis Team, Vietstock Advisory Department

– 16:58 December 7, 2025

Market Paradox: Index Gains, Portfolio Pains

Despite the VN-Index extending its winning streak to the 8th consecutive session today (December 5th), many investors are experiencing a sense of “index gains, portfolio pains.” While the VN-Index climbed higher, red dominated the market landscape.

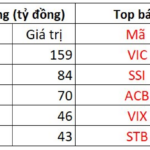

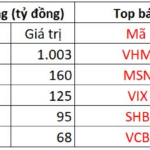

Foreign Investors’ Sudden Shift: Nearly VND 700 Billion Net Sold on December 5th – Which Stocks Were Hit Hardest?

Foreign investors’ transactions were a notable drawback as they shifted to net selling, amounting to approximately VND 678 billion.