India has long been a significant player in the global silver market, but this year, the South Asian nation has emerged as the primary force driving silver prices above $58 per ounce—an all-time high. A surge in physical silver purchases, coupled with major policy shifts by the Reserve Bank of India (RBI), is reshaping the silver market.

According to Metals Focus’s summer report, India is now the world’s second-largest market for physical silver investment, accounting for nearly 80% of global demand for silver bars and coins. The country also remains the largest consumer of silver jewelry and household items by volume.

In a recent update, Metals Focus revealed that over the past five years, Indian citizens—particularly low-income rural households—have purchased approximately 29,000 tons of silver in jewelry and 4,000 tons in coin form. This highlights silver’s traditional role in Indian household asset structures.

Policy Shift Fuels Silver Buying Spree

A pivotal factor driving the recent spike in silver demand is a groundbreaking RBI regulation. Starting April 1, 2026, Indians will be able to pledge physical silver as collateral for loans, similar to how gold is currently used.

“Gold has long been the ultimate collateral in India. Now, silver—more accessible to lower-income households—has the opportunity to enter the formal credit ecosystem,” Metals Focus noted. Silver’s affordability has made it widely accumulated in the form of anklets, toe rings, household items, and traditional jewelry.

RBI’s formal recognition of silver as credit-eligible collateral could unlock vast household silver reserves and expand credit access for millions. Although announced in November, RBI has been developing this framework since early 2025 and shared a draft with lenders in October.

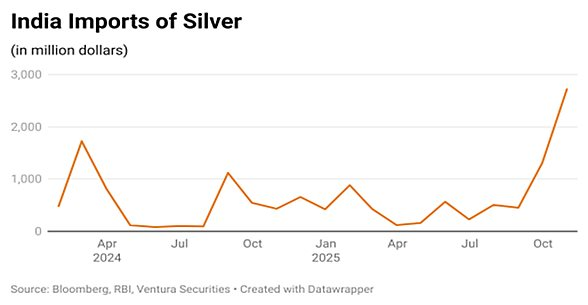

Trade data shows India imported $2.72 billion worth of silver in October alone, compared to $0.43 billion in the same period last year—a clear indicator of surging demand.

India’s silver imports surged in 2025.

Supply Shortages Tighten Global Silver Market

The massive influx of silver into India has left London’s over-the-counter market illiquid, with leasing rates soaring to record highs. Global silver inventories remain near historic lows, directly pushing prices above $50 and nearing $59 per ounce.

Metals Focus notes that while gold and silver have been used by Indians for generations, silver has only recently begun to be viewed as a genuine financial asset.

India’s total bank credit stands at approximately ₹193 trillion ($2.1 trillion), with $38 billion secured by gold jewelry—up sharply from $8 billion in 2021. However, the silver lending market remains constrained by purity risks, as most silver jewelry lacks certification and contains alloys.

The formal gold lending market currently handles around 700 tons, while the informal segment reaches 1,000–1,500 tons. With RBI’s standardized silver collateral framework, Metals Focus predicts this segment will “skyrocket” in the coming years, becoming a parallel credit channel that complements rather than competes with gold lending.

India Reshapes the Global Silver Market

Analysts argue that India’s demand explosion is creating significant volatility in the global silver market, as strong buying depletes supplies and drives prices to new records.

“While informal silver-backed lending has existed for decades, this marks the first time silver is formally recognized within the collateral ecosystem,” Metals Focus observed.

With the new regulation, India’s blend of traditional demand and financial investment opportunities is positioning it as a key determinant of silver’s price trajectory, especially as global markets grapple with supply deficits.

Source: Kitco News

Silver Prices Reverse, Heading South

Today, silver prices have plummeted both domestically and globally, marking a significant downturn in the precious metals market.