The recently released Q3/2025 consolidated financial report of Kinh Bac Urban Development Corporation (stock code: KBC) has officially unveiled the first specific financial figures related to the Trump International Hung Yen project.

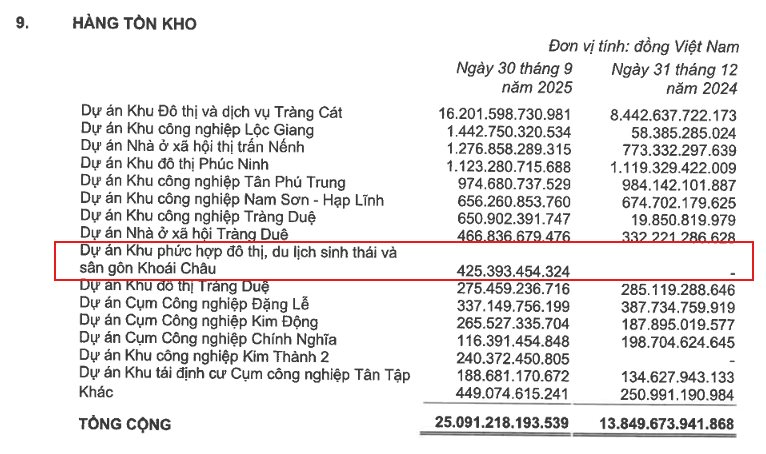

In the inventory section, Kinh Bac recorded an investment value of

425.4 billion VND

into the

“Urban Complex, Eco-Tourism, and Golf Course Project in Khoai Chau.”

This project spans a massive 990 hectares with a total investment of approximately

1.5 billion USD,

positioned as a key project to leverage the economic restructuring of Hung Yen province. However, in the latest update, KB Vietnam Securities (KBSV) assessed that due to its large scale, the project requires extended legal preparation and infrastructure investment.

Mr. Eric Trump, Vice Chairman of the Trump Organization, at the project groundbreaking ceremony – Photo: VGP/Nhat Bac

Based on land clearance progress and current cash flow, analysts predict the project will begin operations and contribute revenue between 2030 and 2050. Thus, according to KBSV, investors may need to wait another 5 years to see the actual commercial impact of the partnership with the U.S. President’s namesake corporation.

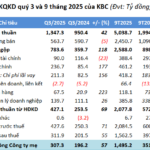

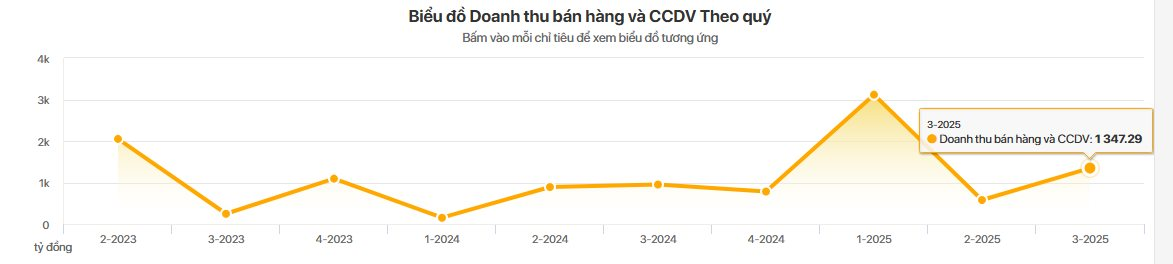

Before this “mega-project” becomes operational, Kinh Bac’s short-term financial performance remains heavily reliant on its existing industrial land portfolio. Q3/2025 financial data shows KBC’s revenue reached 1,347 billion VND, up 42%, and after-tax profit hit nearly 312 billion VND, a 55% increase year-over-year.

.png)

KBC’s business results. Source: cafef

The primary growth driver stems from the handover of commercial land in key industrial zones. In the first nine months of 2025, the company recorded impressive triple-digit growth, with revenue reaching 5,039 billion VND (up 153%) and after-tax profit hitting 1,563 billion VND (up 293%), completing nearly 49% of the annual profit plan.

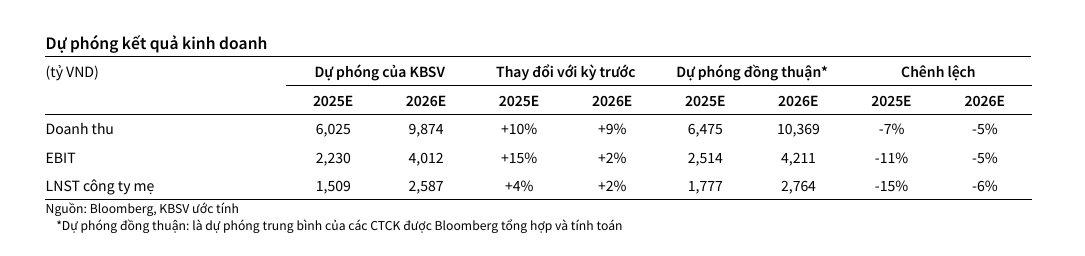

To bridge the growth gap while awaiting the Trump Hung Yen project, KBSV forecasts that the Trang Cat Urban Area will become the main driver for Kinh Bac’s commercial real estate segment starting in 2026. Wholesale sales at Trang Cat in 2026 are estimated to reach 20 hectares, generating approximately 4,620 billion VND. Additionally, industrial land handover activities in the next two years (2025-2026) are expected to remain stable, with areas of 110 hectares and 80 hectares, respectively.

A notable aspect of Kinh Bac’s financial structure is the increasing leverage pressure to support these major projects. As of September 30, 2025, the company’s total debt (short-term and long-term) surged to 27,007 billion VND, a 2.6-fold increase from the 10,112 billion VND recorded at the beginning of the year.

The Debt-to-Equity ratio consequently rose sharply from 0.5 to 1.04. In a context where cash flow for the Hung Yen project and new industrial zones must be continuously maintained, balancing cash flow and managing interest expenses will be a critical challenge for Kinh Bac’s leadership over the next five years.

KBC Records Over $1.5 Billion in 9-Month Profits, Loan Portfolio Surpasses $1 Billion Milestone

Fueled by a surge in revenue from its industrial park segment, property transfers, and factory sales, KBC’s after-tax profit for the first nine months soared to over 1.5 trillion VND, nearly quadrupling year-on-year. However, financial debt also skyrocketed to over $1 billion, reaching an all-time high.

“Chicilon Media: Trailblazing the Path as a Telecom-Registered Media Enterprise”

In August 2025, Chicilon Media blazed a trail by completing the registration process for telecommunications services in accordance with the Telecommunications Law and the Government’s Decree No. 133/2025/ND-CP. By doing so, they became one of the foremost advertising and media enterprises in Vietnam to successfully navigate this regulatory landscape.