China and India’s thermal coal imports surged in November, reaching a combined total of 44 million tons. This uptick comes as both economies brace for heightened electricity and heating demands during the winter season.

According to Reuters correspondent Clyde Russell, citing data from DBX Commodities, China imported 30.96 million tons of thermal coal in November, up from 29.18 million tons in October. However, year-over-year imports remain 38.19 million tons lower than the previous year.

India also saw a rise in imports, with thermal coal shipments hitting 13.01 million tons in November. This marks an increase from 12.38 million tons in October and surpasses the 12.24 million tons imported in November 2024.

The surge in imports follows a four-year low in international coal prices, which dipped to $65.72 per ton in early June, prompting buyers to capitalize on the lower costs. However, as purchasing activity increased, prices rebounded, suggesting that import volumes from major consuming nations may stabilize in the coming months.

In October, China’s energy demand drove international coal prices up by 37% from their July lows. This recovery coincided with increased electricity output from coal-fired plants and a decline in domestic coal supply due to government efforts to regulate production.

China’s coal output in October fell by 2.3% compared to October 2024. Nonetheless, year-to-date production remains 1.5% higher, fueled by record-breaking extraction in the first half of the year.

India’s coal production also declined in October, marking the second consecutive month of decreases. This drop was attributed to weaker demand from power plants amid lower electricity consumption. Official data released in late November showed an 8.5% year-over-year decrease in October’s coal output.

Russell notes that severe winter weather in China is expected to drive coal demand to record highs for power generation and heating. Conversely, India’s coal consumption may decline as solar energy output surges, prompting coal-fired plants to adjust operations in response to alternative energy sources.

In Vietnam, coal imports across various categories exceeded 55 million tons in the first ten months of the year, valued at $5.6 billion. While import volumes rose by 2.3%, the total value decreased by 15% due to sharply lower prices.

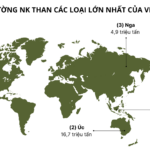

Vietnam’s coal imports primarily originate from Australia, Indonesia, and Russia, which collectively account for over 83% of the country’s total coal import value.

The Ministry of Industry and Trade highlights Vietnam’s substantial demand for imported raw materials and fuels. Between 2025 and 2030, the country’s annual coal import requirements are projected to range from 60 to 100 million tons.

Vietnam ranks among the top five coal-consuming economies in Southeast Asia. Despite being a long-standing coal producer, Vietnam relies on imports due to domestic supply constraints and quality shortfalls. Additionally, dwindling easily accessible reserves have forced mines to dig deeper, increasing costs and reducing efficiency. Importing cheaper coal allows businesses to maintain supply flexibility and lower production expenses.

Source: Oilprice

The Great Russian Retail Rush: Vietnam’s 5% Import Tax Advantage Makes it the 5th Largest ‘Shark’ in the World.

“Russia’s National Treasures: A Russian Extravaganza in Vietnam.

Throughout this year, Vietnam has witnessed an influx of Russia’s national treasures at incredibly attractive prices. A veritable feast of Russian culture and history has been on offer, captivating and intriguing locals and tourists alike.”